WHAT HAPPENED YESTERDAY

As of New York Close 20 Apr 2020,

FX

U.S. Dollar Index, +0.23%, 99.95

USDJPY, +0.14%, $107.68

EURUSD, -0.14%, $1.0863

GBPUSD, -0.48%, $1.2438

USDCAD, +0.94%, $1.4131

AUDUSD, -0.36%, $0.6342

NZDUSD, +0.28%, $0.6043

STOCK INDICES

S&P500, -1.79%, 2,823.16

Dow Jones, -2.44%, 23,650.44

Nasdaq, -1.03%, 8,560.73

Nikkei Futures, -1.37%, 19,430.0

COMMODITIES

Gold Futures, +0.44%, 1,706.35

Brent Oil Spot, -6.54%, 24.88

SUMMARY:

Dollar Index edged 0.23% higher, 99.95, on Monday. Oil-linked currencies were weaker with the U.S. dollar 0.94% higher against its Canadian counterpart.

S&P 500 declined 1.79% on Monday, although that was relatively modest given the implosion in the oil market where the expiring May contract for WTI crude closed negative for the first time ever. The Dow Jones Industrial Average declined 2.44%, the Nasdaq Composite declined 1.03%, and the Russell 2000 declined 1.3%. U.S. 2yr yield remained unchanged at 0.20% and U.S. 10yr yield fell 2bp to 0.63%.

Specifically, WTI crude futures for May delivery collapsed 306% to -$37.63/bbl ahead of expiration, as no one presumably wanted to take physical delivery given the well-documented storage constraints and lack of demand. The negative price also indicated that producers are paying someone to take their oil. According to Bloomberg, USO owned 25% of the outstanding volume of May WTI oil futures contracts as of last week. With that contract set to expire today, the buyers of that “paper oil” have to sell or take physical delivery at the end of May. ETFs like USO are not created to take physical delivery of the oil contracts and were forced to unwind at any price.

The historic, and mind-boggling, occurrence appeared to spoil an intraday rebound in stocks, which started to accelerate losses heading into the futures settlement time at 2:30 p.m. ET. Around that same time, it was also reported that a vote to replenish the small business loan program was delayed in the Senate due to ongoing negotiations.

It should be noted, though, that the WTI futures curve did show rising prices amid expectations that prices should rebound with production cuts and hopefully increased demand. For instance, the June WTI crude futures contract settled at $20.43/bbl, although that was still an 18.9% decline.

In equities, Walt Disney (DIS 102.26, -4.37, -4.1%) and Boeing (BA 143.61, -10.39, -6.8%) underperformed the broader market following a pair of analyst downgrades and negative-sounding reports. Disney is reportedly suspending pay for 100,000 employees, while a GE leasing subsidiary canceled 69 orders of Boeing’s 737 MAX.

OIL CRASHES INTO NEGATIVE FOR THE FIRST TIME IN HISTORY

U.S. crude oil futures collapsed below $0 on Monday for the first time in history, amid a Covid-19-induced supply glut, ending the day at a stunning minus $37.63 a barrel as desperate traders paid to avoid having to take delivery of physical oil. Brent crude, the international benchmark, also slumped, but that contract was nowhere near as weak because more storage is available worldwide.

IMPACT: Traders fled from the expiring May U.S. oil futures contract in a frenzy on Monday with no place to put the crude, but the June WTI contract settled at a much higher level of $20.43 a barrel. The May U.S. WTI contract fell 306%, to settle at a discount of $37.63 a barrel after touching an all-time low of -$40.32 a barrel. Brent was down 6.54%, to settle at $24.88 a barrel.

Refiners are processing much less crude than normal, so hundreds of millions of barrels have gushed into storage facilities worldwide. Traders have hired vessels just to anchor them and fill them with the excess oil. A record 160 million barrels are sitting in tankers around the world.

TRUMP TO CONSIDER HALTING SAUDI OIL IMPORTS

Trump said on Monday that his administration was looking at the possibility of stopping incoming Saudi Arabian crude oil shipments as a measure to support the battered domestic drilling industry.

“The problem is no one is driving a car anywhere in the world, essentially…Factories are closed, businesses are closed,” Trump said. “We had really a lot of energy to start off with, oil in particular, and then all of a sudden they lost 40%, 50% of their market.”

