WHAT HAPPENED YESTERDAY

As of New York Close 25 May 2020,

FX

U.S. Dollar Index, -0.11%, 99.75

USDJPY, +0.05%, $107.68

EURUSD, -0.02%, $1.0900

GBPUSD, +0.30%, $1.2202

USDCAD, -0.16%, $1.3973

AUDUSD, +0.21%, $0.6550

NZDUSD, -0.03%, $0.6107

STOCK INDICES

S&P500, 0.00%, 2,955.45 U.S. Markets were closed on Monday.

Dow Jones, 0.00%, 24,465.16 U.S. Markets were closed on Monday.

Nasdaq, 0.00%, 9,324.59 U.S. Markets were closed on Monday.

Nikkei 225, +1.73%, 20,741.65

COMMODITIES

Gold Spot, -0.53%, 1,726.88

Brent Oil Spot, +2.25%, 34.94

SUMMARY:

EUR steadied around the $1.09 level on Monday in a potentially big week for European policymakers as they debate the outlines of a recovery fund aimed at helping member nations. Austria, Netherlands, Denmark, and Sweden want loans from a time-limited fund for nations struggling to recover from the pandemic, rather than the grants proposed by France and Germany last week for the European Union’s coronavirus recovery plan. The Franco-German plan sent the euro rallying above $1.10 last week before the much-expected counter proposal by the four countries pushed it back below $1.09.

Elsewhere, the Dollar erased earlier gains and edged lower on the day though concerns about a growing standoff between the United States and China over civil liberties in Hong Kong kept sentiment subdued. The USD Index, which tends to behave like a safe haven asset in times of market turmoil and political uncertainty, was steady near a one-week high at 99.75.

U.S. Markets were closed on Monday.

Singapore downgraded its 2020 gross domestic product forecast for the third time as the Covid-19 pandemic continues to batter the economy, the trade ministry said early this morning. The city-state lowered its GDP forecast range to a contraction of 7% to 4% from the prior range of a decline of 1% to 4%.

WHO WARNS OF ‘SECOND PEAK’ IN AREAS WHERE COVID-19 DECLINING

Countries, where Covid-19 infections are declining, could still face an “immediate second peak” if they let up too soon on measures to halt the outbreak, the World Health Organization said on Monday. WHO said epidemics often come in waves, which means that outbreaks could come back later this year in places where the first wave has subsided. There was also a chance that infection rates could rise again more quickly if measures to halt the first wave were lifted too soon.

IMPACT: Epidemiologists have warned that the virus may hit again in a second wave when fall comes. In a grim reminder, the second wave of the Spanish flu claimed more lives than the first wave. The rapid spread of Spanish flu in the fall of 1918 was at least partially to blame on public health officials unwilling to impose quarantines during wartime, this is very much akin to wanting to save the economy at the expense of doing the right thing. We are not out of the woods yet, until a vaccine is found, risk assets continue to tread on thin ice and the illusion of an economic rebound. In times of uncertainty and incessant money printing, hard assets such as Gold remain the easiest trade.

AUSTRALIA TO OUTLINE ECONOMIC RECOVERY PLANS AS LOCKDOWNS EASE

Australian Prime Minister Scott Morrison will later today outline his government’s plans to revive the sputtering economy but is expected to warn a recovery will take between three to five years. Australia has reported just over 7,100 COVID-19 infections, including 102 deaths. That is well below numbers reported by many other developed countries, an achievement it attributes to tough social distancing rules, which have prevented local hospitals from being swamped but taken a heavy toll on the economy.

Morrison will say in a speech that tax reform, deregulation, and lower energy costs will be central to stimulating economic growth as Canberra begins to unwind it’s more than A$250 billion worth of stimulus.

IMPACT: Australia is one of the few countries that managed the virus outbreak effectively and the government seems cognizant of the fact that this will be a protracted road to recovery, given their expected time horizon of three to five years. Prudence and facing reality are the first steps to recovery because then proper and effective measures can be put in place. Amidst the China-Australia tension, Australia seems to be under good stewardship and should relations improve with its biggest trading partner and the world returns towards normalcy, the AUD might outperform.

BRAZIL SURPASSES U.S. IN DAILY COVID-19 DEATH TOLL

Brazil daily Covid-19 deaths were higher than fatalities in the United States for the first time over the last 24 hours, according to the country’s Health Ministry. Brazil registered 807 deaths over the last 24 hours, whereas 620 died in the United States.

Brazil has the second-worst outbreak in the world, with 374,898 cases, behind the U.S. with 1.637 million cases. Total deaths in the U.S. have reached 97,971, compared with Brazil at 23,473.

IMPACT: Brazil is a reminder that we are still in the midst of the first battle as the virus makes its round across the hemispheres. The world should be prudent about the situation and how it manages the opening of economies, as suggested above, a second wave in the later part of the year is highly likely.

DAY AHEAD

The AUD appears to be oblivious to rising tensions not only between the United States and China but also between Australia and China. The prospect of a rekindled trade war is being eclipsed by expectations that the world’s biggest economies will enjoy a V-shaped recovery in the second half of 2020, supported by some encouraging results from vaccine trials. But there is a real risk that markets are underestimating the level of anger towards China in Washington, a feeling shared across all political spectrums, hence, as things stand, future flare ups are more likely than not. Quarterly figures are due on construction (Wednesday) and capital expenditure (Thursday), which should provide strong clues as to how the economy performed in the first quarter and whether Australia suffered a similar large contraction as that’s been reported in China, Europe and the US.

SENTIMENT

OVERALL SENTIMENT:

Stocks ripped higher on a day when the US markets were closed. Seems no news is good news these days. With S&P 500 futures now above recent highs, it is critical to see if the market can hold on to gains made when most of the US participants are out. Interesting to note that the FX market did not really go risk on despite the rally in stock indices around the world. Price action today could be key. If the gains are kept, then we could see a strong push higher in the near future, but if not, then from here to the psychological 3000 level in S&P 500 will be strong resistance levels.

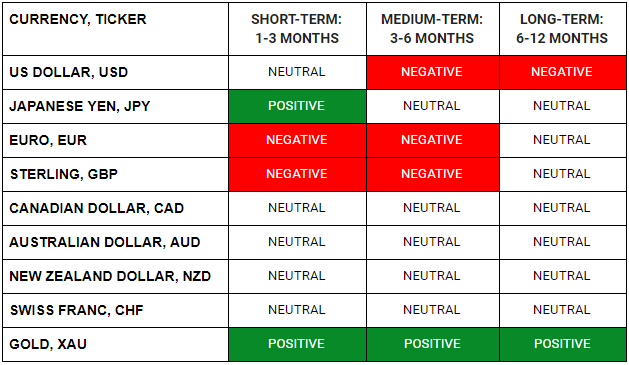

FX

STOCK INDICES

TRADING TIP

When To Choose What?

Currency trading at this point is a tricky affair because we are required to trade one economy against another. What happens when most economies are all basket cases given the way their governments are managing the crisis? Then we are forced to choose the lesser evil, which is really not the ideal situation for a pairing that will bring about a “trade of least resistance”. Presented with such a situation, we should take a step back and think about the universe of assets, at this point given geopolitical uncertainty, political uncertainty, incessant money printing and risk of a second wave, the assets that will continue to hold value will be USD, JPY, Gold and stocks of large tech companies that sells to customers all around the world (i.e. Amazon, Microsoft).