NOTABLE MOVES

- U.S. CPI m/m inline at 0.3%. Core CPI m/m inline at 0.2%. Japanese Prelim GDP q/q inline at -0.3%. USDJPY down -0.22%, $113.56. The 2-yr yield lost two basis points to 2.86%, and the 10-yr yield lost three basis points to 3.12%.

- Italy stuck to its 2019 budget with a 2.4% deficit target and a growth forecast of 1.5%. The EU Commission is expected to give an update on Italy next Wednesday, Nov 21st. German Prelim GDP q/q at -0.2% vs expected -0.1%. Euro up 0.19%, $1.1312.

- In Brexit news, UK Prime Minister Theresa May announced that her cabinet has approved the draft withdrawal agreement, but that draft is still subject to British Parliament and EU approval. The 585-page draft withdrawal agreement has now been published, alongside a shorter statement setting out what the UK and EU’s future relations will look like. U.K. CPI y/y at 2.4% vs expected 2.5%. PPI Input m/m at 0.8% vs expected 0.6%. Sterling up 0.08%, $1.2984.

- Chinese Fixed Asset Investment ytd/y at 5.7% vs expected 5.5%. Industrial Production y/y at 5.9% vs expected 5.8%. Aussie Wage Price Index q/q inline at 0.6%. Aussie up 0.21%, $0.7233.

- Aussie Wage Price Index q/q inline at 0.6%. Aussie popped in early Asian session on the back of strong numbers. Employment Change at 32.8K vs expected 19.9K. Unemployment Rate at 5.0% vs expected 5.1%. Aussie up 0.21%, $0.7233.

- S&P 500 down -0.76%, 2,701.58. Nasdaq down -0.89%, 6,769.87. Nikkei up 0.16%, 21,846.48.

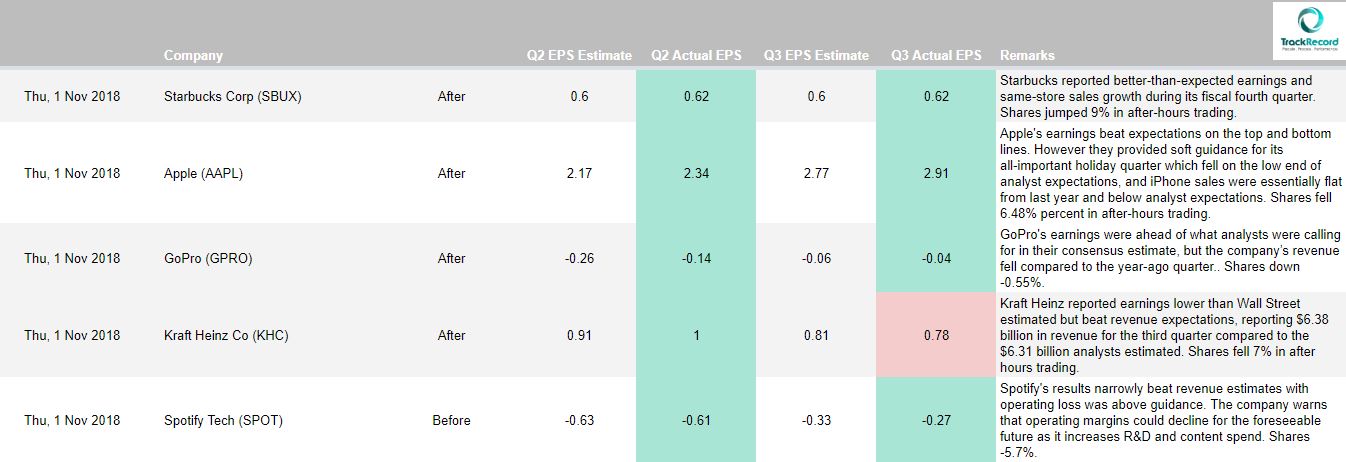

- Stocks rallied at the open after the October CPI reading showed consumer prices rose 0.3% as expected last month, but soon fell back amid continued Apple (AAPL 186.80, -5.43) weakness and following a regulatory reminder from Congresswoman Maxine Waters. Waters, who is set to take over the House Financial Services Committee this January, vowed that the days of weakening regulations will be coming to an end. Waters’ comments should not be seen as a surprise though, as it was understood this would likely be the case following the midterm election results. Apple dropped -2.8%, extending its monthly losses to -14.7%, after being downgraded to ‘Neutral’ from ‘Buy’ at Guggenheim on Thursday.

- Chip stocks, however, extended Tuesday’s rebound, pushing the Philadelphia Semiconductor Index higher by 0.4%. In earnings, Macy’s (M 33.22, -2.57) fell -7.2% despite beating profit estimates and raising its earnings guidance for its fiscal 2019 year. Cannabis stocks Canopy Growth (CGC 34.30, -4.18, -10.9%) and Tilray (TLRY 102.34, -9.21, -8.3%) also dropped after reporting. Canopy missed revenue estimates, while Tilray beat earnings estimates but its revenue was at the low end of its upside pre-announcement.

BLOCKCHAIN & CRYPTOCURRENCY NEWS

The New York State Department of Financial Services (DFS) has just issued a new BitLicense to the New York Digital Investment Group (NYDIG), allowing it to offer crypto-related services in the Empire State. Allegedly, DFS has granted its virtual currency license to the company, allowing NYDIG to offer liquidity and asset management services to New York residents. DFS has also granted the NYDIG Trust Company, a subsidiary to the main entity, permission to operate as a limited purpose trust company. As such, NYDIG is now able to offer custody and trade execution services, including services for bitcoin, bitcoin cash, ether, XRP and litecoin. These services include self-custody, contracting with a third party to offer custodial services or contracting with NYDIG Trust or NYDIG Execution directly for custody services. NYDIG becomes the 14th institution to receive the virtual currency license, which has now been awarded to payments startups, crypto exchanges and a bitcoin ATM firm, among others.

Forex exchange (FX) settlement giant CLS will launch soon its IBM blockchain-powered netting service according to Chief Strategy Officer (CSO) Alan Manquard. CLS Group, which reportedly settles on average $5 trillion in payment instructions daily, is a U.S. FX settlement service supplier with high-profile members that include Goldman Sachs, JPMorgan, Barclays, and Citigroup. The netting service involves offsetting and the determination of the value of multiple positions or payments due to be exchanged between the parties accounting for factors such as the currency volatility caused by differences in time zones. In such cases, the service is used to fix the remuneration a given party is owed. The tech giant’s Hyperledger-based blockchain can tackle the 2.9 million daily transactions that are estimated to result in an average of 25,000 disputes per year, locking up around $100 million. It is also expected to reduce the time taken for dispute resolution from forty days to under ten.

Tokyo police have arrested eight men that are suspected of collecting a total amount of $68.4 million in cash and cryptocurrency using a pyramid scheme. The suspects claimed to run a U.S. investment company dubbed “Sener,” conducting seminars with foreign speakers. Allegedly, the suspects received cash and Bitcoin (BTC) from about 6,000 people in 44 prefectures, including Tokyo. A group lawsuit was filed at the Tokyo District Court by 73 victims of the fraud, seeking approximately $3.2 million in damages. Six persons have already admitted to the allegations, while two others deny them. The investigators believe the suspects tried to avoid prosecution by using cryptocurrencies, as they are in a “gray zone.” However, although digital currencies are not considered as securities that are under the jurisdiction of current law, they can be regulated depending on the structure of the investment.