CURRENCY MARKET WRAP

As of Thu 28th, Singapore Time zone UTC+8

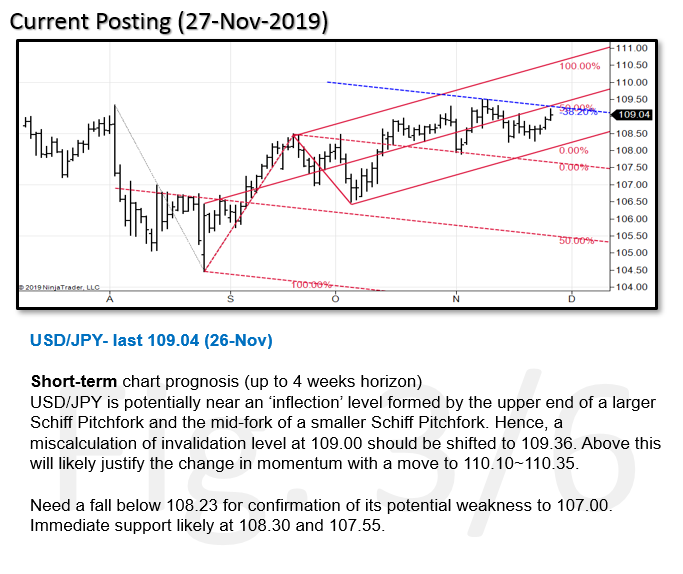

U.S. Dollar Index, +0.12%, 98.37

USDJPY, +0.30%, $109.38

EURUSD, -0.14%, $1.1005

GBPUSD, +0.49%, $1.2930

USDCAD, +0.11%, $1.3286

AUDUSD, -0.29%, $0.6769

NZDUSD, -0.22%, $0.6413

U.S. key data points included durable goods orders unexpectedly rising 0.6% in October (consensus -0.7%), weekly jobless claims reversing two straight weekly increases, and Q2 GDP being revised up to 2.1% (consensus 1.9%) from 1.9% in the advance estimate. As for trade, Trump said the U.S. and China are in the “final throes of a very important deal.”

U.S. Treasuries ended the session on a lower note, sending yields higher across the curve. The 2-yr yield and the 10-yr yield both increased three basis points each to 1.62% and 1.77%, respectively. The U.S. Dollar Index increased 0.12% to 98.37. WTI crude declined 0.5%, or $0.30, to $58.11/bbl.

STOCK MARKET WRAP

S&P500, +0.42%, 3,153.63

Nasdaq, +0.66%, 8,705.17

Nikkei Futures, +0.36%, 23,463.0

It was a steady, broad-based advance that was reflected across gains in ten of the 11 S&P 500 sectors, most notably in the consumer discretionary sector (+0.8%). Sentiment on trade and the economy remained upbeat following mostly positive economic reports and some trade comments from Trump.

Trading volume was understandably lighter than usual before the holiday, but that shouldn’t take away from the bullish narrative propelling stocks higher. Some of the market’s most familiar, and widely-owned, stocks in Apple (AAPL 267.84, +3.55, +1.3%), Amazon (AMZN 1818.51, +21.57, +1.2%), and Facebook (FB 202.00, +3.03, +1.5%) saw increased buying interest.

The S&P 500 industrials sector (-0.2%) was the lone holdout today amid losses in Boeing (BA 368.00, -5.51, -1.5%) and Deere (DE 169.06, -7.59, -4.3%). Boeing was pressured by news that the FAA will take control in re-certifying the airworthiness of each 737 MAX plane. In Deere’s case, its cautious FY20 guidance outweighed its revenue beat.