WHAT HAPPENED YESTERDAY

As of New York Close 16 Mar 2020,

FX

U.S. Dollar Index, -0.64%, 98.12

USDJPY, -1.60%, $106.19

EURUSD, +0.52%, $1.1164

GBPUSD, -0.07%, $1.2268

USDCAD, +1.51%, $1.4013

AUDUSD, -1.33%, $0.6102

NZDUSD, -0.28%, $0.6042

STOCK INDICES

S&P500, -11.98%, 2,386.13

Dow Jones, -12.94%, 20,186.48

Nasdaq, -12.32%, 6904.59

Nikkei Futures, -2.26%, 16,410.0

COMMODITIES

Gold Futures, -0.70%, 1,506.05

Brent Oil Futures, -11.88%, 29.83

SUMMARY:

Safe haven currencies strengthened amidst the carnage with the Japanese Yen and Euro gaining the most ground as risk sensitive commodity currencies like the Aussie, Kiwi and Canadian Dollars got battered. Volatility was with USDJPY spiking from 106.50s to 107.50s on news that the BoJ was scheduled for an emergency meeting to breaking down back to where it was when the BoJ again did what it has been doing for years with no result i.e. increased support for the stock market through ETFs buying. This is the very definition of insanity – doing the same thing repeatedly and expecting different results. USDJPY eventually broke lower to test 105.15 before rebounding steadily back to 106.50s region.

It was pretty much a day of pain for many traders where both longs and shorts could be getting stopped out during the course of the day. Speaking of safe havens, Gold seems to have forgotten that it is supposed to play that role for its fans, dropping almost 5% on the day to 1450s on deleveraging flows as speculators rush to cash, before recovering above to close above 1500.

There was a crisis of confidence in the stock market today, which led to the worst day of losses since the crash of 1987.

Fear ruled when the futures market went limit down within minutes of Asian open after the Federal Reserve announced a surprise Sunday rate cut of a whopping 100bp and a stunning series of policy measures aimed at supporting the financial markets and the flow of credit. That should have led to a stock market rally in normal times, but we are no longer in Kansas, Dorothy. The market spiked was barely a blip and the futures were immediately at the limit down (-5%) for the rest of the day till the NY open. The selling continued despite attempts at rallies through the day.

The Dow Jones Industrial Average declined 12.94%, the S&P 500 fell 11.98%; the Nasdaq Composite dropped 12.32%, and the Russell 2000 plunged 14.3%. U.S. 2yr Yields fell 13bp to 0.36% and U.S. 10yr Yields fell 21bp to 0.73%.

US FEDERAL RESERVE ROLLS OUT THE BAZOOKA

Specifically, the target range for the fed funds rate was cut by 100 basis points to 0.00%-0.25%, the discount rate was cut by 150 basis points to 0.25%, a $700 billion quantitative easing program is to be implemented, there was coordinated central bank action to enhance liquidity via standing U.S. dollar liquidity swap line arrangements, and bank reserve requirement ratios were reduced to 0.00%, effective March 26. The policy effort is laudable, yet market participants quickly made it known that it isn’t thought to be enough to turn the tide of deteriorating confidence on Main Street and Wall Street.

There was some chatter during the day that the White House is pushing an $800 billion stimulus proposal, half of which would involve a payroll tax cut and an assistance package for the airline industry. Separately, Senate Minority Leader Schumer was reportedly floating a $750 billion stimulus proposal. Notwithstanding those ideas, there was nothing concrete as a step-up measure on the fiscal side to alter investor confidence. The end result was wholesale selling of risk assets, which escalated further in the final hour as President Trump and his coronavirus task force conducted a press conference, which featured a suggestion that the trajectory of the virus might not peak until July or August. Importantly, though, it didn’t feature any announcement of a fiscal stimulus plan.

IMPACT: With everything thrown at the market, you would have expected at least a minor rally. However, the Covid-19 newsflow dominated market sentiment and sellers dominated the flows. What are the politicians and central bankers going to try next?

