WHAT HAPPENED YESTERDAY

As of Wed 26 Feb, Singapore Time zone UTC+8

FX

U.S. Dollar Index, -0.37%, 99.00

USDJPY, -0.38%, $110.29

EURUSD, +0.23%, $1.0879

GBPUSD, +0.57%, $1.3003

USDCAD, -0.10%, $1.3281

AUDUSD, +0.01%, $0.6605

NZDUSD, -0.27%, $0.6322

STOCK INDICES

S&P500, -3.03%, 3,128.21

Dow Jones, -3.15%, 27,081.36

Nasdaq, -2.77%, 8,965.61

Nikkei Futures, -0.18%, 22,315.0

COMMODITIES

Gold Futures, -1.84%, 1,641.60

Brent Oil Futures, -3.55%, 54.30

SUMMARY:

FX market again became a side-show as global equity markets continued to slide. The breakdown in correlations is likely a sign of positions reducing and deleveraging by various market participants in the light of heightened uncertainty. Though equity indices sold off steadily throughout the day, Gold could not make any headway and in fact, was down almost 2% on the day.

Stocks sold off again on Tuesday, as the global spread of Covid-19 continued to undermine growth expectations and exacerbate the flight for safety in Treasuries. The Nasdaq Composite (-2.77%) turned negative for the year while the S&P 500 (-3.03%), Dow Jones Industrial Average (-3.15%), and Russell 2000 (-3.5%) dropped at least 3.0%.

CDC officials warned that the spread of the COVID-19 in the U.S. appears inevitable, but the HHS said the immediate risk is low. NEC Director Kudlow tried to ease nerves by telling CNBC that the U.S. has contained the virus “pretty close to air-tight,” but the market didn’t care much for optimistic views.

Fed Vice Chair Clarida provided a pragmatic view, reiterating that it’s still too early to assess the growth impact from the COVID-19, or whether it will lead to a material change in its outlook, but the market didn’t care for pragmatism, either. Companies, after all, continued to provide warnings due to the virus, leading investors to believe the impact could be worse than expected.

Elsewhere, the rally in U.S. Treasuries persisted amid the underlying growth concerns. The 2-yr yield fell six basis points to 1.20%, and the 10-yr yield fell five basis points 1.33% after setting a record low at 1.31%. The U.S. Dollar Index fell 0.37% to 99.00. WTI crude fell back below $50 per barrel, closing the session down 2.7%, or $1.36, at $49.89/bbl.

U.S. BRACES FOR COVID-19 SPREAD

The United States told Americans on Tuesday to begin preparing for COVID-19 to spread within the country as outbreaks in Iran, South Korea, and Italy escalated and fears that the epidemic would hurt global growth rattled markets. U.S. Health and Human Services Secretary Alex Azar on Tuesday asked a Senate sub-committee to approve $2.5 billion in funding to expand surveillance systems for the virus, help the development of vaccines and boost stockpiles of protective equipment.

IMPACT: While saying the immediate risk from COVID-19 in the United States remained low, a top CDC official, Dr. Anne Schuchat, said it was no longer a question of if the virus would become a global pandemic. “It’s a question of when and how many people will be infected.” The Dow and S&P 500 tumbled 3% on Tuesday in their fourth straight day of losses as investors struggled to gauge the virus’ economic impact. If cases in North America rise, we should see a deeper correction in risk assets.

EU FORESEES HARD TALKS WITH UK ON FUTURE TIES

The European Union said on Tuesday talks on post-Brexit ties with Britain would kick off next Monday, but warned that the process would be “very hard” and could fail if London fails to secure the Irish border as previously agreed. With both sides talking tough ahead of the negotiations, Ireland warned that even a basic trade deal would be impossible by the end of this year if London does not honor border obligations under its exit deal.

IMPACT: British exports to the European Union could fall by as much as 14% if the two sides are unable to strike a free trade deal and could be 9% lower even if an agreement is reached, a United Nations study found. The imposition of tariffs under a no-deal scenario would crimp trade, with the effect amplified by so-called non-tariff measures (NTMs) such as quotas, licensing and regulatory measures protecting health, safety and the environment. Sterling volatility will remain elevated throughout this period and there is little edge in trying to speculate the eventual outcome.

U.S. AIRLINES, HOTELS EXTEND REBOOKING OPTIONS AS COVID-19 SPREADS

Delta Air Lines Inc said that reservations through March 2 on flights to Bologna, Milan, and Venice in northern Italy, where cases have climbed, are eligible for rescheduling. Air Canada has also added parts of Italy to its list of places eligible for rebookings. Hyatt Hotels said it would allow travellers from South Korea, