Analogy of what Options are (without considering the payoffs):

To explain an option on a lighter note, let’s say you book tickets for a particular movie in advance.

You have bought the right to view the movie but are not under any obligation to do so. i.e. you have an option to watch the movie.

If you have better things to do at time of screening, you can decide not to go to the movie. If the movie is bad, you can stop watching. But if it is great, and win awards before your day of screening, the cinema cannot raise prices on you.

You could either exercise your right to view the movie on date of the movie or you can sell off your tickets, for a higher or lower price, depending on the demand for the movie.

Lastly, you may just decide to let your tickets go to waste and not show up for the show at all.

On the flip side, the person who sells an option can be compared to the theatre owners. Once they have sold movie tickets to you, they are obliged to show you the movie.

It is not exactly how financial options work but the similarity is the right to do something but not the obligation to do

DEFINITIONS

Options: A contract which gives its holders (investors that bought the contract) the right to buy/sell an underlying asset at a specified price known as the strike price. An option need not be exercised should the condition be unfavourable to the holder, limiting the risk to its holders. Option writers (investors that sell the contract) are obligated to fulfil the contract should it be exercised.

Call: The right to buy an underlying at a specified strike price.

Put: The right to sell an underlying at a specified strike price.

Strike: The price you pay for the underlying when the option is exercised.

Option Premium: How much is needed to pay for the option contract. Option sellers get the option premium as a credit.

In the Money (ITM): When an Option is said to be ITM, it means that the strike is greater than the price of the underlying for calls and lower than the price of the underlying for puts.

Out of the Money (OTM): When an Option is said to be OTM, it means that the strike is lower than the price of the underlying for calls and greater than the price of the underlying for puts.

At the Money (ATM): When an Option is said to be ATM, it means that the strike is equal to the price of the underlying.

Option Expiry: The Date where the Option expires, Should the Option be exercised, the underlying will be delivered to you at the strike. As a result, OTM and ATM options expire worthless while ITM Options will have a value of – the price of the underlying at expiry minus the strike this value is otherwise known as the Intrinsic Value of the option.

Intrinsic Value of an Option: price of the underlying at expiry minus the strike

Extrinsic Value: Option Premium – Intrinsic Value which can be from the time remaining or interest rates

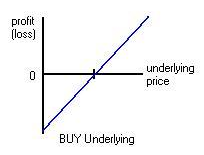

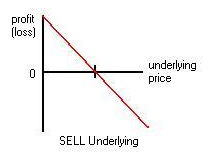

Payout Profiles of Trading the Underlying or Option

Vertical Line on Horizontal Axis represents the Strike Price of the option / Price at which the underlying is bought.

Buying the Underlying outright

Short Position in the Underlying.

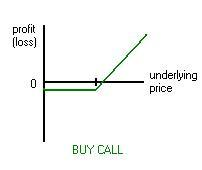

Long Call position:

Breakeven Price at Strike Price + Option Premium.

Limited Downside Risk of Option Premium,

Profit increases as underlying price increases.

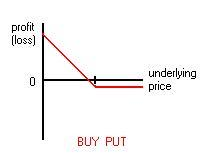

Long Put position:

Breakeven Price at Strike Price – Option Premium.

Limited Downside Risk of Option Premium,

Profit increases as underlying price decreases.

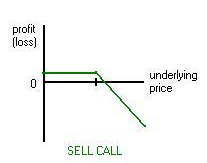

Short Call position:

Breakeven Price at Strike Price + Option Premium.

Unlimited Downside Risk as underlying price increases.

Max Profit = Option Premium.

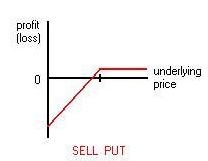

Short Put position:

Breakeven Price at Strike Price – Option Premium.

Limited Downside Risk as underlying price decreases.

Max Profit = Option Premium.