WHAT HAPPENED YESTERDAY

As of New York Close 11 Mar 2020,

FX

U.S. Dollar Index, +0.22%, 96.62

USDJPY, -1.04%, $104.54

EURUSD, -0.16%, $1.1262

GBPUSD, -0.70%, $1.2817

USDCAD, +0.34%, $1.3771

AUDUSD, -0.44%, $0.6478

NZDUSD, -0.12%, $0.6263

STOCK INDICES

S&P500, -4.89%, 2,741.38

Dow Jones, -5.86%, 23,553.22

Nasdaq, -4.70%, 7,952.05

Nikkei Futures, -5.15%, 18,790.0

COMMODITIES

Gold Futures, -1.02%, 1,643.40

Brent Oil Futures, -3.71%, 35.84

SUMMARY:

USD ruled the day once again as bad news continued to stream in from the Covid-19 front. Governments all around the world are talking of fiscal stimulus as expected. The disappointment from the lack of details of Trump’s promised tax cuts dominated sentiment throughout the day. The Bank of England cut 50bp in a surprised move that was neither here nor there as they should have either cut last week together with the Fed for maximum impact or just waited for the scheduled meeting later this month. The usual selling on rate cuts which pushed GBP immediately to the low of 1.2830s were met with buyers who managed to squeeze the shorts and print a high of 1.2975.

That did not last as USD strength took over when equity markets started to sell off to the lows of the day. It was a day of pain for many traders as bonds and commodities all fell on the day despite the weak equity markets.

It was an ugly day for stocks on Wednesday with the Dow Jones Industrial Average (-5.86%) closing in bear market territory, or down 20% from a recent high, amid recessionary fears induced by Covid-19. The S&P 500 fell 4.89%, the Nasdaq Composite fell 4.7%, and the Russell 2000 fell 6.4%.

The World Health Organization officially declared COVID-19 as a global pandemic, and with no stimulus plan enacted from Washington, the market was left with discouraging news updates that heightened the economic uncertainty.

Large events were banned in Washington State and San Francisco with many more getting canceled or delayed in other U.S. states. Dr. Fauci, the director for the National Institute of Allergy and Infectious Diseases, cautioned that the worst is yet to come. Trump has even imposed new travel restrictions on Europe.

Separately, the NY Fed announced it will raise daily oversight repo limits to $175 billion from $150 billion beginning tomorrow and continuing through April 13 in response to unfavorable market conditions caused by Covid-19 .

Notably, U.S. Treasuries didn’t exhibit the flight-to-safety one would expect during an exodus from stocks. Some profit-taking and speculation that Washington will have to issue more debt to finance a fiscal stimulus plan were the leading explanations for the decline in bonds. The 2-yr yield remained unchanged at 0.50%, and the 10-yr yield increased 6bp to 0.82%.

UK FIRES BOTH BARRELS: EMERGENCY RATE CUT AND BUDGET BOOST

The Bank of England slashed interest rates by half a percentage point on Wednesday (to 0.25%) and announced support for bank lending just hours before the unveiling of a budget splurge designed to stave off a recession triggered by the Covid-19 outbreak. “This is a big package. It’s a big package. It is a big deal,” Carney said, adding that the BoE’s package was equivalent to “north of 1%” of economic output. He said the Bank was coordinating with the government to have “maximum impact”.

Britain’s government promised on Wednesday nearly $39 billion in stimulus to its economy as its new chancellor of the Exchequer, Rishi Sunak, outlined plans to boost public spending and bury the austerity politics of the last decade. Among the pledges he made was about $9 billion to support the self-employed, businesses and vulnerable people and about $6.5 billion for Britain’s frayed National Health Service and other public bodies.

IMPACT: Most UK stocks fell despite the Bank of England’s emergency rate cut, and the government’s Covid-19 stimulus programme. GBP tried gamely to take it as a positive before USD strength pushed it back to end at the lows of the day. The fiscal budget was too underwhelming to sway risk sentiment as market participants foresee that the knock-on effects from a halt in supply chains will require a much more sizable budget. In addition, the BoE’s emergency cut is not much of a surprise as it follows the playbook of other central banks in the past 2 weeks.

U.S. CONSUMER PRICES UNEXPECTEDLY RISE IN FEBRUARY

U.S. consumer prices unexpectedly rose in February but are likely to decline in the months ahead as the Covid-19 outbreak depresses demand for some goods and services, outweighing price increases related to shortages caused by disruptions to the supply chain.

The Labor Department said its consumer price index increased 0.1% last month, matching January’s gain, as rising food and accommodation costs offset cheaper gasoline. In the 12 months through February, the CPI rose 2.3%. That followed a 2.5% jump in January, which was the biggest year-on-year gain since October 2018. Economists polled had forecast the CPI would be unchanged in February and rise 2.2% year-on-year.

IMPACT: The key takeaway from the report is that it isn’t going to alter the market’s belief that the Federal Reserve will soon be cutting the target range for the fed funds rate in size at next week’s FOMC meeting (if not sooner).

