Disclaimer: The views and opinions expressed in this material do not constitute a recommendation by TrackRecord Pte Ltd or Gregg Tan and does not have regards to specific investment objectives, financial situation and/or the particular needs of any specific person. The main objective of this material is for educational and discussion purposes only. The technical views and commentaries are to facilitate the finer application of various technical tools. These technical views may be subject to further revision without notice. No part of this material may be reproduced or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission of TrackRecord Pte Ltd or Gregg Tan.

Historical Identical Movements (HIM): 20 Dec 2019

Humans are creatures of habit and oftentimes react in a similar way to identical financial events or price swings. These emotional reactions are reflected in price activities which can be visualised on a chart. The Historical Identical Movements (HIM) displayed below reveals an almost identical movement in its past, if HIM were to repeat, it can be used as a visual guide for movements ahead. Be forewarned that I rely on various charting techniques and technical tools for my actual market analysis. All analysis only attempts to forecast the likely movement ahead, HIM provides an ‘insight’ into how price could unfold ahead of time.

Do note that HIM employs a totally different approach from “A Technician’s Perspective” report. HIM’s sole purpose is to locate Historical Identical Movements that are almost identical to current price setup. Should projected path in HIM (movement after the light blue demarcation) align with “A Technician’s Perspective” report – it is at best a visual guide to how price could unfold.

