WHAT HAPPENED YESTERDAY

As of New York Close 23 Apr 2020,

FX

U.S. Dollar Index, +0.04%, 100.52

USDJPY, -0.08%, $107.65

EURUSD, -0.45%, $1.0775

GBPUSD, +0.15%, $1.2352

USDCAD, -0.68%, $1.4066

AUDUSD, +0.83%, $0.6377

NZDUSD, +0.92%, $0.6005

STOCK INDICES

S&P500, -0.05%, 2,797.80

Dow Jones, +0.17%, 23,515.26

Nasdaq, -0.01%, 8,494.75

Nikkei Futures, +1.54%, 19,313.0

COMMODITIES

Gold Spot, +0.81%, 1,728.78

Brent Oil Spot, +3.98%, 20.91

SUMMARY:

Gains in Euro unwound (high of +0.22%) when it became clear that eurozone leaders weren’t going to come up with any solid fresh stimulus and it fell further on talk that they won’t have anything ready until 2021. Commodity currencies enjoyed a good day, with the Canadian Dollar, CAD, strengthening amidst the rally in oil but note that only the front-month Crude climbed while the rest of the curve was more-or-less flat.

U.S. Initial claims for the week ending April 18 decreased by 810,000 to 4.427 million (consensus 4.0 million). Continuing claims for the week ending April 11 increased by 4,064,000 to 15.976 million (a record high). The key takeaway from this report, which covers the period in which the survey for the April Employment Situation Report was conducted, is that it presents some hope that the peak of the layoffs following the Covid-19 shutdowns has passed. Nonetheless, it is also a reminder of how bad things are on the labor front. This did not impact the market much as bad numbers are all within expectations now.

The S&P 500 advanced as much as 1.6% on Thursday after the number of weekly initial claims declined to about 4.4 million, but stocks gave up gains following a negative report regarding potential Covid-19 treatment. The benchmark index finished just below its flat line with a 0.05% decline. The Dow Jones Industrial Average (+0.17%) and Nasdaq Composite (-0.01%) also closed little changed, while the Russell 2000 (+1.0%) outperformed. U.S. 2yr yield remained unchanged at 0.22% and U.S. 10yr yield fell 2bp to 0.61%.

The Financial Times reported that Gilead’s (GILD 77.78, -3.53, -4.3%) remdesivir drug flopped in its first randomized clinical trial in China, according to draft documents published accidentally by the World Health Organization (WHO). The news unnerved the market, and wiped out gains, as Stat News reported last Friday that the drug showed promising signs in one Chicago trial.

Gilead defended the results, saying WHO had an inappropriate characterization of the study, and the data still suggested the drug had a “potential benefit,” according to Stat News. Shares of Gilead still declined (-4.3%), and the broader market struggled the rest of the session, as the report reminded investors that the medical breakthroughs still needed to restore consumer confidence are not easily achieved.

U.S. HOUSE PASSES $500 BILLION COVID-19 BILL

U.S. House of Representatives overwhelmingly approved (vote of 388-5) a $484 billion Covid-19 relief bill on Thursday, funding small businesses and hospitals and pushing the total spending response to the crisis to an unprecedented near $3 trillion. The House action sent the latest of four relief bills to the White House, where Republican President Donald Trump has promised to sign it quickly into law.

The House also approved a select committee, with subpoena power, to probe the U.S. response to the Covid-19. It will have broad powers to investigate how federal dollars are being spent, U.S. preparedness, and Trump administration deliberations.

IMPACT: The $484 billion aid bill is the fourth passed to address the Covid-19 crisis. It provides funds to small businesses and hospitals struggling with the economic toll of a pandemic that has killed more than 47,000 Americans and thrown a record 26 million out of work, wiping out all the jobs created during the longest employment boom in U.S. history. These stimulus packages are an overcompensation for actual economic destruction that will not disappear because more money has been thrown at it, the chickens will eventually come home to roost and the weakening bids in the S&P500 is a sign of things to come.