WALL STREET TUMBLES FURTHER AS WHO DECLARES PANDEMIC

WHO chief Tedros Adhanom Ghebreyesus told a news conference that he was deeply concerned by the spread and severity of COVID-19, and by the “alarming levels of inaction” in some countries. Tedros warned that the number of cases reported and the number of countries affected ‘doesn’t tell the full story’. “Pandemic is not a word to use lightly or carelessly,” Dr. Tedros Adhanom Ghebreyesus, chief of the W.H.O., said at a news conference in Geneva.

IMPACT: Until now, the W.H.O. had avoided using the term to describe the epidemic spreading across the world, for fear of giving the impression that it was unstoppable and countries would give up on trying to contain it. The organization had said earlier in the outbreak that it no longer officially declares when an epidemic reaches pandemic proportions, preferring instead to declare global public health emergencies. The designation itself is largely symbolic, but public health officials know that the public will hear in the word elements of danger and risk. Governments have all been waiting for the rise in infection cases before they implement social distancing measures, when the rise is all but a certainty if no measures are imposed.

DAY AHEAD

After American, Canadian, and Australian, UK central banks all slashed rates to negate the negative effects of Covid-19 on their economies, it’s now the turn of European policymakers to decide whether to follow suit. The ECB will conclude its meeting on Thursday and while markets are convinced rates will be cut by 10 basis points to -0.6%, economists disagree.

And with good reason. European interest rates are deep in negative territory already, meaning that the ECB only has a couple more ‘rate bullets’ left, and it might prefer to save them for a crisis where monetary policy can actually help. Cutting rates is a weak ‘antidote’ for a supply-side shock like this one, and even the positive effects on demand are questionable if fears intensify enough for consumers to curtail spending.

Another issue is how divided ECB officials are. Several policymakers – especially those representing large economies like Germany and France – think that monetary policy is already extremely accommodative and that any more stimulus would do next to nothing to boost the struggling economy. Therefore, cutting rates further may be a bridge too far.

Instead of cutting rates, the ECB could announce a scheme to provide liquidity to businesses impacted by the virus, helping those that have seen their supply lines cut and their cash flows dry up, by giving them very cheap loans. This is arguably the best strategy available, considering that the Bank is low on policy ammunition and highly divided. It won’t really boost market confidence, but it does put a ‘bandage’ on the wound.

SENTIMENT

OVERALL SENTIMENT:

Sell, Mortimer, Sell! The world is finally waking up to the horror story that is the Covid-19 outbreak. Inevitable and unstoppable until governments impose the draconian measures that are required. Trump imposed a temporary travel ban that “will not only apply to the tremendous amount of trade and cargo, but various other things as we get approval.” If true, markets are going to be under tremendous pressure as they wake up to this development.

