WHAT HAPPENED YESTERDAY

As of New York Close 21 Apr 2020,

FX

U.S. Dollar Index, +0.26%, 100.20

USDJPY, +0.09%, $107.72

EURUSD, -0.06%, $1.0856

GBPUSD, -1.09%, $1.2301

USDCAD, +0.30%, $1.4191

AUDUSD, -0.71%, $0.6291

NZDUSD, -1.23%, $0.5963

STOCK INDICES

S&P500, -3.07%, 2,736.56

Dow Jones, -2.67%, 23,018.88

Nasdaq, -3.48%, 8,263.23

Nikkei Futures, -2.89%, 19,073.0

COMMODITIES

Gold Futures, -0.32%, 1,705.70

Brent Oil Spot, -24.88%, 18.69

SUMMARY:

The Dollar rose to a two-week high against a basket of currencies as investors fled riskier assets for the world’s most liquid currency while putting pressure on oil-linked currencies such as the Mexican Peso (USDMXN, +1.40%) and the Canadian Dollar (USDCAD, +0.30%).

U.S. Existing home sales declined 8.5% m/m in March to a seasonally adjusted annual rate of 5.27 million (consensus 5.35 million). Total sales were up 0.8% year-over-year, marking the ninth straight month that they have increased on a year-over-year basis. The key takeaway from the report is that it showed existing home sales activity was relatively soft before the Covid-19 impact, with low inventory and high prices crimping sales. Existing home sales are counted when the deals are closed, so the sales activity for March is predicated mostly on contracts signed in January and February.

In New Zealand, the central bank (RBNZ) said it is open to direct monetization of government debt. A central bank buying debt directly from the government issue is not something that will inspire confidence in markets, this will be viewed as a Kiwi negative event (NZDUSD, -1.23%). Central banks get around this by buying sovereign debt from the market, not directly from the government press, with the stated reason being helping to stabilize markets or guide interest rates to a desired level.

S&P 500 fell 3.07% on Tuesday, closing near session lows for its second straight decline, as risk sentiment remained suppressed by the ongoing turmoil in the oil futures market. The Dow Jones Industrial Average declined 2.67%, the Nasdaq Composite declined 3.48%, and the Russell 2000 declined 2.3%. U.S. 2yr yield remained unchanged at 0.20% and U.S. 10r yield fell 5bp to 0.58%.

The May WTI contract officially expired at $10.01/bbl after falling negative yesterday, but the fundamental problems that drove the contract into negative territory continued to plague the rest of the WTI futures curve. Specifically, WTI crude futures for May delivery collapsed 306% to -$37.63/bbl ahead of expiration, as no one presumably wanted to take physical delivery given the well-documented storage constraints and lack of demand. The June WTI contract plunged 43.0%, or $8.70, to $11.57/bbl, after trading to an intraday low of touch $6.50/bbl at its low (a whopping 69% fall). Intraday price swings of 10-20% were occurring within minutes as extreme volatility was the order of the day.

Separately, news that Congressional leaders and the Trump administration reached a stimulus bill agreement, which reportedly includes $310 billion in small business funding, was encouraging but not market moving. The Senate and House will still need to vote on the bill.

SINGAPORE EXTENDS LOCKDOWN

In Singapore, the circuit breaker measure to choke off the spread of the Covid-19 will be extended by another month to June 1, and existing measures will be tightened until May 4, said Prime Minister Lee Hsien Loong. While he noted that the circuit breaker measures have been working, he stressed that Singapore cannot be complacent. He said the number of unlinked cases has not come down, which suggests a “hidden reservoir” of cases in the community.

IMPACT: The Singapore Dollar (USDSGD, +0.76%) weakened on the back of the measures as businesses will suffer for an extended period. This is an important and bearish development as it shows that even a well organised city state like Singapore needs extended social distancing measures to keep the virus spread at bay. Anything else will likely lead to disastrous outcomes.

U.S. SENATE PASSES $500 BILLION COVID-19 AID PACKAGE

The U.S. Senate on Tuesday unanimously approved $484 billion in fresh relief for the U.S. economy and hospitals hammered by the Covid-19 pandemic, sending the measure to the House of Representatives for final passage later this week.

Previously, Washington provided nearly $350 billion in loans to small businesses impacted by the economic fallout from the Covid-19 that can turn into grants if certain requirements are met. That funding was quickly exhausted. Critics of the program said too much of the money had gone to larger, better-connected businesses. Indeed, burger chain Shake Shack Inc (SHAK.N) said on Monday it would return a $10 million loan it received after coming under public criticism.

To reduce the risk of large companies getting the bulk of the loans, Senate Democratic leader Chuck Schumer said, $125 billion of small business funds in the latest package would go to “mom and pop” and minority-owned stores.

IMPACT: The House is expected to vote on Thursday on what would be the fourth Covid-19-related measures. Taken together, the four measures amount to about $3 trillion in aid since last month to confront a crisis that has killed more than 43,000 Americans.

