NOTABLE MOVES

- U.S. ISM Manufacturing PMI at 57.7 vs expected 59.0, the pullback is most likely a natural slowing of activity following what has been an impressive acceleration in manufacturing activity on a national level. That point notwithstanding, the deceleration in what has been one of the hottest sectors will feed into the peak-growth narrative that has been prominent of late. U.S. Treasuries ticked higher on Thursday, pushing the 2-yr yield down four basis points to 2.84% and the 10-yr yield down two basis points to 3.14%. USDJPY down -0.19%, $112.72.

- There were no prints from the E.U., with French and Italian banks closed for holiday. Euro popped 0.80%, $1.1403. Bank of England unanimously voted to leave rates unchanged at 0.75% as expected on Thursday. Additionally, the central bank lowered its growth forecasts for 2018 and 2019 by 0.1% in each year to 1.3% and 1.7%, respectively. The bank that it would need to step up the pace of interest rate rises in the years ahead if Theresa May was able to negotiate a smooth Brexit deal. Announcing the verdict of the bank’s latest Monetary Policy Committee meeting, the BoE said rate rises would still be “gradual”, but indicated that it would need to raise rates to 1.5% over the next three years to keep inflation under control. Three months ago, it suggested only one quarter-point increase was necessary over the same period to stop the economy from overheating. Mark Carney said the bank’s central forecast was that the economy would run hotter, pushing inflation higher and “as a consequence, a margin of excess demand emerges”. U.K. Manufacturing PMI at 51.1 vs expected 53.0. Sterling rallied 1.86%, $1.3003.

- Dollar was broadly weak on Thursday, USDCAD down -0.49%, $1.3091. Aussie Trade Balance at 3.02B vs expected 1.71B. Aussie rallied 1.85%, $0.7205.

- S&P 500 up 1.06%, 2,740.37. Nasdaq up 1.47%, 7,069.17. Nikkei down -1.06%, 21,687.65.

- Favorable trade-related tweet by Trump lifted stocks from their early downtrend. The benchmark index briefly turned negative in the early going before comfortably trading in positive territory for most of the session. Trump tweeted that he had a “long and very good conversation” with President Xi, adding that discussions have been moving along nicely with meetings being scheduled at the upcoming G-20 summit in Argentina. According to a Reuters report, President Xi confirmed he spoke with Trump over the phone, expressing his willingness to meet with Trump at the G-20 summit, hopeful for a stable relationship with the U.S.

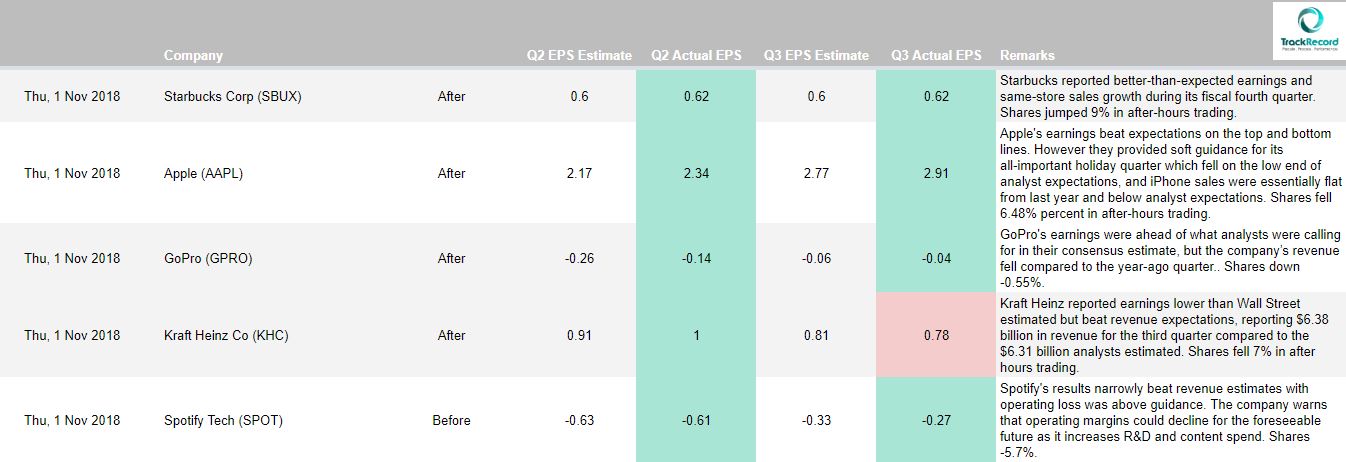

- Music streaming platform Spotify (SPOT 141.16, -8.53) lost -5.7% after it reported a Q3 operating loss above guidance. The company also slightly lowered its fourth quarter monthly active user (MAU) and premium subscriber guidance, which did not bode well for a stock trading in a very competitive space.

BLOCKCHAIN & CRYPTOCURRENCY NEWS

NASDAQ Eyes Crypto Market Manipulation Use Case for Market Surveillance Tool

The world’s second-largest stock exchange NASDAQ says its market surveillance technology can “stamp out manipulation” in cryptocurrency markets. Regulators, brokers and exchanges have surveillance teams that monitor activity constantly and advanced technologies to help capture and analyze abusive behaviors including pump-and-dump schemes, insider trading, wash trading as well as spoofing and layering. The move comes as Bitcoin’s new-found stability temporarily takes emphasis off the idea that its markets were subject to foul play. NASDAQ saw the first cryptocurrency client for its SMARTS Market Surveillance solution come in April in the form of Gemini, the cryptocurrency exchange operated by the Winklevoss twins.

Hong Kong Regulator Announces New Plans for Cryptocurrency Industry

The Hong Kong Securities and Futures Commission (SFC) issued two circulars on Thursday concerning cryptocurrency regulations. The first outlines a new approach which aims to bring virtual asset portfolio managers and distributors of virtual asset funds under its regulatory net, and the second document addresses intermediaries that distribute crypto funds. The SFC will impose licensing conditions on firms which manage or intend to manage portfolios investing in virtual assets and it will explore whether crypto exchanges “are suitable for regulation in the SFC regulatory sandbox.”

Anypay Provides Bitcoin Cash Invoices That Can Be Paid by Sending a Text Message

On Oct. 29, a Bitcoin Cash proponent used the Cointext wallet to purchase a croissant by text message at La Maison Navarre, a bakery in Portsmouth, New Hampshire. The shop uses the free Anypay point-of-sale application, which connects to the Cointext system to allow people to make purchases by SMS. The Anypay.global payment processor, a free point-of-sale application for retail merchants, has integrated Cointext payments within its invoice platform. If a user chooses to pay for a product with bitcoin cash, they will be introduced to Anypay’s invoice system, which displays a written BCH address, a QR code, and the ability to pay by text using an SMS-based code. The Cointext wallet is a light client for mobile phones that allows users to send BCH over standard text messaging services without an internet connection.