WHAT HAPPENED YESTERDAY

As of New York Close 13 Mar 2020,

FX

U.S. Dollar Index, +1.00%, 97.47

USDJPY, +0.12%, $104.68

EURUSD, -0.76%, $1.1183

GBPUSD, -1.94%, $1.2573

USDCAD, +1.21%, $1.3945

AUDUSD, -3.25%, $0.6274

NZDUSD, -2.46%, $0.6115

STOCK INDICES

S&P500, -9.51%, 2,480.63

Dow Jones, -9.99%, 21,200.85

Nasdaq, -9.43%, 7,201.80

Nikkei Futures, -13.63%, 16,730.0

COMMODITIES

Gold Futures, -4.00%, 1,576.55

Brent Oil Futures, -8.19%, 32.86

SUMMARY:

Early Asian hours started off positively with news that Trump was going to address the nation and hopes were lifted that he would announce a fiscal package that would help the markets. Instead, he turned up to shut down the borders to visitors from Europe with the exception of those from the UK (yup, friendly English-speaking tourists are safe from the virus, apparently).

With that, everything went downhill quickly. Equities sold off, USD strengthened against most of everything except EUR and JPY. That only lasted till London strolled in and the mighty USD started to take off and S&P500 index futures hit the 5% limit down level. With USD funding being in high demand through the cross-currency basis market, USD took another leg higher.

ECB did not cut rates but increased their asset purchase amount by an additional 120 billion EUR for the rest of the year, and EUR, for some inexplicable reason, tried to rally. When the rally ran out of steam, everyone realised that it was just more QE and more of the same, USD took centre stage again as stocks hit the next limit down (at 7% on the day) when US hours started.

Things went from bad to worse as the bond market started to lose its gains and dribbled lower. A massive order went through in the late morning and the 10-year bond yield spiked 10bp (basis points) to hit the day’s high of 0.90% in a matter of minutes as risk parity strategies started to unwind their positions.

When news that the NY Fed will be adding more liquidity into the system with asset purchases broke, the markets tried gamely to retrace, with equities rallying 6% from the lows before getting smacked down again as market realises yet again, it’s more of the same and the virus epidemic is just beginning.

Each of the major indices dropped more than 9% on Thursday, as new stimulus measures from central banks failed to stir confidence among investors without a meaningful fiscal response from Washington. The Russell 2000 (-11.2%) led the retreat, followed by the Dow Jones Industrial Average (-9.99%), S&P 500 (-9.51%), and Nasdaq Composite (-9.43%) with each closing down more than 25% from prior highs. US 2yr Yields finished unchanged at 0.50%. The US 10yr Yields traded in a wild range of 0.63% to 0.90%, and dribbled lower after the close of 0.88% (6bp higher than previous close) to trade around 0.76% in early Asian hours.

For the second time this week, the S&P 500 triggered a 15-minute trading halt after falling by 7.0% shortly after the open following more economic disruptions caused by Covid-19. Notable ones included Trump suspending travel from most European countries for 30 days and major sports leagues in the U.S. suspending their 2019-2020 seasons. While it’s encouraging that central banks are committed in ensuring ample liquidity in these disastrous trading conditions, it’s unlikely that the measures will boost consumer confidence. Elsewhere, the reported disagreements between Republicans and Democrats regarding a stimulus plan only exacerbated the dire mood on Wall Street.

FED ANNOUNCES $1.5 TRILLION IN CAPITAL INJECTIONS

The extraordinary funding measure first involves a $500 billion injection at 1:30 p.m. ET on Thursday, the bank said. The cash will be added to money markets through a three-month market repurchase agreement, or repo operation. One-month and three-month repos for $500 billion each will be conducted today and continue to be offered weekly through the calendar month, the bank added.

The central bank said it will also expand its $60 billion reserve-management purchases to buy up “a range of maturities” roughly matching that seen in Treasury assets outstanding. Securities targeted include Treasury bills, floating-rate notes, and nominal coupons. The first such purchase will begin today, the bank said.

IMPACT: S&P 500 knee-jerked higher by 6% from the lows on the announcement of the stimulus, but couldn’t hold onto gains for long as markets are not getting the stimulus they want, which is fiscal in nature and only Washington can provide it. This is not a crisis that can be saved through credit, but a direct intervention on mainstreet is required, and the bazooka better be sizable because there is blood on the street, anything less than an unprecedented fiscal stimulus might send the market reeling into “unknown depths”.

