WHAT HAPPENED YESTERDAY

As of New York Close 16 Mar 2020,

FX

U.S. Dollar Index, +1.31%, 98.75

USDJPY, +3.13%, $107.92

EURUSD, -0.71%, $1.1106

GBPUSD, -2.35%, $1.2277

USDCAD, -0.89%, $1.3804

AUDUSD, -0.83%, $0.6184

NZDUSD, -0.48%, $0.6059

STOCK INDICES

S&P500, +9.29%, 2,711,02

Dow Jones, +9.36%, 23,185.62

Nasdaq, +9.35%, 7,874.88

Nikkei Futures, -8.55%, 16,790.0

COMMODITIES

Gold Futures, -4.63%, 1,516.70

Brent Oil Futures, +1.90%, 33.85

SUMMARY:

U.S. Dollar outperformance continues as a global liquidity panic is creating a grab for cash in the global reserve currency. In times of uncertainty, investors do not have time to cherry pick based on a macro perspective, but rather run for the hills first and then access the situation from safer grounds. As panic continues to grip the global economy and central banks throw the kitchen sink to stop the market panic, all correlation goes to one and instinct takes over, the USD is regaining its status as the primary safe haven, and we will continue to see a global dollar shortage as desks and institutions will soon drawdown on credit lines. Extreme JPY weakness was extremely disconcerting for many who are used to seeing JPY perform when fear rules the market.

The stock market rebounded on Friday, though the advance still left the major averages deep in the red for the week. The S&P 500 rallied 9.29%, narrowing this week’s loss to 8.8% while the Russell 2000 (+7.7%; -16.6% for the week) underperformed.

Stocks jumped out of the gate after equity futures hit a circuit breaker, but this time, it was to the upside. The early rally set expectations for a strong rebound, but the bulk of the cash session was not as inspiring. The first three hours of trade saw a pullback, during which the S&P 500 approached yesterday’s closing level. The index returned to its starting mark in midday trade but regrouped and staged a huge 6.7% rally in the last 30 minutes as Trump was discussing measures to deal with the Covid-19.

Lawmakers in Washington neared an agreement on some fiscal relief measures while Trump declared a national emergency during a late-afternoon speech. The declaration will allow up to $50 bln in spending. Separately, Trump said interest on student loans will be waived until further notice and that the U.S. will be purchasing oil to fill the Strategic Petroleum Reserve. (Clarification later showed that interest waived do not mean lower monthly repayments for those with student loans, just that more of the payment goes to reduce the principal amount of outstanding loans.)

US 2yr Yields opened 16.1bp lower at 0.329% and traded to a low of 0.285% and US 10yr Yields opened 30pb lower at 0.64% – day’s low, early this morning, in reaction to Fed’s emergency cut on Sunday.

AS COVID-19 CHAOS SPREADS GLOBALLY, TRUMP DECLARES U.S. EMERGENCY

President Donald Trump declared a U.S. national emergency over the quick spreading Covid-19 on Friday, opening the door to more government aid to combat a pathogen that has infected more than 138,000 people worldwide and left over 5,000 dead. “To unleash the full power of the federal government to this effort today, I am officially declaring a national emergency – two very big words,” Trump said in remarks at the White House Rose Garden, adding that the U.S. situation could worsen and “the next eight weeks are critical.”

Trump, whose action makes available $50 billion in federal aid to states and localities, had faced criticism from some experts for being slow and ineffective in his response to the crisis and playing down the threat. The latest steps came two days after Trump announced travel restrictions blocking U.S. entry for most people from continental Europe. While Britain was among the countries exempted, Trump said on Friday that might change because infections there had risen “precipitously.”

IMPACT: Wall Street staged a furious rally in the waning moments of the session on Friday after U.S. President Donald Trump declared a national emergency to combat the rapidly spreading Covid-19, although major averages still suffered sharp losses for the week. Markets were relieved at the fact that Trump is finally taking the threat of the virus seriously and so actual progress can be made in curtailing the impending economic destruction in the U.S. should authorities continue to remain sanguine.

EU FISCAL STIMULUS

Germany – long criticized by the Commission and other EU nations for running ultra-tight budgets during periods of economic strength – on Friday promised half a trillion euros in guarantees for business in a four-point plan that won a thumbs-up from economists.

Von der Leyen proposed a 37 billion euro ($41 billion) investment initiative based on funds that could be quickly re-channelled to sectors in need, officials said. This revised a figure of 25 billion euros that she previously announced for the same initiative. The commission offered “full flexibility” in its interpretation of fiscal rules, aiming to encourage governments with fiscal space such as Germany and the Netherlands to spend more. However, Brussels fell short of declaring a full suspension of its fiscal rules, known as the Stability and Growth Pact, in a move probably meant to maintain some ammunition if the crisis worsened.

