SGD/JPY Weekly Candlesticks & Ichimoku Chart

Fundamentally, as trade tensions worsen, SGD should weaken in tandem with CNY while risk aversion will cause JPY to strengthen. On the charts, SGD/JPY is trying to break below the Ichimoku clouds. Keep an eye on this as it could develop into a strong bear trend on the weekly chart.

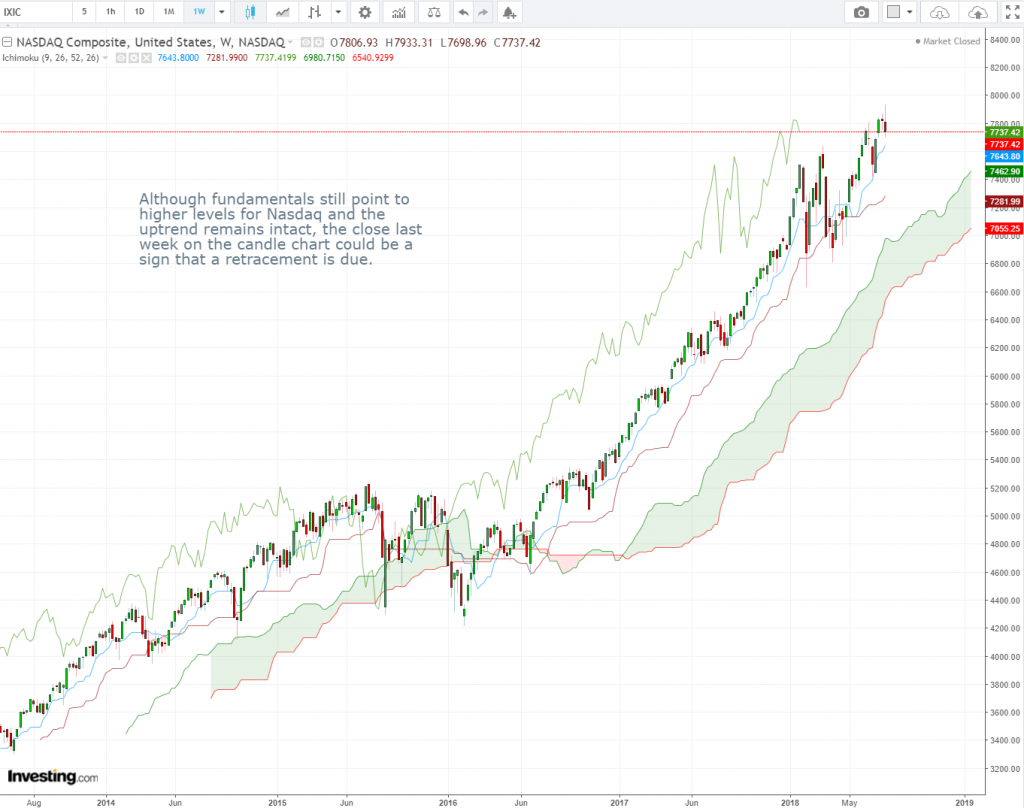

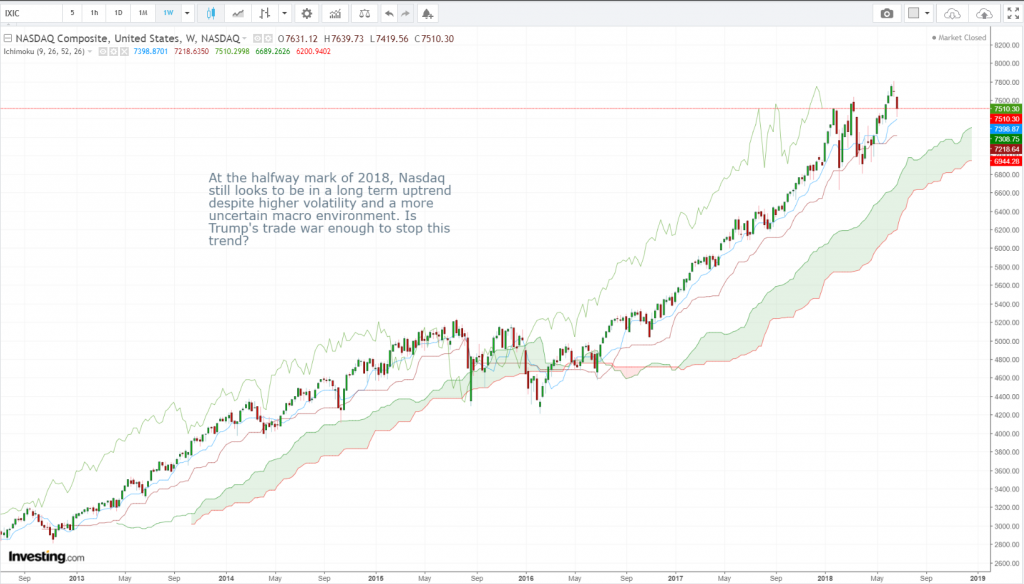

Nasdaq Composite Weekly Candlesticks & Ichimoku Chart

Although fundamentals still point to higher levels for Nasdaq and the uptrend remains intact, the close last week on the candle chart could be a sign that a retracement is due.

Vee, our Founder/CIO highlights patterns/formations on selected chart(s) every week which may have the potential to turn into trading opportunities. These charts are extracts of our weekly subscription product – “CIO’s Week Ahead Update” which provides analysis for the week ahead, first sent out on Monday of the week.

Receive first hand information on these charts and learn how to leverage on possible trading opportunities >>> Click here!

Disclaimer: The views and opinions expressed in this material do not constitute a recommendation by TrackRecord Pte. Ltd. that any particular investment, security, transaction or investment strategy is suitable for any specific person. No part of this material may be reproduced or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission of TrackRecord Pte. Ltd.