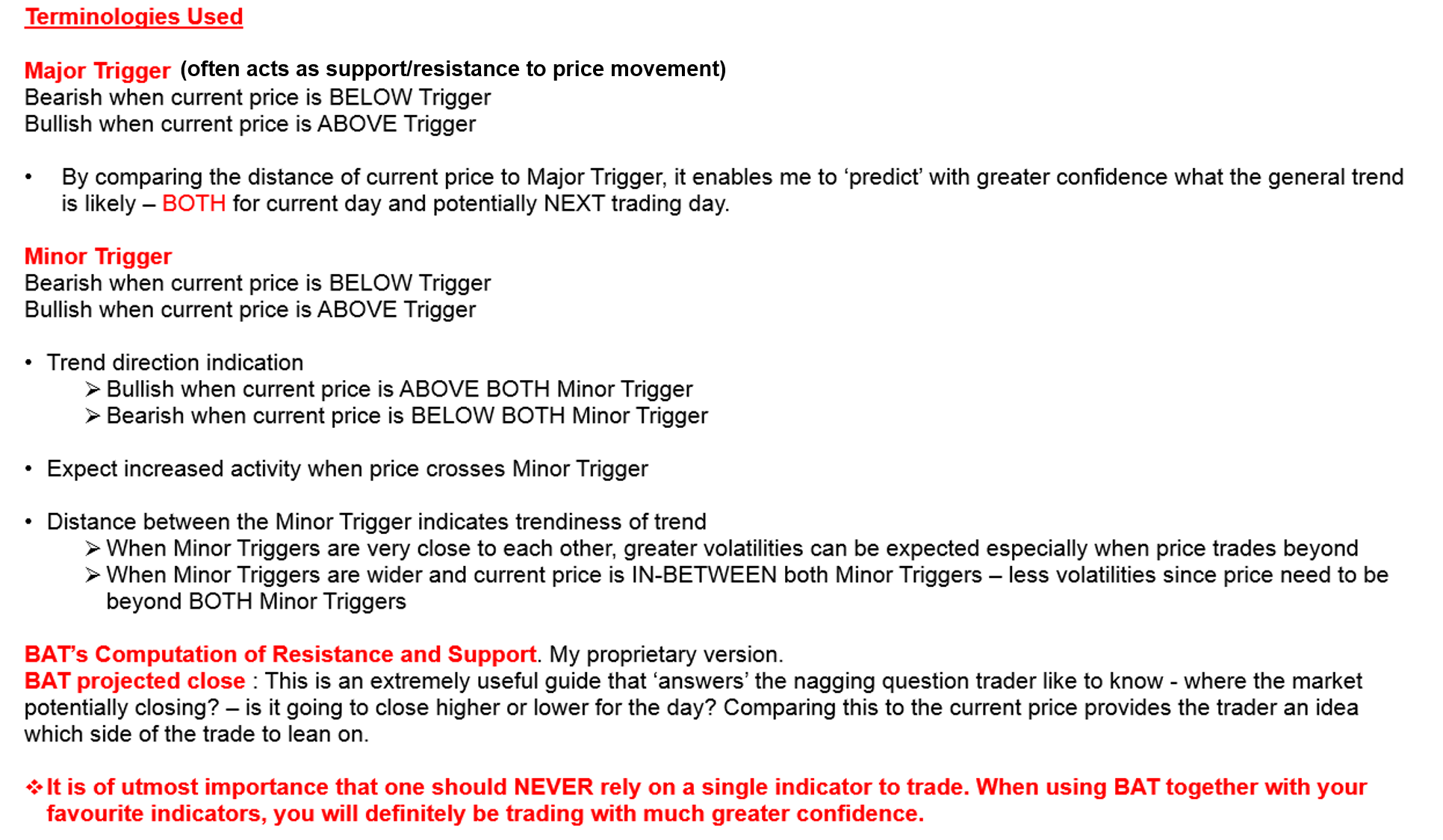

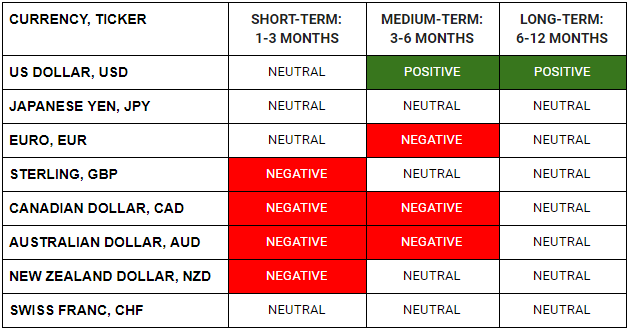

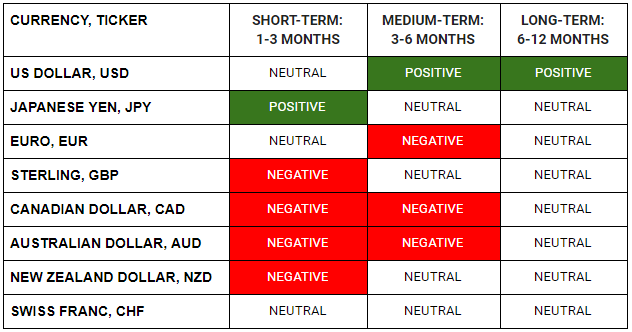

FX

STOCK INDICES

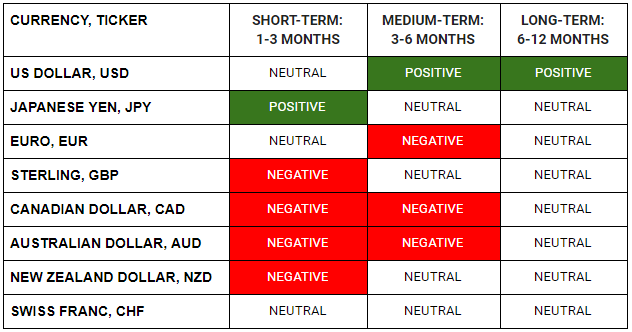

TRADING TIP

Where is the Pain?

In times of extreme volatility and uncertainty, investors tend to seek safe havens. Investments that are typically thought to be safe havens are the US government bonds and Gold. On the day that the S&P500 Index fell almost 6% during the US trading session, you would expect those two assets to be doing quite well.

What happened, instead, was that both fell on the day, with Gold losing nearly 2% from the highs of the day and the 10-year US Treasury bond yield rising 20 basis points (0.20%) from the low of the day. As has been our constant refrain recently, historical relationships cannot be assumed as a given in times of market stress.

Markets tend to inflict the maximum amount of pain during these times because subscribed positions are usually crowded. The safest haven, when you have no clue what is going on and when the margin clerks are busy on the phones, is cash.

As such, all subscribed positions tend to come under pressure and get liquidated as investors head for the exit. The strategy of choice in the years since the Great Financial Crisis has been the risk parity strategy where investors are long both bonds and equities (in various proportions, according to some volatility adjusted formulae, for which the investment manager gets paid the big bucks to come up with) for the long term.

That could very well continue to work in the long term. In the long run, given the untold economic damage that will be inflicted by Covid-19, the race to zero and below for global interest rates will continue apace.

However, we now live in the short term and in the short term, we know where the crowded positions are. In a crowded room, with a small exit, what do you think happens next, when someone smells smoke?