WHAT HAPPENED YESTERDAY

As of New York Close 27 Mar 2020,

FX

U.S. Dollar Index, -0.94%, 98.36

USDJPY, -1.54%, $107.90

EURUSD, +1.02%, $1.1142

GBPUSD, +2.09%, $1.2457

USDCAD, -0.27%, $1.3980

AUDUSD, +1.68%, $0.6166

NZDUSD, +1.27%, $0.6037

STOCK INDICES

S&P500, -3.37%, 2,541.47

Dow Jones, -4.06%, 21,636.78

Nasdaq, -3.79%, 7,502.38

Nikkei Futures, +3.92%,19,080.0

COMMODITIES

Gold Futures, -1.59%, 1,625.00

Brent Oil Futures, -5.35%, 24.93

SUMMARY:

Dollar continued its descent after a week of declines and the safe-haven Yen powered on, as Covid-19 lockdowns tightened across the world and investors braced for a prolonged period of uncertainty. The weekend brought more bad news on the virus front. The U.S. has emerged as the latest epicenter of the outbreak, with more than 137,000 cases and 2,400 deaths. Trump, who had talked about reopening the economy for Easter, on Sunday extended guidelines for social restrictions to April 30 and said the peak of the death rate could be two weeks away.

The S&P 500 declined 3.37% on Friday after a rebound effort faded into the close, the benchmark index had started the session down 4.2%, then cut its losses to just 0.5% after the House passed the $2 trillion stimulus bill in the afternoon. The Dow Jones Industrial Average lost 4.06%, the Nasdaq Composite lost 3.79%, and the Russell 2000 lost 4.1%. U.S. 2yr Yield fell 5bp to 0.25% and U.S. 10yr Yield fell 11bp to 0.73%.

The stimulus bill will provide relief for U.S. households and businesses, as the rising number of Covid-19 infections continues to keep much of America in shutdown mode. On a related note, the U.S. surpassed China and Italy for the most confirmed cases of Covid-19.

Before the close, United Airlines (UAL 32.84, -2.71, -7.6%) said it isn’t going to conduct involuntary furloughs or pay cuts in the U.S. before September 30; however, it cautioned that air travel demand could remain suppressed possibly into next year. Within the Dow, shares of Boeing (BA 162.00, -18.55, -10.3%) fell 10% after Treasury Secretary Mnuchin said the company has no plans of using government aid at this time.

U.S. VIRUS CASES EXCEED 100,000

Doctors and nurses on the front lines of the U.S. Covid-19 crisis pleaded on Friday for more protective gear and equipment to treat waves of patients expected to overwhelm hospitals as the sum of known U.S. infections climbed well past 100,000, with more than 1,600 dead.

“We are scared,” said Dr. Arabia Mollette of Brookdale University Hospital and Medical Center in Brooklyn. “We’re trying to fight for everyone else’s life, but we also fight for our lives as well, because we’re also at the highest risk of exposure.” One emergency room doctor in Michigan, an emerging epicenter of the pandemic, said he was using one paper face mask for an entire shift due to a shortage and that hospitals in the Detroit area would soon run out of ventilators.

IMPACT: The United States ranked sixth in death toll among the hardest-hit countries, with at least 1,632 lives lost as of Friday night, a record daily increase of 370 according to a tabulation of official data. Worldwide, confirmed cases rose above 720,000 with 33,958 deaths, the Johns Hopkins Covid-19 Resource Center reported.

HISTORIC $2.2 TRILLION COVID-19 BILL PASSES U.S. HOUSE, BECOMES LAW

The U.S. House of Representatives on Friday approved a $2.2 trillion aid package – the largest in history – to help cope with the economic downturn inflicted by the intensifying Covid-19 pandemic, and Trump quickly signed it into law.

The massive bill passed the Senate and House of Representatives nearly unanimously. The rare bipartisan action underscored how seriously Republican and Democratic lawmakers are taking the global pandemic that has killed more than 1,500 Americans and shaken the nation’s medical system.

“Our nation faces an economic and health emergency of historic proportions due to the Covid-19 pandemic, the worst pandemic in over 100 years,” House Speaker Nancy Pelosi said at the close of a three-hour debate before the lower chamber approved the bill. “Whatever we do next, right now we’re going to pass this legislation.”

