NOTABLE MOVES

- There were no notable prints out of the U.S. on Tuesday. U.S. Treasuries jumped, pushing yields lower across the curve. The 2-yr yield lost five basis points to 2.88%, and the 10-yr yield lost four basis points to 3.15%. USDJPY down -0.03%, $113.80.

- In the E.U. there were reports that Italy has agreed on a 2.4% budget deficit for next year and maintain a 1.5% growth target. Prime minister Giuseppe Conte hopes the resubmission to the EU will be at least partially conciliatory. German ZEW Economic Sentiment at -24.1 vs expected -24.2. Euro up 0.83%, $1.1311.

- Sterling popped on headlines indicating that the EU and the UK reached a deal on the Irish border issue. Prime Minister May met with her ministers yesterday, the cabinet and EU meets separately today and the withdrawal agreement could be made public before the end of the week. U.K. Average Earnings Index 3m/y inline at 3.0%. Unemployment Rate at 4.1% vs expected 4.0%. Sterling up 1.28%, $1.3014.

- S&P 500 down -0.15%, 2,722.18. Nasdaq up 0.03%, 6,830.91. Nikkei down -2.06%, 21,810.52.

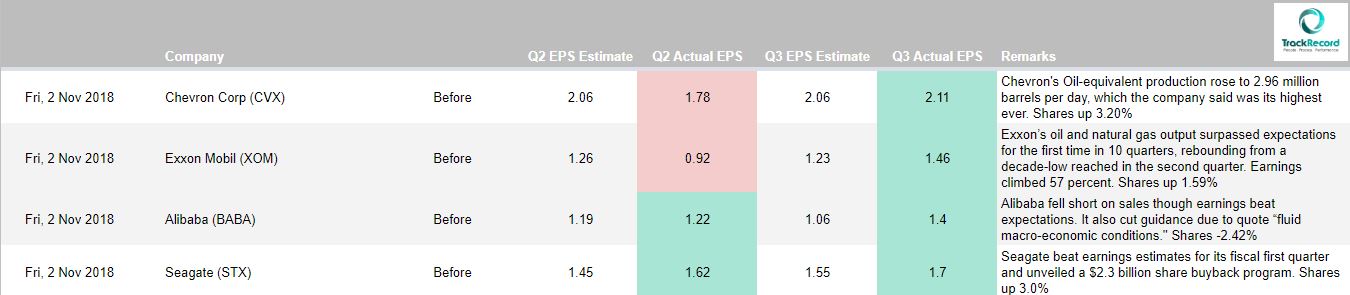

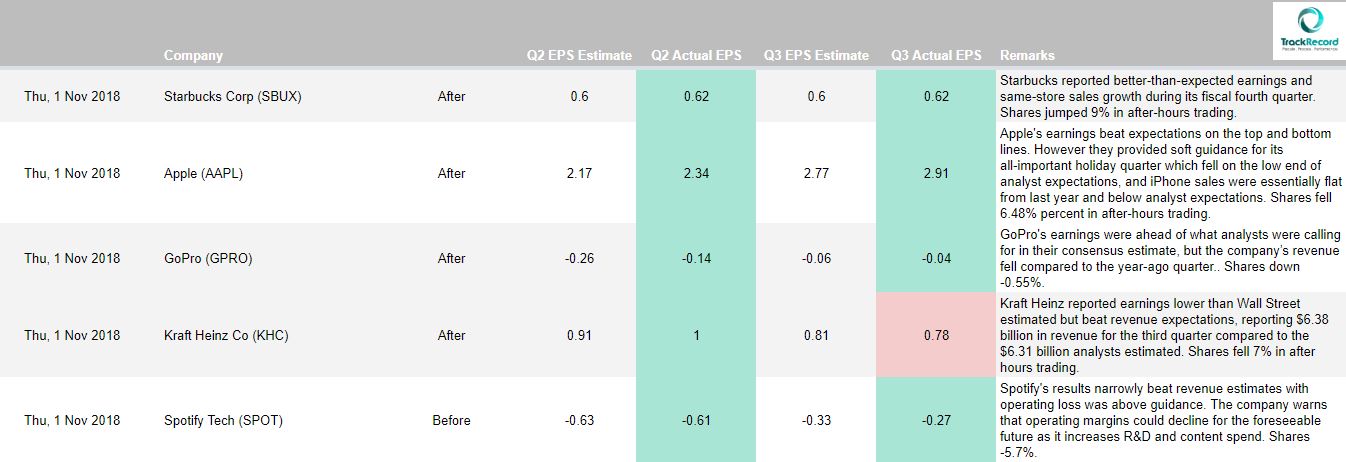

- The benchmark S&P500 index climbed as high as 1.0% amid early U.S.-China trade optimism, but energy stocks eventually led the broader market lower as oil prices tanked. WTI crude fell -7.0% to $55.67/bbl, extending its losing streak to 12 straight sessions and settling at its lowest level since November 2017. Crude extended losses in the wake of OPEC’s monthly supply report, in which it cut its 2019 oil demand forecast for the fourth consecutive month. Likewise, the oil-sensitive energy sector dropped -2.4%, and energy component Haliburton (HAL 32.27, -1.89) surrendered -5.5%. Apple (AAPL 192.23, -1.94) lost -1.0% amid another guidance warning from one of its suppliers, Qorvo (QRVO 63.65, -0.15, -0.2%), which cut its guidance due to “recent demand changes for flagship smartphones.”

BLOCKCHAIN & CRYPTOCURRENCY NEWS

The Chinese city of Loudi has launched a blockchain platform to store real estate data. The platform is backed by land, tax and real estate departments in the city, which is located in central Hunan province. Starting Nov. 15, the new system will let citizens avoid lines and other bureaucratic processes when submitting documents to the above-listed departments. The first real estate electronic voucher was also issued in the city via the new blockchain-based system. According to a report, blockchain has been actively tested in the sphere of real estate globally, especially in issuing digital mortgages to reduce paperwork and increase interoperability between different institutions.

The Commonwealth Scientific and Industrial Research Organization’s (CSIRO) Data61 division and Commonwealth Bank of Australia (CommBank) have completed a successful trial of a prototype blockchain app that aims to make money “smart.” The app is based on a blockchain token coded with smart contracts allowing participants and service providers to execute payments based on pre-defined conditions, such as who can spend which funds by what deadline. CSIRO and CommBank believe that if the prototype was developed and implemented at a full scale across Australia, it could save “hundreds of millions of dollars annually,” estimating that users of the app could potentially save 1–15 hours per week and 0.3–0.8 percent of annual revenue.

Financial services giant American Express (Amex) has filed a patent for a blockchain-based system to capture and transmit the image of a receipt. Financial services giant American Express (Amex) has filed a patent for a blockchain-based system to capture and transmit the image of a receipt. First, the system lets a user with a mobile device capture the image of a receipt. The system then, via “optical character recognition,” deciphers the image and matches it with “related records,” namely transaction history. The blockchain structure may include a distributed database that maintains a growing list of data records. The blockchain may provide enhanced security because each block may hold individual transactions and the results of any blockchain executables.