WHAT HAPPENED YESTERDAY

As of New York Close 30 Mar 2020,

FX

U.S. Dollar Index, +0.86%, 99.21

USDJPY, +0.15%, $108.06

EURUSD, -1.01%, $1.1029

GBPUSD, -0.69%, $1.2371

USDCAD, +1.44%, $1.4181

AUDUSD, 0.00%, $0.6166

NZDUSD, -0.46%, $0.6009

STOCK INDICES

S&P500, +3.29%, 2,625.10

Dow Jones, +3.18%, 22,325.10

Nasdaq, +3.62%, 7,774.15

Nikkei Futures, +0.25%, 19,128.0

COMMODITIES

Gold Futures, +0.80%, 1,638.00

Brent Oil Futures, +6.14%, 26.46

SUMMARY:

Dollar advanced on Monday, snapping a week of declines, as investors braced for prolonged uncertainty as governments tightened lockdowns and launched monetary and fiscal measures. China’s central bank (People’s Bank of China) cut the 7D reverse repo from 2.4% to 2.2% when it injected CNY50 billion into the interbank market (Renminbi closed lower, -0.36%). Overall, FX moves on Monday were relatively well contained.

S&P 500 climbed 3.29% on Monday, led higher by shares of healthcare and technology companies, even as the White House extended its social distancing guideline through the end of April. The Dow Jones Industrial Average (+3.18%) and Nasdaq Composite (+3.62%) also rose more than 3.0%, while the Russell 2000 increased 2.3%. U.S. 2yr Yield fell 2bp to 0.23% and U.S. 10yr Yield fell 2bp to 0.70%.

In addition, quarter-end rebalancing continued to play a factor in providing a bid in the stock market, while medical breakthroughs from Abbott Labs (ABT 79.34, +4.78, +6.4%) and Johnson & Johnson (JNJ 133.01, +9.85, +8.0%) helped sentiment. Specifically, Abbott Labs is launching a point-of-care test to detect COVID-19 in as little as five minutes, while JNJ said it selected a lead vaccine candidate that it plans to test in clinical trials by September.

Separately, oil prices continued to falter with WTI crude falling 6.6%, or $1.43, to $20.22/bbl, as the market remained plagued by excess supply and dwindling demand. On a related note, Putin and Trump discussed oil in a phone call on Monday, and ordered their energy ministries to hold further talks on global oil markets, the Kremlin said. The Kremlin did not say what exactly the ministers will discuss, but Moscow has previously signalled it would like to see more countries joining efforts to balance global oil markets following the collapse of its deal with OPEC earlier this month.

FORD, GE TO PRODUCE 50,000 VENTILATORS IN 100 days

Ford Motor Co said on Monday it will produce 50,000 ventilators over the next 100 days at a plant in Michigan in cooperation with General Electric’s healthcare unit, and can then build 30,000 per month as needed to treat patients afflicted with Covid-19.

On Friday, Trump said he would invoke powers under the Defense Production Act to direct manufacturers, including Ford and General Motors Co, to produce ventilators. On Monday, the head of the United Auto Workers and other officials compared the auto industry’s effort to build ventilators to Detroit’s conversion to bomber production during World War Two.

IMPACT: Firing up America’s manufacturing industry to help with the virus situation and pharmaceutical innovations made by Abbot, Gilead and Johnson & Johnson may be the turning point for America and global sentiment should these measures and drugs prove to be successful. It is important to note that there are turnaround times for these advancements to take effect and it’s the on-going narrative that markets are constantly pricing in. Until then, expect continued volatility in the market.

BRAZIL’S BOLSONARO URGES NO MORE COVID-19 QUARANTINE, SAYS JOBS BEING LOST

Brazil’s President Jair Bolsonaro said on Monday that there can be no more quarantine measures imposed on the country than those already in place to combat Covid-19 because jobs are being destroyed and the poor are suffering disproportionately.