COVID-19 PANDEMIC “COULD BE OVER BY JUNE” IF COUNTRIES ACT, SAYS CHINESE ADVISER

The global coronavirus pandemic could be over by June if countries mobilize to fight it, a senior Chinese medical adviser said on Thursday, as China declared the peak had passed there and new cases in Hubei fell to single digits for the first time.

Zhong Nanshan, the government’s senior medical adviser, told reporters that as long as countries take the outbreak seriously and are prepared to take firm measures, it could be over worldwide in a matter of months. “My advice is calling for all countries to follow WHO instructions and intervene on a national scale,” he said. “If all countries could get mobilized, it could be over by June.”

IMPACT: There is light at the end of the tunnel if governments act effectively, we have seen it with China, Singapore and South Korea that the virus can be contained. If western governments follow the same playbook and bite the bitter pill early, the economy can recover a lot quicker. It should be monitored if Washington is going to follow this playbook.

ECB APPROVES FRESH STIMULUS FOR REELING ECONOMY BUT KEEPS RATES STEADY

The European Central Bank approved fresh stimulus measures on Thursday to help the eurozone economy cope with the growing cost of the Covid-19 epidemic but kept interest rates unchanged (0.00%) in a move that may disappoint financial markets. ECB President Christine Lagarde, who has led the central bank for just over four months, used a press conference to call for an “ambitious and coordinated fiscal policy response” by European governments.

The ECB said it now expects the euro zone’s economy to grow by 0.8% this year, 1.3% in 2021 and 1.4% in 2022. This compares to an expansion of 1.1% for 2020 and of 1.4% for each of the following two years projected in its December forecasts.

IMPACT: With millions of people in lockdown, markets in turmoil and companies struggling with disrupted supply chains, the economy is already reeling so ECB support was fully priced in and investors were only guessing about the extent of any move, as we all know, markets were disappointed with the lack of fiscal response and were repriced lower.

DAY AHEAD

Market participants will be glued to the screen, watching the tape unravel itself to every piece of news regarding Covid-19, Fiscal Measures and Policy Measures in response to the virus. The “hopium” for an adequate fiscal response is one of the last threads that is keeping the markets from another huge repricing lower, and with liquidity this thin, who knows where the bottom is?

SENTIMENT

OVERALL SENTIMENT:

This was what we wrote yesterday:

“Sell, Mortimer, Sell! The world is finally waking up to the horror story that is the Covid-19 outbreak. Inevitable and unstoppable until governments impose the draconian measures that are required. Trump imposed a temporary travel ban that “will not only apply to the tremendous amount of trade and cargo, but various other things as we get approval.” If true, markets are going to be under tremendous pressure as they wake up to this development.“

Did you sell Mortimer? Though the White House clarified that the ban only referred to people, and not cargo, the damage was not lessened. From dismissing the gravity of the Covid-19 crisis to suddenly closing its borders to travellers from Europe, Trump must have finally been spooked out of his stupor by some frightening statistics. This is just the beginning of the inevitable spread of the virus.

Central bankers and governments will throw everything they have to support the asset markets, but you know what to do, Mortimer.

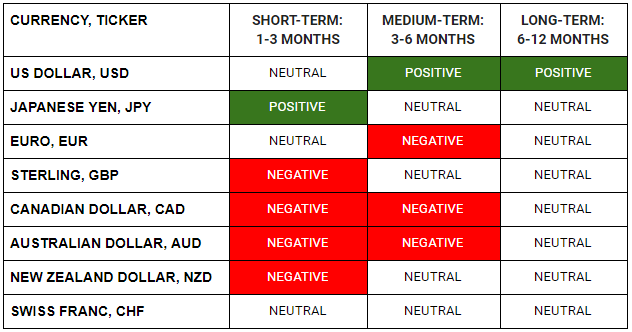

FX

STOCK INDICES

TRADING TIP

You Heard it HERE first!

For those of you who were surprised by the bloodbath yesterday where every asset class sold off and have no clue what risk parity positions unwinding is, here’s the TIP of the WEEK for you – Read TrackRecord’s stuff diligently! Don’t be lazy, click through and be one step ahead of the market.

In case you missed out on everything, listen to all of Vee’s thoughts from his radio feature on today’s Money FM’s The Breakfast Huddle: https://trackrecordasia.com/market-watch/vees-segment-money-fm-13-mar-2020