Boundaries & Triggers (BAT): 23 Dec 2019

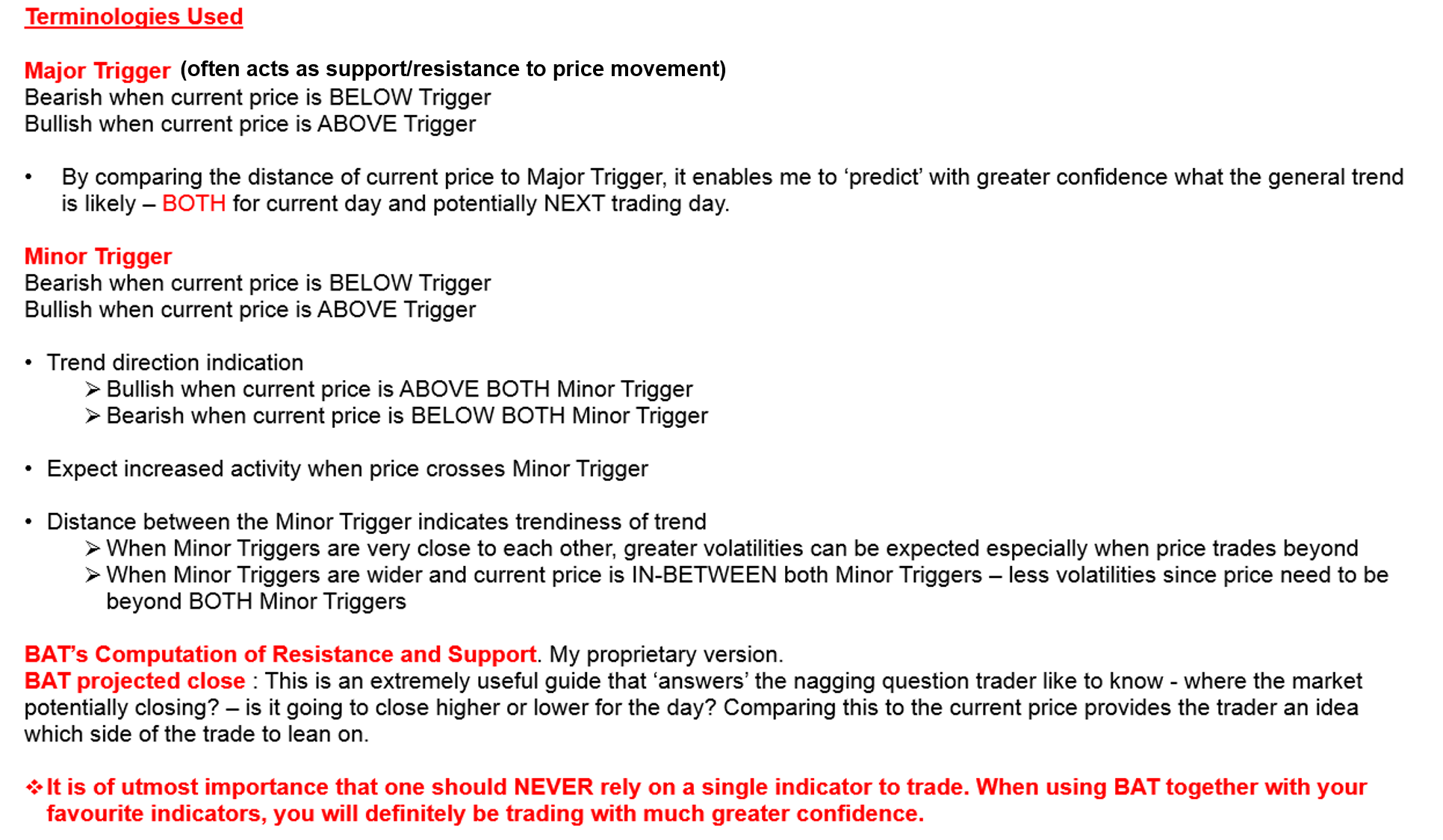

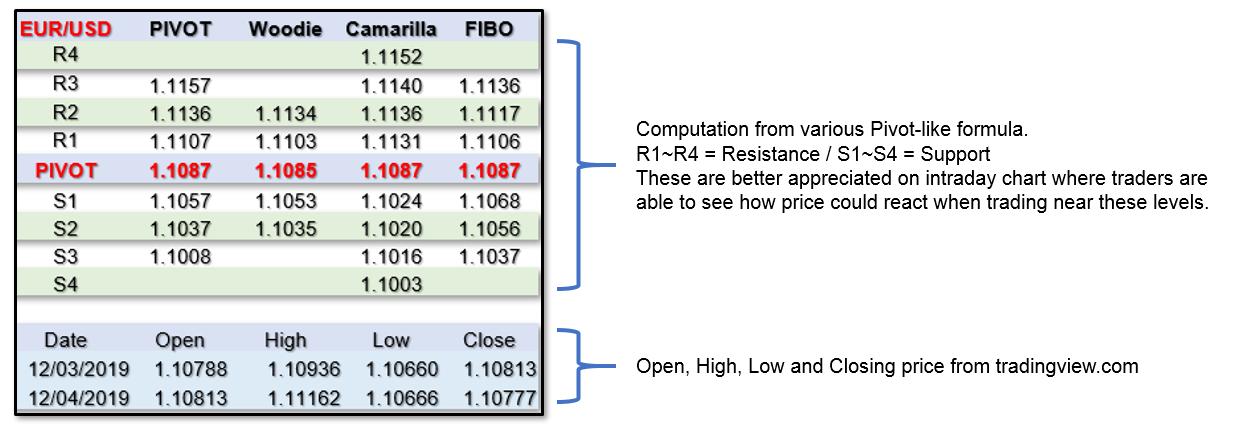

Daily Boundaries are actually a compilation of various Pivot Points like mathematical calculation that are popular with intraday traders. The Boundaries (Support and Resistance) though may be very accurate – are generally used just as a guide in conjunction with other indicators. The featured Pivots are – Standard Pivot Point, Woodies Pivot, Camarilla Pivot and Fibonacci Pivot. We are also featuring our proprietary Boundaries And Trigger (BAT). This is a complex formula requiring the identification of unique price behaviour, price projections and BAT Triggers. The Triggers are levels that will likely attract immediate follow-through activities when price crosses it.

AUD/USD – 120 Mins (Click to view explanation on usage of BAT and Pivot Points)

EUR/USD – 120 Mins (Click to view explanation on usage of BAT and Pivot Points)

GBP/USD – 120 Mins (Click to view explanation on usage of BAT and Pivot Points)

USD/CHF – 120 Mins (Click to view explanation on usage of BAT and Pivot Points)

USD/JPY – 120 Mins (Click to view explanation on usage of BAT and Pivot Points)

USD/CAD – 120 Mins (Click to view explanation on usage of BAT and Pivot Points)

A Technician’s Perspective: 20 Dec 2019

USD/CAD – DAILY

S&P 500 INDEX – DAILY

AUD/CAD – DAILY

GOLD SPOT – DAILY