Brazil’s Senate passed a bill on Monday evening guaranteeing some of the country’s poorest citizens’ income of 600 reais ($117) a month for three months, a package that could cost almost 50 billion reais. According to Bolsonaro, all measures to combat the crisis could cost 800 billion reais, and the economy, which is expected to contract this year, could rebound and be back on track within a year.

Earlier on Monday, Bolsonaro had stepped up his stand-off with state governments, branding governors in the hardest-hit states “job-killers” and suggesting that democracy could be at risk if the Covid-19 crisis leads to social chaos.

IMPACT: Brazil’s political leaders have been eager to negotiate emergency measures such as a “war budget” exempt from fiscal rules, but many have criticized the president, who lacks a solid alliance in Congress, for downplaying health risks. If Brazil does not handle the situation with prudence, the virus can wreak more economic and social turmoil than what Bolsonaro fears, what the president is insisting is the definition of “penny wise pound foolish” actions.

U.S. CONGRESS EYES NEXT STEPS IN COVID-19 RESPONSE

Three days after passing a $2.2 trillion package aimed at easing the heavy economic blow of the Covid-19 pandemic, the U.S. Congress was looking on Monday at additional steps it might take as the country’s death toll approached 3,000.

Democrats who control the House of Representatives were discussing boosting payments to low- and middle-income workers, likely to be among the most vulnerable as companies lay off and furlough millions of workers, as well as eliminating out-of-pocket costs for Covid-19 medical treatment.

House Speaker Nancy Pelosi said she would work with Republicans to craft a bill that could also provide added protection for front-line workers and substantially more support for state and local governments to deal with one of the largest public health crises in U.S. history. Pelosi, the top U.S. Democrat, said she did not expect new legislation to be completed until sometime after Easter, which is on April 12.

IMPACT: More fiscal measures are coming as governments understand that the economic impact of the virus on families is another crisis that should be preemptively stemmed before it blows out into social unrest.

DAY AHEAD

It’s a busy data week in America. Besides the nonfarm payrolls report, there’s also the latest ISM manufacturing and non-manufacturing PMIs coming up on Wednesday and Friday respectively. These surveys will give us a taste of how much damage the virus has inflicted on the U.S. economy and therefore, of how deep the upcoming recession will be. As far as economic data go these days, these are extremely important, and a serious disappointment could derail the latest rebound in stocks.

SENTIMENT

OVERALL SENTIMENT: Though volatility remains high, market participants are getting conditioned to the swings. Sentiment has stabilised despite worsening news from the virus spread because everyone has become conditioned to bad news. The good news from policymakers have also been well publicised, so more of the same is unlikely to move the needle until some effects are felt. While the market waits for new drivers and expects volatility to remain high within a wide range.

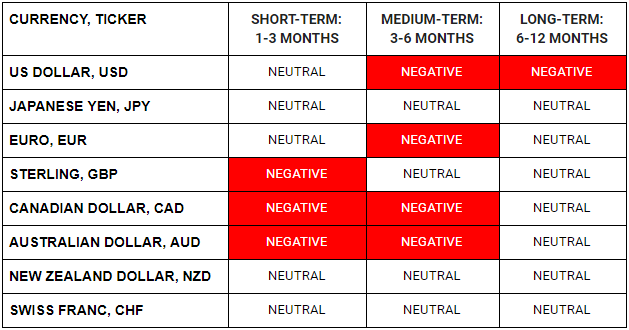

FX

STOCK INDICES

TRADING TIP

Money for Nothing…

In the world to come, we will have unlimited supply of fiat money especially USD given that the Fed’s printing presses are working non-stop these days. Many central banks around the world are doing the same and this flow of money will eventually start to affect prices of things.

When something is unlimited in supply, its value drops relative to things which are limited in supply. The task then is up to us to find what is it that is finite in supply and will be demanded in the world to come. So, the questions we must ask are what are the stores of value in this world that are finite in supply and what are the goods that have limited production and consumers will need in the world to come?

The answers to these questions will give you clarity on what are the trends that will soon emerge in time to come.