WHAT HAPPENED YESTERDAY

As of New York Close 17 Apr 2020,

FX

U.S. Dollar Index, -0.25%, 99.72

USDJPY, -0.40%, $107.53

EURUSD, +0.38%, $1.0878

GBPUSD, +0.35%, $1.2501

USDCAD, -0.58%, $1.4000

AUDUSD, +0.57%, $0.6365

NZDUSD, +0.92%, $0.6026

STOCK INDICES

S&P500, +2.68%, 2,874.56

Dow Jones, +2.99%, 24,242.49

Nasdaq, +1.38%, 8,650.14

Nikkei Futures, +2.39%, 19,700.0

COMMODITIES

Gold Futures, -1.90%, 1,698.80

Brent Oil Spot, +0.23%, 26.62

SUMMARY:

Dollar ticked lower on Friday as investors, cautiously optimistic about the results of a drug trial and Trump’s plan to reopen the economy, regained some appetite for risk. Dollar, which has closely tracked risk sentiment through the Covid-19 crisis, fell -0.19%, 99.72.

S&P 500 advanced 2.68% on Friday amid hopes for a Covid-19 treatment and optimism about reopening the economy. The Dow Jones Industrial Average (+2.99%) and Russell 2000 (+4.3%) outpaced the benchmark index, while the Nasdaq Composite (+1.38%) had a more modest performance. U.S. 2yr Yield was unchanged at 0.20%. U.S. 10yr Yield rose 4bp to 0.65%.

A report published by Stat News indicated that most Covid-19 patients treated with Gilead Sciences’ (GILD 83.99, +7.45, +9.7%) remdesivir showed a rapid recovery in a trial at the University of Chicago Medicine. Note, Gilead did not issue an official statement regarding the trial, which lacked a placebo group for comparison. The University of Chicago itself warned that drawing any conclusions was “premature and scientifically unsound”.

The possibility that there might be an effective Covid-19 treatment, though, added to the positive sentiment in the market as it could restore some confidence for consumers when the economy starts to reopen. Trump said on Thursday that some states already satisfied the administration’s new guidelines to reopen before May.

The information technology sector (+1.4%) underperformed today amid relative weakness in Apple (AAPL 282.80, -3.89, -1.4%), which was downgraded to Sell from Neutral at Goldman Sachs on a view that iPhone sales will take more time to recover than expected. Boeing (BA 154.00, +19.76, +14.7%) shares rose nearly 15% after the company said it plans to restart production at its Puget Sound facility next week. Procter & Gamble (PG 124.69, +3.19, +2.6%) advanced with the broader market after it beat earnings estimates.

U.S. COVID-19 CRISIS TAKES A POLITICAL TURN

Trump lashed out at four Democratic governors over their handling of the pandemic after having conceded that states bear ultimate control of restrictions to contain the outbreak. The Republican president targeted three swing states critical to his re-election bid – Michigan, Minnesota and Virginia – where his conservative loyalists have mounted pressure campaigns challenging those governors’ stay-at-home orders.

Amplifying a theme that his supporters have trumpeted this week in street protests at the state capitals of Lansing, St. Paul, and Richmond, Trump issued a series of matching Twitter posts touting the slogans: “LIBERATE MICHIGAN!” “LIBERATE MINNESOTA!” and “LIBERATE VIRGINIA!”

IMPACT: Michigan has become a particular focus of agitation to relax social-distancing rules that rank among the strictest in the nation after Governor Gretchen Whitmer, widely seen as a potential running mate for presumed Democratic presidential candidate Joe Biden, extended them through the end of April. Trump, who played down the Covid-19 threat in its early stages, had been pressing to restart idled businesses as soon as May 1, at first declaring “total” authority to do so and branding governors who resisted his approach, many of them Democrats, as “mutineers.”

TRUMP: SOME STATES TO BEGIN LIFTING RESTRICTIONS IN COMING DAYS

Trump said on Saturday that Texas and Vermont will allow certain businesses to reopen later today while still observing Covid-19-related precautions and Montana will begin lifting restrictions on Friday. He said both Republican and Democratic governors “have announced concrete steps to begin a safe and gradual phased opening.” Texas and Vermont “will allow certain businesses to open on Monday while still requiring appropriate social distancing precautions,” he said.