GEORGIA TESTS BOUNDARIES OF LIFE POST-PANDEMIC WITH REOPENING

A handful of mostly southern U.S. states will begin loosening economic restrictions this week in the midst of a still virulent pandemic, providing a live-fire test of whether America’s communities can start to reopen without triggering a surge that may force them to close again.

The Republican governors of Georgia, South Carolina, Tennessee and Ohio all announced on Monday they would begin peeling back the curbs on commerce and social activity aimed at stopping the Covid-19 outbreak over the next two weeks. Colorado’s Democratic governor said on Tuesday he would open retail stores on May 1.

Georgia has been hardest-hit of these states, with 19,000 cases and nearly 800 deaths, including a dense cluster in the state’s southwest. Amid a national debate over how to fight the virus while mitigating the deep economic toll, these moves are the first to test the borders of resuming “normal” life.

IMPACT: None of the states have met basic White House guidelines unveiled last week of two weeks of declining cases before a state should reopen. Most are weeks away from the timing suggested in modeling by the influential Institute for Health Metrics and Evaluation (IHME), based on the virus’s spread and social distancing. As the case with Singapore and Japan show, premature complacency will lead to even more pain in the longer run.

U.S. ENERGY SECRETARY TO URGE HOUSE LAWMAKERS TO BUY OIL FOR STRATEGIC RESERVE

The U.S. energy secretary said on Tuesday he would talk with leaders in the U.S. House of Representatives and urge them to fund the purchase of crude to fill the emergency oil reserve.

In March, Trump ordered Energy Secretary Dan Brouillette to fill the Strategic Petroleum Reserve, or SPR, to the top as the price of oil plunged while the Covid-19 crushed global demand. So far, Congress has declined to fund the purchase, with some Democrats opposed to bailing out the oil industry.

As the Energy Department works with Congress on a purchase, it also is moving forward with a plan to lease an initial 23 million barrels of storage space in the reserve to oil companies.

IMPACT: Oil prices are falling for many reasons, with the primary one being an unprecedented level of demand destruction as social distancing measures and travel restrictions are imposed in various countries worldwide. Trying to stem the tide of overwhelming amounts of supply is futile.

DAY AHEAD

The Eurozone’s preliminary PMIs for April will be released tomorrow, and the numbers could be abysmal. The preliminary PMIs for April will reveal just how much economic damage the pandemic has inflicted, with forecasts pointing to another drop deeper into contraction territory for both the manufacturing and services indexes.

Admittedly though, economic data don’t mean much right now. While investors could pay some attention to the PMIs since they also contain a forward-looking component, most of the price action in the euro might be driven by the meeting of EU leaders.

They will be discussing more stimulus measures, including the prospect of some risk-sharing mechanism like Eurobonds. If agreed, this could be a game-changer for the euro. It would imply a quicker recovery in the most virus-ravaged economies such as Italy and Spain, and remove some of the political risk premia.

However, despite some recent signs of flexibility, such an agreement remains very unlikely given the scale of opposition from Germany and the Netherlands. Therefore, the risks surrounding the euro’s reaction seem asymmetric. With nobody really expecting a deal, a surprise Eurobond agreement would likely push the euro much higher, whereas another disappointment might only generate minor losses.

SENTIMENT

OVERALL SENTIMENT:

The wild swings and the continued sell off in WTI crude oil futures dominated the news headlines and caused risk aversion in various asset classes including Gold which was down almost 3% at one point. This will continue to weigh on sentiment as victims of the crisis in various shapes and forms will relentlessly pop out of the woodwork as time passes.

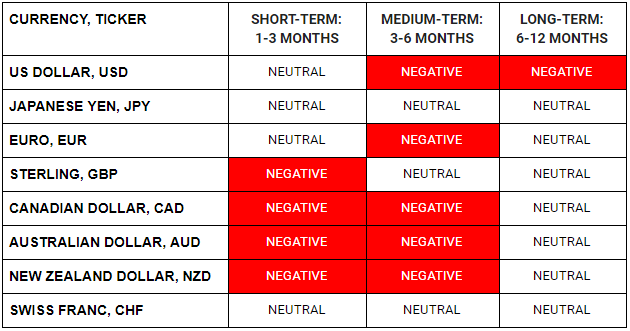

FX

STOCK INDICES

TRADING TIP

Beware the Assumed Boundaries

Many people trade with the assumption that prices are somehow bound by some limits without fully understanding why they hold these assumptions.

Interest rates can never be less than zero else there would be queues at the banks to borrow money and get paid for doing so. That was assumed true until it wasn’t. Oil prices cannot be at zero because then it would be free. That was true until the price of oil futures went deeply negative.

Always review what are the assumptions that are inherent in your thinking if you want to succeed at trading. Many have lost the shirts in the process of buying blue chip investment bank stocks such as Lehman Brothers all the way down to zero!