Disclaimer: The views and opinions expressed in this material do not constitute a recommendation by TrackRecord Pte Ltd or Gregg Tan and does not have regards to specific investment objectives, financial situation and/or the particular needs of any specific person. The main objective of this material is for educational and discussion purposes only. The technical views and commentaries are to facilitate the finer application of various technical tools. These technical views may be subject to further revision without notice. No part of this material may be reproduced or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission of TrackRecord Pte Ltd or Gregg Tan.

Boundaries & Triggers (BAT): 14 Jan 2020

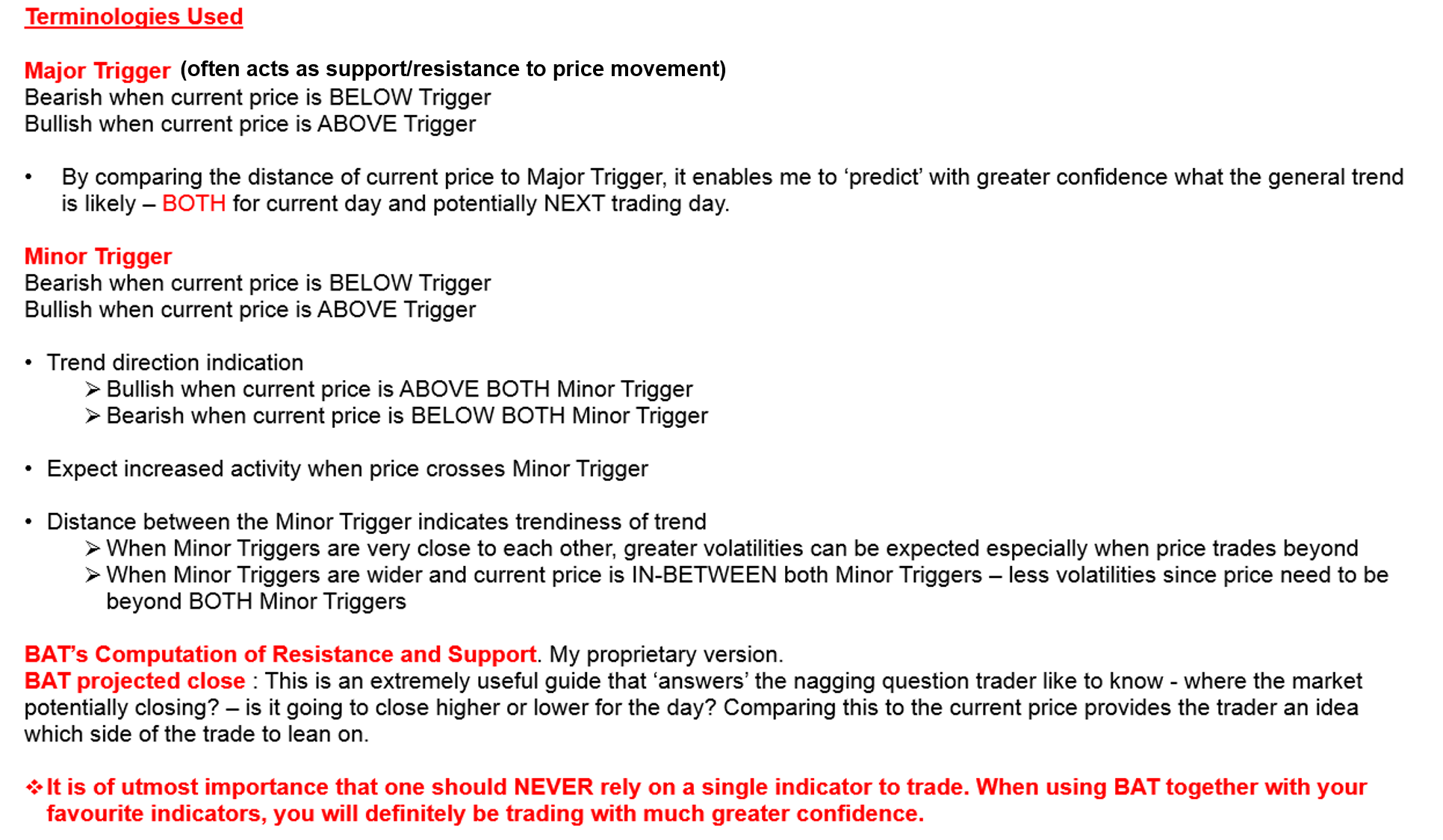

Daily Boundaries are actually a compilation of various Pivot Points like mathematical calculation that are popular with intraday traders. The Boundaries (Support and Resistance) though may be very accurate – are generally used just as a guide in conjunction with other indicators. The featured Pivots are – Standard Pivot Point, Woodies Pivot, Camarilla Pivot and Fibonacci Pivot. We are also featuring our proprietary Boundaries And Trigger (BAT). This is a complex formula requiring the identification of unique price behaviour, price projections and BAT Triggers. The Triggers are levels that will likely attract immediate follow-through activities when price crosses it.

AUD/USD – 60 Mins (Click to view explanation on usage of BAT and Pivot Points)

EUR/USD – 60 Mins (Click to view explanation on usage of BAT and Pivot Points)

GBP/USD – 60 Mins (Click to view explanation on usage of BAT and Pivot Points)

USD/CHF – 60 Mins (Click to view explanation on usage of BAT and Pivot Points)

USD/JPY – 60 Mins (Click to view explanation on usage of BAT and Pivot Points)

USD/CAD – 60 Mins (Click to view explanation on usage of BAT and Pivot Points)

Boundaries & Triggers (BAT) REVIEW: 13 Jan 2020

Here’s how yesterday’s charts panned out based on the trigger levels identified.

AUDUSD Crossed Above Minor Trigger (0.69025), potential to trend upwards.

EURUSD Crossed Above Minor Trigger (1.11114), potential to trend upwards.

GBPUSD Crossed Below Major Trigger (1.29972), potential to trend lower.

USDCHF Crossed Below Minor Trigger (0.97340), potential to trend lower.

USDJPY Crossed Above Minor Trigger (109.540), potential to trend upwards.

USDCAD In Between Minor Triggers (1.30529 – 1.30638), potential breakout pending.

The charts above are compiled by Gregg. Gregg has over 38 years of experience in the finance industry. His responsibilities in the initial 20 years was mainly with major Financial institutions, spanning across roles as a Trader, Dealer and as Head of Fundamental/ Technical Research of a team in Indonesia. He then spent the next 18 years at Bloomberg as an Application Specialist for Charting and Technical Analysis. Many of Bloomberg’s Institutional clients have acknowledged that they found true value at Gregg’s sessions. Gregg was a key contributor to Bloomberg’s charting ecosystem, as evident when the development team even rescheduled a planned global summit just to accommodate his busy schedule. Gregg has recently joined TrackRecord’s team of professional analysts to value-add to our existing offerings.