NOTABLE MOVES

- U.S. Core Retail Sales m/m at 0.7% vs expected 0.5%. Retail Sales m/m at 0.8% vs expected 0.6%. Philly Fed Manufacturing Index at 12.9 vs expected 20.1. U.S. Treasuries gave up early gains, returning yields to their unchanged marks. The benchmark 10-yr yield finished flat at 3.12%. USDJPY down -0.04%, $113.57.

- Press reports indicated that Italian League economic adviser Borghi is making waves about Italy possibly leaving the eurozone if the Italian League wins a majority in the next election. Euro up 0.12%, $1.1324.

- Brexit secretary Dominic Raab, and several other ministers, resigned a day after UK Prime Minister Theresa May received cabinet approval for her draft withdrawal statement. The resignations put pressure on May’s leadership position and the fate of the Brexit plan in the British Parliament. U.K. Retail Sales m/m at -0.5% vs expected 0.2%.Sterling dropped -1.77%, $1.2766.

- WTI crude rose for the second straight session, adding 0.5% to $56.44/bbl, though is still well-off its October 3 high of $76.90/bbl. Also, the EIA’s weekly crude oil inventory report showed that U.S. crude stockpiles rose by a higher-than-expected 10.3 million barrels last week. USDCAD down -0.50%, $1.3173.

- Aussie Employment Change at 32.8K vs expected 19.9K. Unemployment Rate at 5.0% vs expected 5.1%. Aussie up 0.47%, $0.7271.

- S&P 500 up 1.06%, 2,730.20. Nasdaq up 1.78%, 6,890.45. Nikkei down -0.20%, 21,803.62.

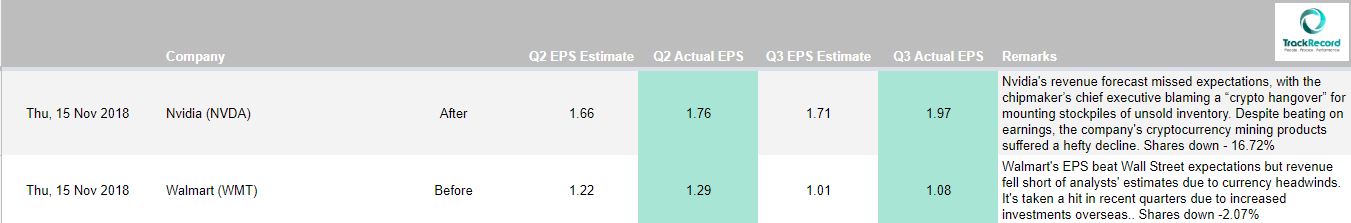

- U.S.-China trade optimism and strength from tech stocks, particularly Apple (AAPL 191.41, +4.61, +2.5%), contributed to the broader market overcoming its morning struggles. More news surrounding U.S-China trade developments helped fuel an afternoon rally. A Financial Times report suggested that China and the U.S. are trying to reach a trade truce ahead of the G-20 meeting at the end of the month. This should not be seen as anything particularly new, though, since similar reports were out earlier in the week. Commerce Secretary Wilbur Ross chimed in, and believes the G-20 meeting will be a ‘big picture’ meeting and he does not expect a deal by the end of the year. Nevertheless, the positive response caught some participants off guard and probably prompted some short-covering action. The trade-sensitive industrials sector finished with gain of 1.3%. Apple showed some resiliency after entering the session with a monthly loss of 14.7%. Morgan Stanley defended the stock, saying that it is currently a buying opportunity; the company also sees a price target of $253/share and is ‘Overweight’ on the stock. Also within the tech space, chipmakers put on a good showing, as the Philadelphia Semiconductor Index gained 3.3%, extending its winning streak to three sessions. Of note, Warren Buffet’s Berkshire Hathaway (BRK.B 217.38, +1.35, +0.6%) disclosed that it initiated new positions in some financial companies including JPMorgan and also increased its positions in Bank of America and other notable financial companies. In earnings, Dow components Wal-Mart (WMT 99.54, -1.99, -2.0%) and Cisco Systems (CSCO 46.77, +2.44, +5.5%) reported upbeat reports but finished mixed. Wal-Mart beat earnings estimates and raised its 2019 fiscal year guidance, and Cisco beat top and bottom lines estimates. Nvidia (NVDA 168.45, -33.94, -16.77%) plummeted as much as 16% during after-hours trading Thursday after the company missed on revenue due in large part to an inventory overhang for mid-range gaming GPUs.

BLOCKCHAIN & CRYPTOCURRENCY NEWS

The government of South Korea’s Gyeongbuk province has launched a “Blockchain Special Committee” with the goal of creating a blockchain hub in the region, inviting 40 domestic and foreign experts in the industry to consult on the project. Gyeongbuk province will work with the special committee, composed of domestic and international experts, to preemptively respond and establish strategies, in order to nurture the blockchain industry. The Committee’s establishment is not the region’s first venture into blockchain. This summer, the province’s government announced plans to issue its own local cryptocurrency, dubbed Gyeongbuk Coin, which will reportedly be accepted by merchants across the region.

Major Russian Art Gallery Tretyakov Launches Blockchain-Based Art Patronage Project

The prestigious State Tretyakov Gallery in Moscow, Russia, is launching a blockchain-based art patronage scheme. The project, dubbed “My Tretyakov,” allows individuals or enterprises to make a private donation to contribute to the digitization of an item from the gallery’s collection, thereby become the artwork’s patron. According to a press statement from the gallery – the donation amount is still under discussion. The system randomly selects which storage unit (electronic copy of an object of art) will be considered digitized using this cartridge, and links the name to the object. The connection of the name or company name to the digitized exhibit is fixed using blockchain technology. My Tretyakov initiative represents a new form of public involvement in art.

Spanish Telecoms Operator Partners With IBM to Manage International Calls With Blockchain

IBM and major Spanish telecommunications firm Telefónica have partnered to apply blockchain technology to managing international mobile phone call traffic. The collaboration aims to streamline certain Telefónica business processes and address various challenges in the field, including the reliability and transparency of information registered from different networks when routing international calls. The project will also help Telefónica identify fraudulent activity as well as address issues like dispute resolution, commercial loss due to uncollected revenues, or discrepancies in information. Telefónica plans to use the IBM Blockchain Platform for tracking the certainty and traceability of each international call and related data, such as origin, destination, and duration. The platform will be applied in building a network of peers consisting of operators, service providers, vendors, and other parties. IBM subsequently confirmed the partnership with Telefónica.