- U.S. Employment Cost Index q/q at 0.8% vs expected 0.7%. Chicago PMI at 58.4 vs expected 60.1. ADP Non-Farm Employment Change at 227K vs expected 188K. Bank of Japan kept monetary policy steady on Wednesday at -0.10% (inline) and slightly trimmed its inflation forecasts as global trade frictions clouded the outlook, reinforcing views the central bank is in no rush to trim its massive stimulus. While ruling out a rate hike, Kuroda said the BOJ could take further steps to ease the strain on markets. The BOJ announced changes in its bond-buying operations, they will reduce the frequency of its bond buying operations in November and aim to have government bonds traded in the secondary market longer than they currently are. USDJPY down -0.20%, $112.86.

- E.U. CPI Flash Estimate y/y inline at 2.2%. Core CPI Flash Estimate y/y inline at 1.1%. Euro down -0.26%, $1.1315. In Brexit, Sterling got bid after Dominic Raab suggested he expects a deal on the UK’s exit from the EU to be agreed within three weeks. The Brexit secretary told a committee of MPs he was happy to appear before them to give evidence “when a deal is finalised” and “currently expected 21 November to be suitable”. Sterling up 0.47%, $1.2767.

- Chinese Manufacturing PMI at 50.2 vs expected 50.6. Non-Manufacturing PMI at 53.9 vs expected 54.7.

- Canadian GDP m/m at 0.1% vs expected 0.0%. WTI crude extended its recent decline, losing -1.3% to $65.31/bbl, reaching its lowest level since August. The U.S. Energy Information Administration reported a weekly crude oil inventory build of 3.2 million barrels, marking the sixth straight week inventories have risen. USDCAD up 0.40%, $1.3159.

- Aussie CPI q/q at 0.4% vs expected 0.5%. Trimmed Mean CPI q/q inline at 0.4%. Aussie down -0.32%, $0.7083.

- S&P 500 up 1.09%, 2,711.74. Nasdaq up 2.31%, 6,967.10. Nikkei up 2.16%, 21,920.46.

- Technology stocks were in control from the get-go, following Facebook (FB 151.79, +5.57, +3.8%) releasing its third quarter earnings report the previous evening. Alphabet (GOOG 1076.77, +40.56, +3.9%) and Netflix (NFLX 301.78, +15.97, +5.6%) joined Facebook with noteworthy gains on Wednesday, underpinning the strength in the communication services sector (+2.1%). Likewise, Apple (AAPL 218.86, +5.56, +2.6%) and Amazon (AMZN 1598.01, +67.59, +4.4%), respectively, provided strong support for the outperforming information technology (+2.4%) and consumer discretionary (+1.6%) sectors.

- JPMorgan Chase (JPM 109.02, +2.29) and Bank of America (BAC 27.50, +0.71) provided strong support with respective gains of 2.2% and 2.7%. Financials benefited from a slight steepening of the yield curve, with the 2-yr yield increasing four basis points to 2.88% and the 10-yr yield rising five basis points to 3.16%.

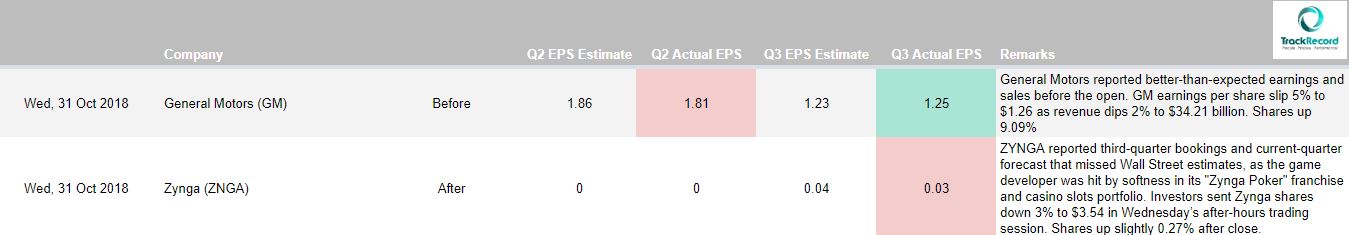

- In other earnings, General Motors (GM 36.59, +3.05, +9.1%), eBay (EBAY 29.03, +1.61, +5.9%), T-Mobile US (TMUS 68.55, +4.63, +7.2%), and Automatic Data (ADP 144.08, +6.82, +5.0%) all sported healthy gains after reporting better-than-expected results. On the other hand, Kellogg (K 65.48, -6.38) lost -8.9% after missing bottom line estimates and lowering its adjusted earnings outlook.

Binance Freezes Funds With Suspected Money Laundering Links From Controversial Exchange WEX

Troubled cryptocurrency exchange WEX.nz has seen its funds frozen by fellow exchange Binance after users claimed the exchange was involved in money laundering. According to CEO Changpeng Zhao, laundered funds would “soon” use decentralized exchanges to avoid freezes traditional platforms are able to instigate. BTC-e remains subject to a giant $4 billion fraud investigation by Greece and U.S., with alleged founder Alexander Vinnik still in custody following his arrest in July 2017. WEX soon began exhibiting suspicious traits once it began operating, with prices of Bitcoin significantly larger on its order book than global norms. At press time, BTC/USD on WEX.nz was quoted at $8,547 – 35 percent higher than the CoinMarketCap average.

Venezuela Begins Public Sale of National Cryptocurrency Petro

On Monday, the Venezuelan government announced that the public can now purchase the country’s national cryptocurrency directly from the Superintendency of Cryptoassets and Related Activities (Sunacrip). Sunacrip is in charge of regulating all crypto-related activities in Venezuela. Buyers can visit the Sunacrip headquarters to purchase the petro with cash. Purchasing with cryptocurrencies can also be done on the petro’s official website. The public sale of the petro was scheduled for Nov. 5. However, Venezuela’s Superintendent of Cryptoassets Joselit Ramirez explained that the launch was moved forward due to the fluidity with which events developed and the support of President Nicolás Maduro. On Thursday, Venezuela’s vice president of the economy, Tareck El Aissami unveiled two more petro options which will be enabled on the Sunacrip website on Nov. 5: Petro Pago (pay) and Petro Ahorro (savings).

Kenya’s Bithub Africa Mines Bitcoin Using Solar Power

Founded in 2015, Bithub.Africa is a commercial blockchain accelerator that is driving the adoption of blockchain technology and solutions across Africa. The company also focuses on building systems that facilitate access to financial services and energy through public blockchain projects and open protocols such as Bitcoin. Bithub Africa has started using off-grid solar power to mine bitcoin and Ethereum and has laid out a series of interconnected cables and devices at its small mining facility in Nairobi. An inverter connects to a battery, which is patched through to a controller that is linked to a 200-watt solar panel. The PV module is fixed to the roof at an angle to maximize solar capture. Bithub Africa also extracts litecoin and ethereum classic using conventional sources of electricity, with only minimum air-conditioning needed to keep the mining rigs from overheating in addition to its solar-powered cryptocurrency mining operations.