IMPACT: On Saturday morning, Governor Andrew Cuomo of New York, the epicenter of the U.S. epidemic, said his Covid-19-battered state may finally be past the worst of the health crisis there. Again, Trump is determined to ignore the lessons that have been learnt by other countries (Singapore, Japan, China) regarding the measures required to stop a 2nd wave of infections.

CHINA’S ECONOMY SHRANK FOR FIRST TIME IN DECADES

China, the world’s second-largest economy shrank 6.8% (expected -6.2%) in the first quarter of 2020 compared to a year earlier. While a contraction was expected, it’s still a historic moment for China. The plunge is the worst for a single quarter that China has recorded since it started publishing those figures.

China’s three major engines for growth — consumer spending, exports and fixed asset investment — all sputtered as large swaths of the country were placed on lockdown in late January and early February to contain the spread of the virus. Retail spending dropped 19% last quarter, while exports plunged more than 13%. Fixed asset investment declined 16%.

IMPACT: China cut its benchmark lending rate as expected on Monday to reduce borrowing costs for companies and prop up the Covid-19-hit economy, after it contracted for the first time in decades. The one-year loan prime rate (LPR) was lowered by 20 bps to 3.85% from 4.05% previously, while the five-year LPR was cut by 10 bps to 4.65% from 4.75%.

DAY AHEAD

While the stimulus is significant to be sure – as it will help prevent this crisis from evolving into a depression – investors might be underappreciating how deep this downturn will be and how long it will take for economies to recover. The speed of job losses in the US is simply terrifying. The unemployment rate will easily surpass 10% next month – the peak of the previous recession – and who knows how much higher it will climb as the pandemic cascades through the economy. Those losses could take years to recover, especially when considering the scars this crisis might leave on consumer behavior. Would you go to a restaurant or cinema on the same day the end of the lockdown, or play it safe and wait? Not to mention the risk of second waves of infections once the lockdowns are lifted, and the possibility of future shutdowns.

All this argues for a slow and protracted recovery as consumption remains soft, something that stock prices don’t seem to fully reflect. Indeed, the latest gains in gold and the yen suggest traders don’t have much faith in the recent stock rally either. The fact that oil prices can’t get off the floor either, despite huge supply cuts, argues the same point. It implies a real pickup in demand isn’t expected anytime soon.

SENTIMENT

OVERALL SENTIMENT:

Rumour of a promising drug trial got the bulls going but the denial from the company did not tamper the enthusiasm and the bears could not regain lost territory. The waves of money from policymakers continue to rule the sentiment for now. Reality will bite eventually, but it takes time.

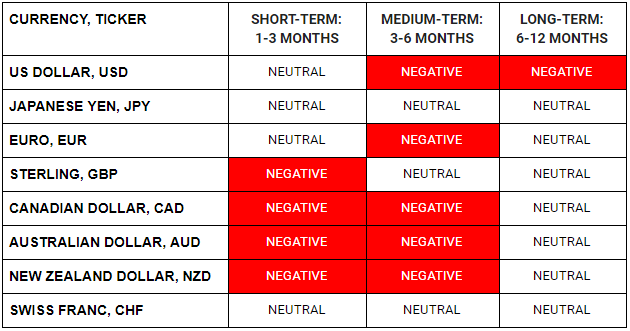

FX

STOCK INDICES

TRADING TIP

The Dollar Smile

The theory states that the Dollar tends to outperform when the US economy is very strong (on the left side of the smile) or very weak (right side). And it does poorly when the US economy is just muddling through (middle of the smile).

Why is this? Well, the logic is straightforward. The US trades at a “safety premium” relative to other countries.

Most international funding is done in USD dollars. So, when the US economy is extremely weak, volatility increases, and markets are perceived as riskier. The risk aversion will lead to these Dollar loans being called back and Brazilian Reals or whichever currency will get converted into USD to cover the dollar debt thus putting upward pressure on the Dollar.

When the US economy is extremely strong and outperforming the rest of the world, investments will flow into USD and the US economy, thus leading to USD strength.