As of New York Close 26 May 2020,

FX

U.S. Dollar Index, -0.85%, 99.02

USDJPY, -0.19%, $107.50

EURUSD, +0.72%, $1.0979

GBPUSD, +1.17%, $1.2332

USDCAD, -1.44%, $1.3785

AUDUSD, +1.53%, $0.6645

NZDUSD, +1.57%, $0.6197

STOCK INDICES

S&P500, +1.23%, 2,991.77

Dow Jones, +2.17%, 24,995.11

Nasdaq, +0.17%, 9,340.22

Nikkei 225, +2.55%, 21,271.17

COMMODITIES

Gold Spot, -0.96%, 1,713.03

Brent Oil Spot, +1.92%, 35.61

SUMMARY:

U.S. Dollar fell across the board on Tuesday as optimism about a potential Covid-19 vaccine and reopening of various economies helped investors shrug off U.S.-China tensions, sapping demand for safe haven assets. U.S.-China tensions have been simmering in the background as Washington repeatedly criticized Beijing’s handling of the Covid-19 outbreak, but investors have largely dismissed them. U.S. Conference Board’s Consumer Confidence Index checked in at 86.6 for May (consensus 88.5) versus a downwardly revised 85.7 (from 86.9) for April. The key takeaway from the report is that attitudes about the short-term outlook increased some, reflecting some budding optimism about reopening efforts.

S&P 500 rallied as much as 2.2% on Tuesday on a familiar reopening trade, but some weakness into the close left the benchmark index up 1.2% for the session. The Dow Jones Industrial Average (+2.2%), Russell 2000 (+2.8%), and S&P MidCap 400 (+3.4%) outperformed, while the Nasdaq Composite increased just 0.2%.

Some attributed today’s late selling to a Bloomberg report that indicated the Trump administration was considering sanctions on Chinese officials, businesses, and financial institutions in response to Beijing’s plans to tighten control over Hong Kong. The news wasn’t exactly “new,” but the negative-sounding headline helped take the S&P 500 below its 200-day moving average (3000) on a closing basis.

Merck (MRK 77.26, +0.89, +1.2%) and Novavax (NVAX 48.17, +2.06, +4.5%) joined the race for a COVID-19 vaccine. Separately, JPMorgan Chase (JPM 95.82, +6.35, +7.1%) CEO Jamie Dimon expressed confidence in his company as well as hope in an economic recovery.

Elsewhere, airline stocks were among today’s biggest gainers, evident by the 11.8% gain in the U.S. Global Jets ETF (JETS 15.31, +1.61, +11.8%).

Hong Kong is set to debate the China National Anthem Bill later today that would criminalise disrespect of China’s national anthem. The anthem bill is set for a second reading later today and is expected to be turned into law next month. It requires China’s “March of the Volunteers” to be taught in schools and sung by organizations and imposes jail terms or fines on those who disrespect it. Expect more volatility in the Asian session.

- The European Commission will later today unveil a plan to…

- IMPACT(What will this do for the EU and how will it pan out for the EUR?): The plan is for the Commission to…

TRUMP TO ANNOUNCE STRONG HONG KONG RESPONSE THIS WEEK

MEXICO AND BRAZIL, NEW COVID BATTLEGROUND

All eyes will turn to the European Commission’s recovery plan later today after EU member states Austria, Sweden, Denmark and the Netherlands stated their opposition to a French-German plan for a 500-billion euros coronavirus recovery fund. The Commission, which garnered no support for its ideas two years ago, also proposed to phase out all the rebates various countries enjoy on their national contributions to the EU budget, halve the amount of customs duties governments keep and to get a bigger share of the Value Added Tax paid to the EU.

The recovery money is to be spent by governments on making the transition to an economy that is climate neutral – emitting no more CO2 than it absorbs – by 2050 and more adapted to the digital age – both EU priorities.

As stated, the fortune of the EUR will be highly linked to the success of a plan being announced.

OVERALL SENTIMENT: Stock markets continued to rip higher as optimism on re-opening continued to cheer the market. USD weakened against the risk currencies such as AUD and NZD as the euphoria caused stop losses to be triggered in risk aversion trades. Gold and Silver started the day strongly but ultimately, also had to retreat as risk assets were bought across the board. However, a note of caution is bellwether tech stock such as Amazon that led the charge up higher from the lows traded weakly yesterday and ended the day down. With Trump promising some action against China should the HK Security Law be passed (and it will be passed), we are in for some interesting times. Should demonstrations against the anthem law in HK get out of hand today, there could be weakness in the Hang Seng Index which will affect risk sentiment.

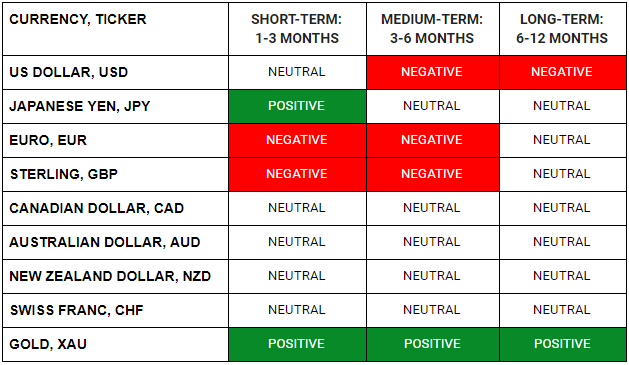

FX

STOCK INDICES

Baptism of Fire

Current market conditions are confusing for market legends, veteran traders, and novice traders alike. Government stimulus and intervention of markets at an unprecedented scale during a time of a global health crisis and economic slowdown of historic proportions, this time truly, is different.

For new traders, the current markets might seem extremely unwelcoming and some who want to start their trading journey are deferring to later. However, the current markets will serve as a good learning ground for them early on in their careers so that they can accumulate valuable experience. After all, trading requires a hands-on approach and current markets present many opportunities for practical learning. Thus, the earlier traders face such treacherous markets, the faster they will become adept at managing their risk and size their positions.