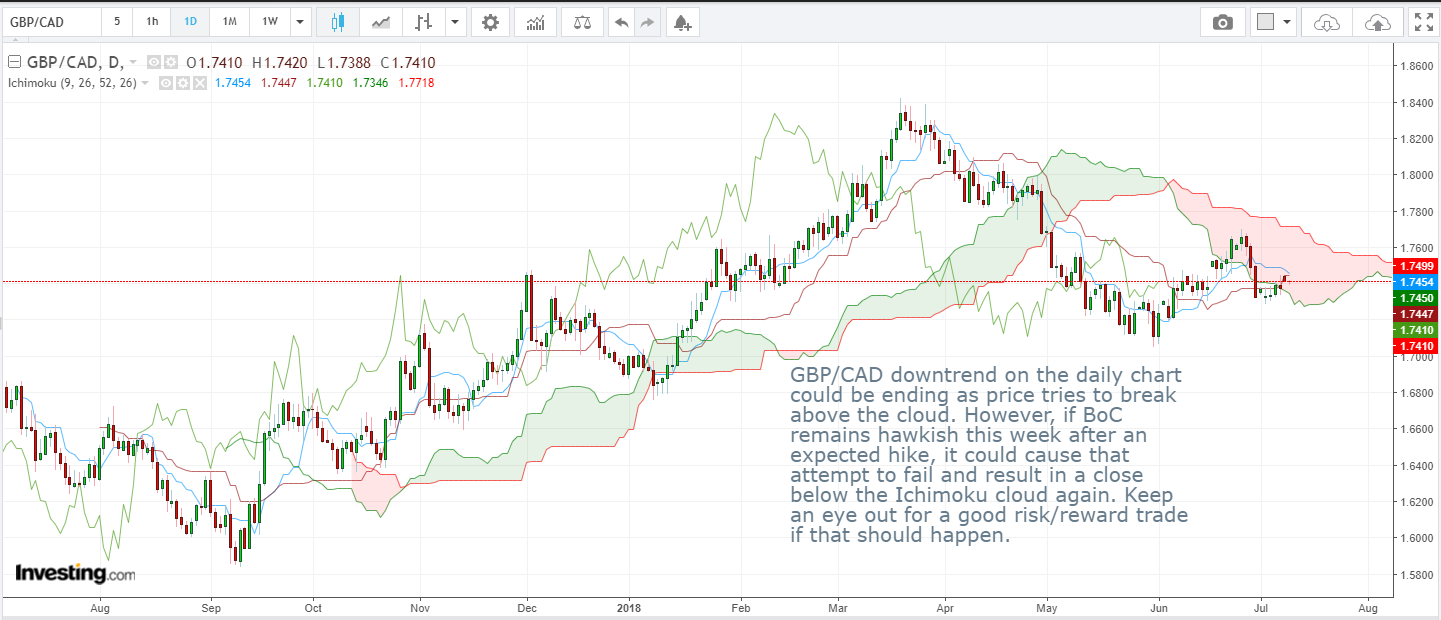

GBP/CAD Daily Candlesticks & Ichimoku Chart

GBP/CAD Daily Candlesticks & Ichimoku Chart

