WHAT HAPPENED YESTERDAY

As of New York Close 15 Apr 2020,

FX

U.S. Dollar Index, +0.81%, 99.65

USDJPY, +0.38%, $107.63

EURUSD, -0.69%, $1.0905

GBPUSD, -0.84%, $1.2519

USDCAD, +1.68%, $1.4116

AUDUSD, -2.07%, $0.6309

NZDUSD, -1.81%, $0.5996

STOCK INDICES

S&P500, -2.20%, 2,783.36

Dow Jones, -1.86%, 23,504.35

Nasdaq, -1.44%, 8,393.18

Nikkei Futures, -1.86%, 19,245.0

COMMODITIES

Gold Futures, -1.49%, 1,742.50

Brent Oil Spot, -6.47%, 26.01

SUMMARY:

On a day of equity weakness, investors fled from riskier assets for safe-havens such as the Dollar and US Treasury bonds. The U.S. dollar index, which had fallen in the four previous trading days, rose as high as 99.98, but returned some of those gains, last trading up 0.81%. IMF’s overnight report, which downgraded global growth more than expected, along with the record downturn in U.S. retail sales, and the huge drop in U.S. industrial production, all combined to see a rush into safe havens.

S&P 500 declined 2.20% on Wednesday, as the release of historically weak economic data undercut risk sentiment. The Dow Jones Industrial Average lost 1.86%, the Nasdaq Composite lost 1.44% to snap a four-session winning streak, and the Russell 2000 underperformed with a 4.3% decline. U.S. 2yr yield fell 3bp to 0.20% and U.S. 10yr yield fell 13bp to 0.63%.

U.S. Retail sales declined 8.7% m/m in March (consensus -8.0%). The key takeaway from the report is that it captured the impact of the Covid-19 shutdown situation, as spending in discretionary categories cratered while spending for essential items accelerated. Industrial production declined 5.4% m/m in March (consensus -4.1%).

In addition, more banks bolstered their loan-loss reserves to prepare for tougher times ahead, the Fed’s Beige Book for April noted a sharp contraction in economic activity with business contacts expecting conditions to worsen, and The Wall Street Journal reported that the Paycheck Protection Program for small businesses was on pace to run out of money today.

The energy sector (-4.7%) declined the most, though, as the group remained pressured by lower oil prices after the EIA projected a 9.2 mb/d decline in oil demand in 2020. Brent Oil settled 6.47% lower, to $26.01/bbl.

Separately, airline stocks finished mixed after the companies reached individual agreements with the government for payroll relief. Shares of American Airlines (AAL 12.29, +0.35, +2.9%) closed higher, while Delta Air Lines (DAL 24.35, -0.19, -0.8%) closed lower.

BANK OF CANADA

Canada’s central bank held interest rates steady at 0.25% as expected, added provincial and corporate bonds to its quantitative easing program, and suspended its economic forecasts given the highly uncertain outlook. “The next challenge for markets will be managing increased demand for near-term financing by federal and provincial governments, and businesses and households,” the Bank of Canada said in a new policy statement April 15. “The situation calls for special actions by the central bank.”

In its quarterly monetary policy report, the bank outlined two scenarios under which real gross domestic product (GDP) would shrink. It estimated real GDP would fall by 1% to 3% in the first quarter and would contract by 15% to 30% in the second quarter, both compared with the fourth quarter of 2019.

IMPACT: Policy-makers already have set up a half-dozen emergency programs aimed at pushing cash into financial markets, including the weekly purchase of at least $5 billion of federal government bonds. In the “coming weeks,” the central bank announced it also will start buying up to $50 billion in provincial debt, and up to $10 billion of investment-grade corporate bonds. Both will be firsts for the Bank of Canada.

U.S. RETAIL SALES & FACTORY OUTPUT SINKS

U.S. retail sales suffered a record drop in March and output at factories declined by the most since 1946, buttressing analysts’ views that the economy contracted in the first quarter at its sharpest pace in decades as extraordinary measures to control the spread of Covid-19 shut down the country.