CENTRAL BANKS WHO EASED SINCE WEEKEND

- The US Fed slashed its rate on Sunday to between 0 and 0.25 per cent, from a range of 1 to 1.25 per cent, matching its previous record-low.

- Bank of Korea (BOK) cut the 7-Day Repo Rate by 50bps to 0.75% (intra-meeting move).

- New Zealand Central Bank (RBNZ) cuts Official Cash Rate (OCR) by 75bps to 0.25%

- Bank of Japan(BOJ) leave interest rate on Excess Reserves (IOER) unchanged from -0.10%; doubles purchases of ETF and J-REIT purchases

- China PBOC cuts Reserve Ratio Requirement (RRR) between 50-100bps to unleash CNY 550B to banking system; effective Monday, Mar 16th

- The Hong Kong Monetary Authority (HKMA) reduced its rate by 64 basis points to 0.86 per cent

- Czech Central Bank (CNB) cuts repurchase rate by 50bps to 1.75%

- Chile Central Bank (BCCH) cuts overnight rate target by 75 bps to 1.0%

- UAE central bank trimmed its interest rate on one-week certificates of deposit by 75 basis points and decided to maintain the repo rate, applicable to borrowing short-term liquidity from CBUAE against CDs at 50 basis points above the 1-week CD rate, the central bank said in a statement.

- Saudi Arabian Monetary Authority cut repo and reverse repo rates by 75 bps. While Kuwait’s central bank cut its deposit rate by 100 bps (1 per cent) to 1.5 per cent, its lowest ever, it also cut its overnight, one-week and one-month repo rates by 100 bps to 1 per cent, 1.25 per cent, and 1.75 per cent respectively.

- Central Bank of Qatar regulator slashed its deposits, lending, and repo rates. Bahrain’s central bank cut overnight, weekly and monthly deposit rates, in addition to its lending rate.

- Sri Lanka Central Bank (CBSL) cut its key rates (intra-policy move)

- Philippines Central Bank (BSP) said to consider 50bps at upcoming rate meeting this week

IMPACT: Same playbook, wrong game but only thing they know to do.

RBNZ SLASHES RATES AT EMERGENCY MEETING AS COVID-19 WORSENS

New Zealand’s central bank slashed interest rates by 75 basis points to a record low on Monday following an emergency meeting as it prepared for a “significant” hit to the economy from the coronavirus. The Reserve Bank of New Zealand (RBNZ) cut the official cash rate (OCR) to 0.25%, and pledged to keep it at this level for at least 12 months, the banks said in its statement.

RBNZ Governor Adrian Orr told a media conference the virus was expected to have a severe impact on New Zealand’s people and economy over the coming year. But he said the move was also to highlight that RBNZ was not at this point contemplating negative interest rates, even as the policy options for central banks dwindle globally.

IMPACT: Kiwi ended the day modestly lower on the back of the RBNZ rate cut. Emergency cuts are no longer much of a surprise, Kiwi is classified as a risk asset and will be driven by structural flows at this point in time.

CANADA SHUTS BORDERS

Canadian Prime Minister Justin Trudeau announced on Monday afternoon that Canada would close its borders to anyone who is not a Canadian citizen, except for permanent Canadian residents, close family members of Canadians, diplomats, and US citizens, as the Covid-19 pandemic worsens. Trudeau also asked all Canadian citizens and legal residents to return to Canada “while it is still possible.”

IMPACT: It’s only a matter of time more western countries shut their borders to one another, trade is slowing, sales and manufacturing is plunging, we have seen this movie before in Asia, we should know how this plays out. The measures of governments to contain the virus should take into account the timespan of containment, Singapore, South Korea and China are good benchmarks.

BOJ EXPANDS MONETARY STIMULUS TO DEFEND ECONOMY FROM COVID-19

The central bank will double its upper limit of annual purchases of exchange-traded funds to 12 trillion yen ($112.46 billion) and of real-estate investment trusts to 180 billion yen per year. It will also expand the upper limit of its corporate bond balance to 4.2 trillion yen and its commercial paper balance to 3.2 trillion yen, each up 1 trillion yen. In addition, it will start a lending program for commercial banks, providing them with one-year loans in exchange for corporate collateral worth 8 trillion yen.