IMPACT: Trump reiterated that his administration plans to top up the nation’s emergency crude oil stockpile as prices plunge. The Department of Energy is in the process of leasing some of the roughly 77 million barrels of available space in the Strategic Petroleum Reserve to U.S. oil companies to help them deal with the dearth of commercial storage as the Covid-19 outbreak crushes domestic energy demand. The administration initially wanted to purchase the crude oil directly, but Congress has yet to approve the funding.

AUSTRALIA EDGES TOWARDS REOPENING SCHOOLS AS COVID-19 INFECTIONS SLOW

Students in Australia’s most populous state, New South Wales, will start returning to school next month in much larger numbers amid a rapid decline in new infections, Premier Gladys Berejiklian said on Tuesday. Australian states and territories have largely shuttered schools for more than a month as part of efforts to slow the spread of Covid-19, despite sometimes conflicting advice from the federal government, which had wanted schools to remain open. Children of emergency workers are among the few who have continued to go to school.

IMPACT: Berejiklian said students will begin to return to school on May 11 on a staggered basis in preparation for full-time schooling to re-start in July. Australia is one of the few nations around the world to detail plans to reopen schools after infection rates plummeted from more than 25% in mid-March to its current level of less than 1% a day.

The reopening of schools has been a key demand of Prime Minister Scott Morrison, who hopes it will stimulate Australia’s economy and allow parents to better juggle work commitments.

DAY AHEAD

Caution returned to world markets as a drubbing for U.S. WTI crude oil kicked off a busy week of data and earnings that will drive home the damage being inflicted by global Covid-19 lockdowns. Investors will be watching for signs of progress as heads of European Union governments are scheduled to hold a video summit over how to tackle the economic fallout from the crisis on Thursday, where differing views on coronabonds, mostly demanded by the southern EU member states, are expected to be voiced.

SENTIMENT

OVERALL SENTIMENT:

The world woke up to the rude fact that the price for oil is not actually bound by zero. Though many will dismiss the panic selling in the May futures of WTI crude oil and say it is primarily due to the maturity contract today, the demand destruction is what has led to persistently weak prices despite the OPEC+ deal with US support. Market disruptions like these will inevitably lead to stories of massive losses in various firms having exposure to the product thinking that 0 is the lowest it can go. Credit losses at banks due to loans made to various firms that have oil trading activities will soon be revealed. Expect unexpected ripple effects…

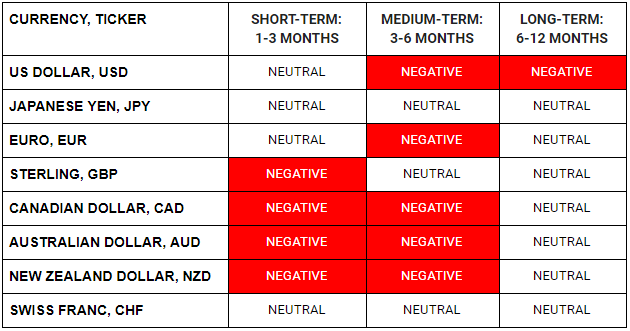

FX

STOCK INDICES

TRADING TIP

Free energy? No, we pay you!!

How did you end up with negative oil prices today? This happens when a physical futures contract finds no buyers close to or at expiry, here is a brief explanation in point form.

- A physical contract such as the WTI Crude has a delivery point at Cushing, in this occurrence May 2020. So people who hold the contract at the end of the trading window have to take physical delivery of the oil they bought on the futures market. – this is very rare.

- It means that in the last few days of the futures trading cycle, (which is today for this one) speculative or paper futures positions start rolling over to the next contract. – this is normally a pretty undramatic affair.

- What happened yesterday is trades or speculators who had bought the contract are finding themselves unable to resell it, and have no storage booked to get delivered the crude in Cushing, where the delivery is specified in the contract.

- This means that all the storage in Cushing is booked, and there is no price they can pay to store it, or they are totally inexperienced in this game and are caught holding a contract they did not understand the full physical aspect of as the time clock expires.

- The June contract is not out of the woods either: yesterday’s action indicates that physical oil markets at Cushing are not in good shape and that storage is getting very full.

Oil costs money to store and due to the Covid-19 induced economic halt, oil isn’t being used much. All the land storage facilities are filled up and nobody who can store it will buy it from you. Hence if you want to get rid of the oil, you have to pay someone.