WHAT HAPPENED YESTERDAY

As of New York Close 16 Apr 2020,

FX

U.S. Dollar Index, +0.26%, 99.90

USDJPY, +0.42%, $107.93

EURUSD, -0.46%, $1.0859

GBPUSD, -0.22%, $1.2488

USDCAD, -0.53%, $1.4039

AUDUSD, +0.65%, $0.6360

NZDUSD, +0.14%, $0.6000

STOCK INDICES

S&P500, +0.58%, 2,799.55

Dow Jones, +0.14%, 23,537.68

Nasdaq, +1.66%, 8,532.36

Nikkei Futures, +0.38%, 19,655.0

COMMODITIES

Gold Futures, -0.53%, 1,731.00

Brent Oil Spot, +2.11%, 26.56

SUMMARY:

The Dollar Index hit a one-week high on Thursday as investors fled to safe-haven assets following the release of weekly U.S. jobless data which showed a record 22 million Americans have sought unemployment benefits in the last month, erasing nearly all job gains since the Great Recession. Weekly jobless claims totaled 5.245 million (consensus 5.000 million), down 1.37 million from the prior week. Housing starts for March declined 22.3% m/m while building permits fell 6.8% m/m. The Philadelphia Fed Index for April plunged 43.9 points to -56.6 (consensus -25.0) for its lowest reading since July 1980.

Stock market closed mixed on Thursday, as investors responded to another round of weak economic data by continuing to buy shares of technology companies while avoiding distressed sectors like financials and energy. The Nasdaq Composite rose 1.66%, while the S&P 500 (+0.58%) and Dow Jones Industrial Average (+0.14%) posted smaller gains. The Russell 2000 declined 0.5%. U.S 2yr yield remained unchanged at 0.20%. U.S. 10yr yield fell 2bp to 0.61%.

TRUMP UNVEILS THREE-STAGE PROCESS FOR STATES TO END COVID-19 SHUTDOWN

Trump proposed guidelines on Thursday under which U.S. state governors could act to revive the U.S. economy from its Covid-19 shutdown in a staggered, three-stage process.

“We are not opening all at once, but one careful step at a time,” Trump told reporters, without himself providing details on his guidelines. The new federal guidelines recommend that states record a 14-day “downward trajectory” in Covid-19 cases before beginning a three-phase process of re-opening. Before states re-open, hospitals should have a “robust testing program” that includes antibody testing in place for healthcare workers, the guidelines say.

The document lays out Trump’s plan for opening businesses in states across the country that have been ravaged by the pandemic and its economic impact even though the responsibility for such decisions lies with the state, not federal authorities.

IMPACT: A White House official described the guidelines as conservative and noted that they had been agreed to by the top doctors on the president’s coronavirus task force.

Trump is pushing to get the U.S. economy going again after the Covid-19 shutdown left millions of Americans jobless. More than 20 million people have filed for unemployment in the U.S. in the past month and over 90% of the country has been under stay-at-home orders.

GILEAD COVID-19 DRUG SUGGESTS PATIENTS ARE RESPONDING TO TREATMENT

A Chicago hospital treating severe Covid-19 patients with Gilead Sciences’ antiviral medicine remdesivir in a closely watched clinical trial is seeing rapid recoveries in fever and respiratory symptoms, with nearly all patients discharged in less than a week.

Remdesivir was one of the first medicines identified as having the potential to impact SARS-CoV-2, the novel coronavirus that causes Covid-19, in lab tests. The entire world has been waiting for results from Gilead’s clinical trials, and positive results would likely lead to fast approvals by the Food and Drug Administration and other regulatory agencies. If safe and effective, it could become the first approved treatment against the disease.

IMPACT: Gilead Sciences shares popped by more than 16% in after-hours trading Thursday after details leaked of a closely watched clinical trial of the company’s antiviral drug Remdesivir, showing what appears to be promising results in treating Covid-19. As a result, S&P500 Futures are up approx. 2.73% in early Asian Trading.

The University of Chicago Medicine recruited 125 people with Covid-19 into Gilead’s two Phase 3 clinical trials. Of those people, 113 had severe disease. All the patients have been treated with daily infusions of remdesivir.

U.S. RAMPS UP RHETORIC AGAINST CHINA, INCREASING TENSIONS

- US EXPLORES POSSIBILITY THAT VIRUS STARTED IN CHINESE LAB, NOT A MARKET

US intelligence is reviewing sensitive intelligence collection aimed at the Chinese government, according to the intelligence source, as they pursue the theory. But some intelligence officials say it is possible the actual cause may never be known.

- US CLAIMS CHINA MAY HAVE CONDUCTED LOW-LEVEL NUCLEAR TEST

According to a US State Dept report China may be secretly conducting nuclear tests with very low explosive power; there is no proof, but there is a series of activities that “raise concerns”.

- US SHOULD HALT TRADE WITH CHINA UNLESS THEIR VIRUS POLICY CHANGES

Sen. Graham suggested that China needs to be held accountable for spreading the virus and advocated for the closing of some markets in China where food is sold. He also said the United States needs to take aggressive action against China or risk another pandemic.

IMPACT: U.S. seems to be orchestrating a narrative warfare on China, leveraging the virus situation to soften the ground for the U.S. administration to sow seeds of discord in time to come. Keep a keen eye on this development as it will shape foreign policies in the near future. Increasing tension in a world where cooperation is needed more than ever should be bad for risk assets when things come to the fore.

DAY AHEAD

With the worst of the pandemic now behind Europe and the US also approaching a peak, markets have turned their sights to when economies will reopen. Stocks have recovered on hopes for a ‘return to normal’, but importantly, safe havens like the yen and gold are also gaining. The combination suggests that traders are still playing defense and that the recent stock rally may be built on shaky foundations. Indeed, investors might be downplaying the scale of this crisis, and how long it will take for economies to recover. As such, the upcoming PMIs could provide a reality check.

SENTIMENT

OVERALL SENTIMENT:

It’s hot and it’s cold, it’s up and it’s down. As the tug of war continues between unlimited money from policy makers and deteriorating economic fundamentals, the market is behaving like a yoyo. It is easy to forget that the world is about to experience the worst depression of our time. However, it is critical to focus on the facts and the relentless flow of money will push prices of hard assets higher over time. Focus on that and ignore the noise.

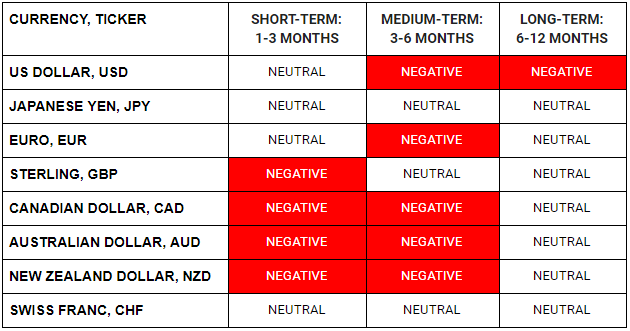

FX

STOCK INDICES

TRADING TIP

Do what works, Avoid what doesn’t

Fighting the market trends can be exhausting. It is both devastating to your financial and mental capital. When market movements do not behave as you expect them to according to your world view, and your trades are not working well, it is best to reduce the size of your risk positions or even just exit everything and take a step back.

Without risk positions to colour your view, you will be in a better frame of mind to objectively take stock of the situation at hand. Even in the midst of a very noisy market, there will be some trades that are working out. Focus on what is working out well and do more of that. If you can’t find anything that works, then you have the answer. Don’t do any trades, take a breather and enjoy the bliss of having no financial capital at risk.

The weekend is upon us, enjoy it!