The drag on sales from social restrictions far outweighed a 3.1% surge in receipts at online retailers like Amazon (AMZN), and grocery stores and pharmacies as consumers stocked up on household essentials such as food, toilet paper, cleaning supplies and medication. Grocery store sales soared 26.9% and receipts at healthcare outlets jumped 4.3%. Sales at building material stores rose 1.3%.

IMPACT: Economists see no respite for consumer spending in the second quarter, with estimates as deep as a 41% rate of decline, despite a historic $2.3 trillion fiscal package, which made provisions for cash payments to some families and boosted unemployment benefit checks. As a reminder, about 16.8 million people have filed claims for unemployment benefits since March 21.

PANDEMIC TO BRING ASIA’S 2020 GROWTH TO HALT: IMF

Asia’s economic growth this year will grind to a halt for the first time in 60 years, as the Covid-19 crisis takes an “unprecedented” toll on the region’s service sector and major export destinations, the International Monetary Fund said on Thursday.

Asian policymakers must offer targeted support to households and firms hit hardest by the pandemic, the IMF said, calling also for efforts to provide ample liquidity to markets and ease financial stress faced by small and midsize firms. Emerging economies in the region should tap bilateral and multilateral swap lines, seek financial support from multilateral institutions, and use capital controls as needed to battle any disruptive capital outflows caused by the pandemic, the IMF said.

IMPACT: While Asia is set to fare better than other regions suffering economic contractions, the projection is worse than the 4.7% average growth rates throughout the global financial crisis, and the 1.3% increase during the Asian financial crisis in the late 1990s. The IMF expects a 7.6% expansion in Asian economic growth next year on the assumption that containment policies succeed, but added the outlook was highly uncertain.

DAY AHEAD

China’s economy contracted in Q1, but by how much?

All this is expected to be revealed tomorrow when China publishes its Q1 GDP growth estimate as well as industrial output and retail sales numbers for March. A dire set of figures could spark some panic selling on fears that the economic slump in Europe and America will be even greater. Forecasts are for GDP to have declined by 10% over the quarter and 6% annually. If the contraction proves to be milder than anticipated, however, this may not necessarily be met with a positive response in the markets as many traders would question the validity of the official data.

SENTIMENT

OVERALL SENTIMENT:

US bonds had a strong rally and US stocks fell, with the S&P500 index dropping around 3% from the strong close of the day before. All on a day with nothing surprising on the news front. It seems likely that the 2840-50 level will be strong resistance on the S&P500 index for now.

No matter how positively Trump wants to spin the situation and want to send people back to work to get the economy started again, doing so preemptively will be a mistake. The price for making mistakes when it comes to dealing with the virus, as we have seen repeatedly, is eventually going to be costly.

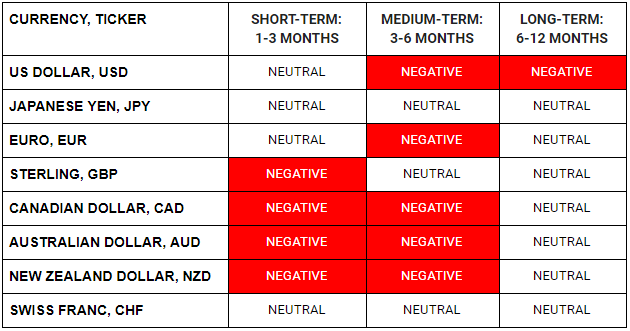

FX

STOCK INDICES

TRADING TIP

The Glass is Half Full

That’s the mode that investors are in right now in seeing the positive spin to every piece of news. Aided by the wave of cheap money from the Fed and fiscal subsidies from the government, sentiment has improved considerably, and fears have subsided.

No matter how positive of a spin you make to give it, the glass is still, in fact, half empty and as time passes, as the deteriorating fundamentals take whole, we are going to have to wake up to the fact that there’s going to be a lot of thirsty people around.

Earnings season has just started and eventually, all the repeated wake-up calls from disappointing earnings will take a toll.