Other policy tools were kept unchanged, with short-term interest rates at -0.1% and long-term interest rates at around zero. It will increase its holding of Japanese government debt by 80 trillion yen a year. “We will purchase ETFs twice as much as before and for as long as necessary,” BOJ Governor Haruhiko Kuroda said at a news conference.

IMPACT: The Nikkei Stock Average spiked upward for a short period of time after the announcement before dropping to close 2.46% lower than it did on Friday. More of the same, for lesser and lesser impact. Keep doing what hasn’t work, in the hope that someday it might – number 1 rule of Japanese central banking.

DAY AHEAD

Announcements of fiscal stimulus in both Australia and the UK failed to bolster neither the Aussie nor Sterling last week, with both currencies maintaining their downward bias against the Dollar. It’s even less likely therefore that any positives in this week’s job numbers would do much to ease the selling pressure as investors’ sole concern right now is what the economic costs of Covid-19 will be and how quickly it can be contained.

The UK employment report for January is out later today and Australia will publish its figures for February on Thursday. Labour markets in both countries withstood the economic slowdown in 2019 and probably stayed resilient in January/February as well. However, any weakness in the data, especially in Australia’s numbers that are more up to date, could further weigh on the respective currencies.

SENTIMENT

OVERALL SENTIMENT:

The world is finally waking up to what we have been screaming about – that this is serious, and drastic social distancing measures are needed everywhere. You don’t need to wait for the number of infected to rise to start. The virus doesn’t respect customs and immigration checkpoints. The economic impact is just starting to be felt and it is going to get worse.

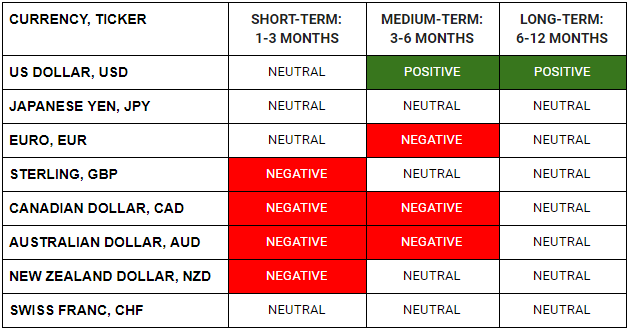

FX

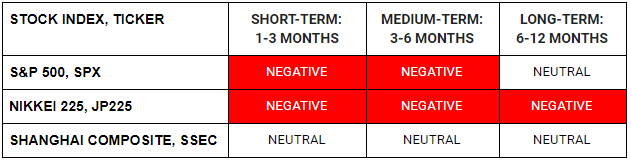

STOCK INDICES

TRADING TIP

You can’t defy the Laws of Physics

Make no mistake, this is a bear market. Politicians and so-called experts are still fooling themselves into thinking that this is just a “slow down”. The disruption to supply chains and the demand destruction that the world is experiencing is unprecedented.

For example, tourist arrivals in Hong Kong for the month of Feb was down 95% year-on-year. Think about that. How does that affect all the businesses that depend on these tourists? How does it affect the employees of all these businesses? Do you think free money from the governments will make them rush out to start consuming again while the virus ravages on?

This will happen all over the cities of the world that depend on tourism. This is just one industry. No amount of fiscal stimulus or interest rate cuts will change that. All those that were calling for recession at the end of last year are now strangely saying that recovery will be fast and swift.

There is no perpetual motion machine. The Laws of Physics cannot be defied. The economic boom cannot go on forever, no matter how much the policymakers wish for it to be so. All the fiscal spending, interest rate cuts and money printing will have a price. The costs may not be obvious just yet but make no mistake – the price will need to be paid at some point.

Stick around, we’ll talk more about this as time passes…