NOTABLE MOVES

- U.S. Average Hourly Earnings m/m inline at 0.2%. Non-Farm Employment Change at 250K vs expected 194K. Unemployment Rate inline at 3.7%.The strong jobs report validated labor market trends that will keep the Fed on a tightening path. The CME FedWatch Tool indicated a 80.7% chance of another Fed rate hike in December, up from a 74.5% chance the previous day. The Fed-sensitive 2-yr yield and benchmark 10-yr yield spiked seven basis points each to 2.91% and 3.21%. USDJPY up 0.43%, $113.20.

- German Final Manufacturing PMI at 52.2 vs expected 52.3. E.U. Final Manufacturing PMI at 52.0 vs expected 52.1. Euro down -0.19%, $1.1387. U.K. Construction PMI at 53.2 vs expected 52.0. Sterling down -0.29%, $1.2973.

- Canadian Employment Change at 11.2K vs expected 12.7K. Unemployment Rate at 5.8% vs expected 5.9%. Trade Balance at -0.4B vs expected 0.2B. WTI crude extended its recent downward trend, losing 0.9% to $63.20/bbl and reaching its lowest level since April.USDCAD up 0.17%, $1.3109.

- Aussie Retail Sales m/m at 0.2% vs expected 0.3%. Aussie down -0.10%, $0.7199.

- S&P 500 down -0.63%, 2,723.06. Nasdaq down -1.47%, 6,965.29. Nikkei up 2.56%, 22,243.66.

- Stocks fell on Friday following conflicting U.S.-China trade reports and softer-than-expected sales guidance from Apple (AAPL 207.48, -14.74, -6.6%). Futures rallied overnight on a Bloomberg report indicating Trump asked his cabinet to draft a trade deal, but stocks eventually fell into negative territory after White House officials denied the report. Director of the United States National Economic Council Larry Kudlow confirmed in a CNBC interview that the cabinet was not asked by Trump to draw up a trade plan for China. Later, as stocks traded at session lows, Trump reiterated his belief to reporters that the U.S. will reach a trade deal with China. This led stocks to cut their losses in late afternoon trading.

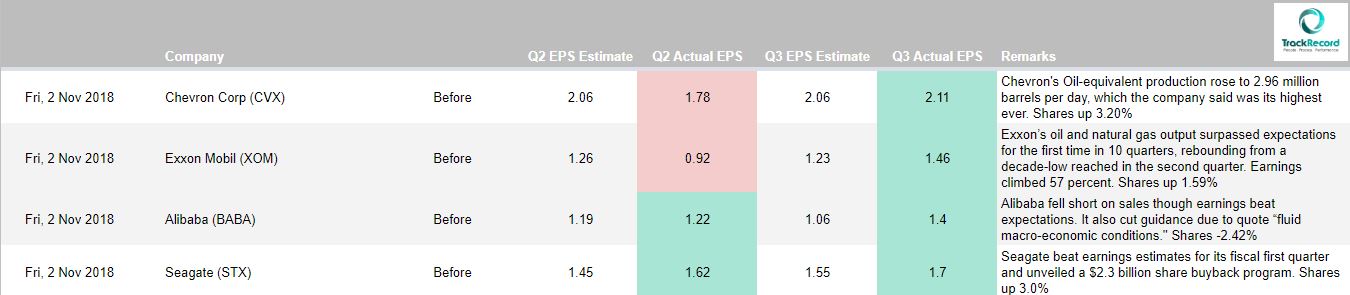

- In earnings, Apple raised some red flags after forecasting weaker-than-expected sales for the holiday quarter and announcing it will no longer provide unit-sales data for the iPhone, iPad, and Mac moving forward. The company did beat both top and bottom line estimates, EPS of $2.91 vs. $2.78 expected and revenues of $62.9 billion vs $61.46 billion expected. Exxon Mobil (XOM 81.95, +1.28, +1.6%) and Chevron (CVX 114.73, +3.56, +3.2%) rose after both reported above-consensus earnings.

BLOCKCHAIN & CRYPTOCURRENCY NEWS

Lawyer Invests $300 Million to Build Crypto City in the Nevada Desert

On Thursday, consumer protection lawyer Jeffrey Berns revealed plans to build a crypto city in the desert, claiming to have invested $300 million. He is the owner and CEO of Blockchains LLC, a company that bought more than 67,000 acres of land in northern Nevada for $170 million earlier this year. The comlex is meant to be a model for running a smart city with a decentralized blockchain infrastructure powering all interactions. The planned city will include residential units for thousands of people to live in, alongside shops for commerce. The area will also host an esports arena and a studio for creating music, movies and games. The company has also signed a Memorandum of Understanding with Nevada’s electricity public utility, NV Energy, agreeing to work together on energy projects powered by blockchain technology.

Israeli Projects Raised Over $600 Million via ICOs as of Q3 2018

According to report by cryptocurrency analytics firm One Alpha released Nov. 2., Israel-based projects have raised over $600 million through Initial Coin Offerings (ICOs) as of the third quarter (Q3) of 2018. Per the research, 140 blockchain-focused companies in Israel have attracted $1.3 billion in investment, wherein more than 60 percent of companies and 88 percent of funds are ICO-related. From Q1– Q3 2018, Israeli startups raised $606 million through ICOs, wherein the largest number of ICOs took place during Q2, and Q1 was the most profitable, with $315 million raised through crypto-asset offerings. The largest ICOs in 2018 include EOS ($4.2 billion), Telegram ($1.7 billion), TaTaTu ($575 million), Dragon ($420 million), and tZero ($328 million). Per the report, ICOs constitute less than 10 percent of the global venture capital funding volume.

Lack of Diversity in Ethereum Smart Contracts Pose Risks to Whole Ecosystem

A lack of diversity of Ethereum (ETH) smart contracts poses a threat to Ethereum blockchain ecosystem, according to research by a group of analysts from Northeastern University and the University of Maryland released on Oct. 31. The paper, entitled “Analyzing Ethereum’s Contract Topology,” claims that most Ethereum smart contracts are “direct- or near-copies of other contracts,” which represents a potential risk if a copied smart contract contains a vulnerable or a buggy code. To date, Ethereum smart contracts are “three times more likely to be created by other contracts” than by users. Considering the low diversity of smart contracts on Ethereum as a potential risk to its whole blockchain ecosystem, the researchers mentioned that Ethereum has become a subject of “high-profile bugs” several times, resulting in over $170 million worth of cryptocurrency being frozen. Multiple implementations of “core contract functionality” on Ethereum would eventually provide “greater defense-in-depth to Ethereum.”