U.S. STATES TEST SAFETY OF REOPENING AS PANDEMIC PUSHES JOBLESS CLAIMS HIGHER

An array of U.S. merchants in Georgia and several other states prepared on Thursday to reopen for the first time in a month under newly relaxed Covid-19 restrictions, as another week of massive unemployment claims highlighted the grim economic toll of the pandemic. From Tennessee and Texas to Ohio and Montana, a handful of governors around the country have announced plans to swiftly allow the reopening of some workplaces that had been ordered closed as a way of curbing the spread of the Covid-19.

IMPACT: Those plans have drawn fire from public health experts and other governors who warn that a premature easing of stay-at-home orders and business closures imposed over the past five weeks could trigger a renewed surge in Covid-19 cases. If China’s and Singapore’s experience has shown us anything, it is that there is evident risk of massive reinfections if measures are dropped prematurely. A second spike in Covid-19 cases in the U.S. will dampen risk sentiment once more and cause the stock market to crater like how it did when infections were rampant in New York city. This will lead to extreme risk aversion which will lead to USD strength.

U.S. WARSHIP SAILS THROUGH TAIWAN STRAIT, SECOND TIME IN A MONTH

A U.S. warship has again sailed through the sensitive Taiwan Straits, Taiwan’s Defence Ministry said on Friday, the second time in a month amid heightening tension between Taiwan and China. This coincides with a Chinese aircraft carrier passing near the island which China considers its own. China has been angered by the Trump administration’s stepped-up support, , such as more arms sales, U.S. patrols near it, and a visit to Washington by Vice President-elect William Lai in February, for Taiwan

IMPACT: China has carried out frequent drills near Taiwan in recent months, including flying fighter jets and nuclear-capable bombers close to the island, in moves denounced by Taipei’s government as attempts at intimidation. The tension between the U.S. and China is ramping up, this adds to the elevated volatility in markets. Extreme risk aversion will lead to a sell off in Asian currencies and USD strength.

DAY AHEAD

Covid-19, reopening of states in the U.S. and Oil developments will continue to grab headlines and drive risk appetite across the board. US durable goods orders later today will give us a sense of how quickly business spending is falling.

SENTIMENT

OVERALL SENTIMENT:

Market sentiment turned strongly risk seeking as oil rallied aggressively off the lows. The rally got serious when the Bank of Japan was reported to be considering unlimited bond buying in their next policy meeting. The party stalled when news that Gilead’s drug trial was not going so well. How fast things turned on a dime as the US stock indices backed off from the highs and oil, gold and risk currencies followed suit.

Volatility remains high as the short-term investor sentiment can change from headline to headline. However, focus on the inevitable. All policymakers around the world are determined to print as much as they can. Hard assets like Gold will eventually power higher and every dip will be met with buyers.

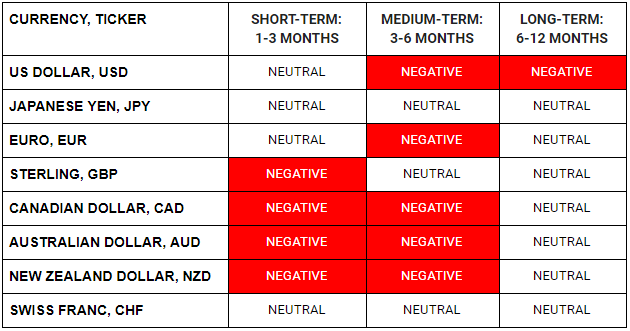

FX

STOCK INDICES

TRADING TIP

Begin at the Beginning

This seems like an obvious thing to do but somehow many people start at the end. What I mean is that quite often conclusions are arrived at even before facts are determined and analysis is done. A good example of this is that many believe that this will be a V-shaped recovery.

This belief is strongly held to without any concrete evidence to back it. Why should there be a V-shaped recovery? Oh, because that’s always been so for the market corrections we have seen in recent memory.

That might well be true, but the economic damage, demand destruction and supply disruption that the world is experiencing is unprecedented. To be successful in trading, it is critical to form conclusions after examining the facts. The facts so far do not suggest that the recovery will be V-shaped. False bravado from politicians counts for nothing. According to them, Covid-19 was just a flu, until it became patently obvious that it wasn’t.