IMPACT: The rescue package is the largest fiscal relief measure ever passed by Congress. The $2.2 trillion measure includes $500 billion to help hard-hit industries and $290 billion for payments of up to $3,000 to millions of families. It will also provide $350 billion for small-business loans, $250 billion for expanded unemployment aid and at least $100 billion for hospitals and related health systems.

U.S. COULD FACE 200,000 COVID-19 DEATHS, MILLIONS OF CASES, FAUCI WARNS

U.S. deaths from Covid-19 could reach 200,000 with millions of cases, the government’s top infectious diseases expert warned on Sunday as New York, New Orleans and other major cities pleaded for more medical supplies.

Since 2010, the flu has killed between 12,000 and 61,000 Americans a year, according to the U.S. Centers for Disease Control and Prevention. The 1918-19 flu pandemic killed 675,000 in the United States. The U.S. Covid-19 death toll topped 2,400 on Sunday after deaths on Saturday more than doubled from the level two days prior. The United States has now recorded more than 137,000 cases of COVID-19, the disease caused by the virus, the most of any country in the world.

IMPACT: Trump has bowed to the inevitable and accepted that his ambition of 12 April, Easter, as a date on which social distancing restrictions on Americans could start to be lifted was always a pipe dream. The new date he gave was the end of April. Whether that sticks remains to be seen. Tests to track the disease’s progress also remain in short supply, despite repeated White House promises that they would be widely available. As the crisis continues to escalate, the economic damage will get worse and will weigh heavily on market sentiment.

DAY AHEAD

The global crisis from the Covid-19 pandemic has produced much turmoil in financial markets even though economic data on the impact has so far been scarce. That is about to change as March figures start rolling in. Given the extent of the market fallout, investors may already be expecting the worst. That’s not to say, however, that once the data lay bare the true scale of the economic damage, investors won’t be unnerved. The main releases this week that could jolt traders are the manufacturing PMIs out of China, and the ISM PMIs together with the latest jobs report from the United States.

SENTIMENT

OVERALL SENTIMENT: The virus spreads on relentlessly while Trump keeps talking about reopening the economy and questioning the requests for help from those at the frontlines of the outbreaks. It is a train wreck happening in slow motion. With all the measures introduced by the central banks and governments, the market now is left to struggle between the flow of unlimited money and the very real effects of a global economy being crushed by both demand destruction and supply disruption.

The escalation in the US is inevitable. Expect more bad news in the days ahead.

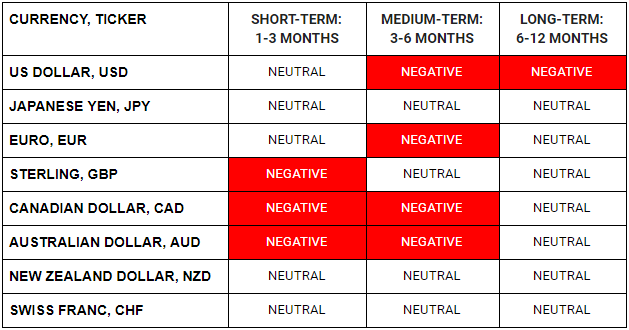

FX

STOCK INDICES

TRADING TIP

Mind the Gap

There seems to be many weekend price gaps in markets recently where the opening levels on Monday mornings in Asia are substantially different from the prices that were last traded at New York close on Fridays.

Traders should be aware of this risk as that would mean that even if you have stop-loss orders, you might not be filled at that level you wanted to exit the risk positions that you have. Losses that you actually take may be substantially more than what you were prepared for.

As such, it is imperative to be cognisant of this risk and reduce your risk positions accordingly into the weekends, especially if the risks are skewed against your position. For now, the situation for the Covid-19 spread continues to deteriorate as the virus never sleeps, while policymakers tend to not be at work during weekends. With the policymakers having thrown almost everything they can think of at the problem, the likelihood of more measures is lessened unless there’s renewed panic in the markets.

Always put yourself in the shoes of other investors as you face the prospect of the looming weekend. What would you do if you were the ones who were long instead of short and vice versa?

When in doubt, just follow us on social media as that’s a constant topic of discussion for us! 😊