NOTABLE MOVES

- U.S. Building Permits inline at 1.26M. Housing Starts inline at 1.23M. U.S. Treasuries were quiet for most of the day, with the benchmark 10-yr yield decreasing one basis point to 3.05%. The U.S. Dollar Index rose 0.7% to 96.85, reversing a recent trend that knocked the index from its yearly high. USDJPY up 0.13%, $112.71.

- There was a new bout of tension between the EU Commission and Italy over the 2019 budget. Italy refuses to reduce the planned deficit of 2.4% in its budget and Prime Minister Salvini threatened to veto the bloc’s next seven-year budget if the EU Commission insists on sanctions. The common currency was also affected by comments from ECB’s Weidmann, who said that policy normalization will take several years. Euro dropped -0.71%, $1.1372.

- In Brexit, the no-confidence vote of PM May proved to be of little threat after Sir Graham Brady, chairman of the 1922 Committee of Tory indicated he still hasn’t received enough letters to trigger it. Subsequently, Spain’s government cited that it will oppose the draft deal if it doesn’t include clarity over Gibraltar and would like to treat it as a bilateral issue to be discussed directly with the UK. Sterling fell below the key 1.2800 figure during US trading, undermined by endless Brexit drama and a resurgent demand for Dollars. Sterling fell -0.49%, $1.2788.

- WTI crude, which has been pressured by ongoing supply concerns, dropped -6.9% to $53.44/bbl and extended its decline to -30.5% from its October 3 high. Furthermore, oil prices were pressured on Tuesday after some speculation that Saudi Arabia might not force an oil production cut now after Trump defended the U.S.’s relationship with Saudi Arabia amid the killing of Jamal Khashoggi. Trump stated, in regards to Saudi Arabia, “They have worked closely with us and have been very responsive to my requests to keeping oil prices at reasonable levels.”

- It’s also worth mentioning that major changes could be in store for the BoC according to Deputy Governor Wilkins who said they will be conducting a complete review of their inflation targeting mandate to see if its worth switching to another an alternative framework. USDCAD popped 1.02%, $1.3306. The commodity bloc trades weakly on Friday on the back of risk-aversion. According to the RBA minutes, the central bank believes that the next move in rates will be higher, but there’s no strong case for a near term adjustments. Aussie dropped -1.07%, $0.7217. Kiwi down -0.70%, $0.6790.

- S&P 500 down -1.82%, 2,641.89. Nasdaq down -1.70%, 6,908.82. Nikkei down -1.09%, 21,583.12.

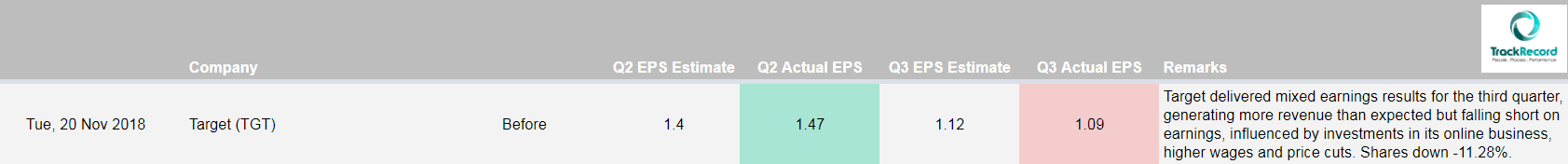

- In the retail space, earnings reports from Lowe’s (LOW 86.15, -5.20, -5.7%), Kohl’s (KSS 64.45, -6.55, -9.2%), Target (TGT 69.03, -8.12, -10.5%), L Brands (LB 28.43, -6.12, -17.7%), and Ross Stores (ROST 82.64, -8.55, -9.4%) reflected ongoing concerns over gross margin pressures, elevated inventory levels, disappointing same-store sales, and included some cautious guidance. On the other hand, Best Buy (BBY 63.63, +1.33, +2.1%) and Urban Outfitters (URBN 36.58, +0.97, +2.7%) reported upbeat reports. Nevertheless, the SPDR S&P Retail ETF (XRT 44.00, -1.51) lost -3.3%. The widely-held FANG group finished off their session lows, with the exception of Apple (AAPL 176.98, -8.88), which tumbled -4.8% to enter bear market territory. Apple has now fallen -23.7% from its October 3 record close. Netflix (NFLX 266.98, -3.62, -1.3%) and Amazon (AMZN 1495.46, -16.83, -1.1%) also closed on a lower note. Conversely, Facebook(FB 132.43, +0.88, +0.7%) and Alphabet (GOOG 1025.76, +5.76, +0.6%) added modest gains to help pare the communication services sector’s (-1.3%) losses. Notable chipmaker NVIDIA (NVDA 149.08, +4.38) gained 3.0%% amid a positive tweet from Citron Research that said, “This is the first time in 2 years (NVIDIA) offers an appealing risk-reward to investors.”

BLOCKCHAIN & CRYPTOCURRENCY NEWS

Autodesk CEO: Blockchain Can Stem Corruption in Construction Industry

Founded in 1982, Autodesk manufactures software for the construction, architecture, media, and entertainment industries. In 2018, the company’s revenue was $2.06 billion. According to American software corporation Autodesk CEO Andrew Anagnost, blockchain technology could eliminate corruption in the construction industry, as well as deliver greater trust in the field. Anagnost asserted that the company has considered blockchain as part of their future developments, saying “we just don’t have a point of view we have stated publicly,” during the fact that Autodesk purportedly has not yet introduced blockchain-powered products. Per the Financial Review, Autodesk has been working on its own non-blockchain digital “escrow” system designed to improve trust in the construction industry.

Catalan Government Considers Blockchain for Public E-Voting System

The head of the Catalan government’s citizen participation council states that the authority is considering blockchain for the community’s voting system. Earlier in October, the Generalitat of Catalonia approved a preliminary bill to establish an e-voting system for residents abroad in major elections and other voting processes in the autonomous community. The use of blockchain in the state e-voting system is still being considered, although the Generalitat has still not decided on the matter. Earlier in July, the Government of Catalonia revealed a plan for blockchain tech deployment within its public administration processes in order to improve “digital services to the public.” According to Ismael Peña-López, director of Citizen Participation of the Government of Catalonia, regardless of what technology the government decides to use in the voting system, it must instill trust.

Singapore’s Central Bank Finalizes Regulatory Framework for Crypto Payment Services

The new Payment Services Bill (PSB), submitted by MAS board member and education minister Ong Ye Kung before parliament, is set to replace two existing pieces of legislation, the Payment Systems (Oversight) Act (PS(O)A) and the Money-Changing and Remittance Businesses Act (MCRBA) in order to bring certain cryptocurrencies under its jurisdiction. In the cryptocurrency space, it is expected to affect e-wallets and digital payment tokens such as GrabPay, Bitcoin (BTC), and Ethereum (ETH). Both PS(O)A and MCRBA will be repealed when the new, streamlined PSB comes into force at the end of 2019. PSB comprises two parallel frameworks, the first being a “designation regime” that enables the central bank to name and thereby bring payment systems it considers “crucial to financial stability” under its oversight. The second entails a mandatory licensing regime for payment service providers, who will be required to apply for one of three licenses based on the nature and scope of their activities.