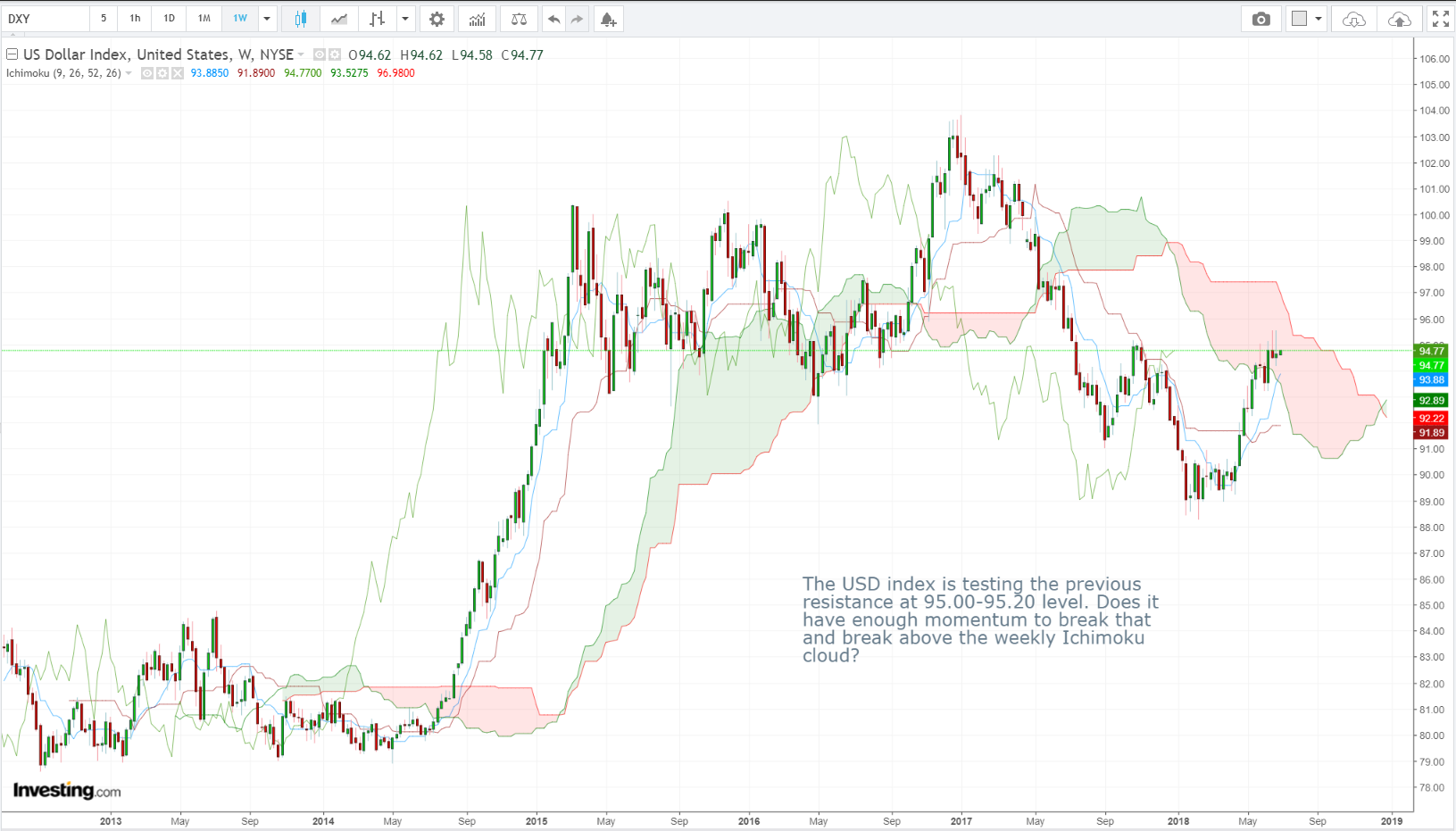

Dollar Index (DXY) Weekly Candlesticks & Ichimoku Chart

Dollar Index (DXY) Weekly Candlesticks & Ichimoku Chart