IMPACT: The EU breaking its tight fiscal gridlock was a positive development as it seems policy makers are putting their differences aside and forging a united front to combat the virus, European risk assets cheered this progress by staging a relief rally.

BOC EMERGENCY RATE CUT

BOC lowered its policy rate to 0.75% (-50bp) and said it “stands ready” to move again if needed. Governor Stephen Poloz, in a joint press conference Friday afternoon with Finance Minister Bill Morneau, also announced a new facility to support funding markets for small- and medium-sized businesses “at a time when they may have increased funding needs and credit conditions are tightening.”

This marks the first emergency rate cut by the country’s central bank since the last 2008-2009 financial crisis and is part of a coordinated government-wide response to respond to a slowdown that threatens to drive the nation’s economy into a recession. Morneau announced he would deliver a fiscal stimulus package next week that will include an additional $10 billion (US$7.1 billion) in new funding to the country’s two business financing agencies – the Business Development Bank of Canada and Export Development Canada.

IMPACT: The BOC’s move is consistent with expectations. Hence, the Loonie did not respond with a collapse in price. With oil being pinned at such low levels due to a supply glut out of the Middle-East, more headwinds will be coming for the oil dependent Canadian economy and coupled with possible border closure with the U.S., the Loonie may have much lower to go from here as the world’s “most steadfast” central bank capitulates to join the rest of its counterparts in a race to zero.

FED SLASHES RATES IN EMERGENCY COVID-19 MOVE

With panic buying on Main Street and fear-driven sell-offs on Wall Street, the U.S. Federal Reserve cut interest rates to near-zero on Sunday in another emergency move to help shore up the U.S. economy amid the rapidly escalating global coronavirus pandemic. For the second time since the financial crisis of 2008, the Fed cut rates at an emergency meeting, aiming for a target range of 0% to 0.25% to help put a floor under a rapidly disintegrating global economy.

“We really are going to use our tools to do what we need to do here,” Powell said, adding that the Fed has gone in “strong” and could increase bond-buying and use other tools to support market functioning and the flow of credit, what he called the Fed’s “most important” function. A broader set of Fed powers, including direct lending to financial firms, remains at the Fed’s disposal, and Powell said the central bank would not hesitate to use them if needed.

IMPACT: The old playbook is breaking down, with markets puking back at the Fed after the rate cut to near-zero. This is the Fed’s bazooka. It also means that after this, the Fed – which just cut rates to zero and launched QE5 – is now out of ammo, as Powell will have to cut rates to negative next and/or buy stocks outright for further monetary stimulus, something that would require the permission of Congress. And since that is unlikely absent a total collapse in the financial system, we are now down to fiscal stimulus. Today’s emergency meeting was in lieu of Wednesday’s meeting.

DAY AHEAD

As the Covid-19 pandemic continues to wreak economic havoc across the globe, the pressure is on central banks to provide more stimulus amid the fast deteriorating outlook. The BoJ will be a more interesting one, however, as, although some action is certain, investors aren’t quite sure what form it will take. BoJ will be having an emergency meeting later at noon today. One central bank that is less likely to announce any change in policy is the Swiss National Bank, despite the Franc’s recent appreciation.

SENTIMENT

OVERALL SENTIMENT:

You know things are really bad when the Fed cut 100bp 3 days ahead of their scheduled meeting after an emergency cut of 50bp just two weeks ago and the S&P 500 index futures spiked briefly (+0.04%) on Asian open but hit the 5% limit down barrier seconds after. If you are long risk assets, and the Fed just threw everything including the kitchen sink at it, and yet stocks are down – What do you do now?

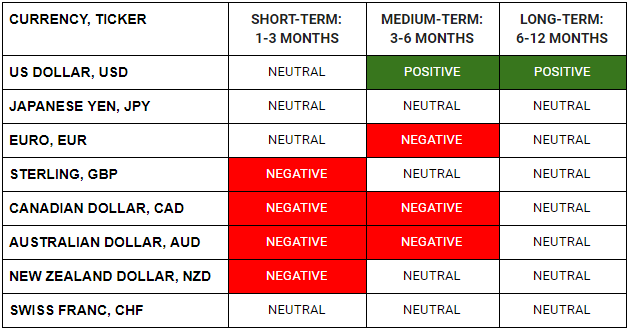

FX

STOCK INDICES

TRADING TIP

What comes after the kitchen sink?

Everything the market hoped the Fed would do, has now been done. In an emergency meeting on Sunday, the Fed threw everything they had including the kitchen sink at the fear monster in an effort to soothe the market. Emergency rate cuts, bond buying, reassurance that they are willing to do whatever they can to help the market and yet, stocks sold off with barely a blip higher.

Volatility is extremely high, confusion reigns and uncertainty is now a way of life. In times of uncertainty, many subscribed positions will get unwound regardless of fundamentals. Volatility is only high relative to recent history and yet, is it really high given the unprecedented situation that the world is facing now?

Size your risk appropriately and tread carefully.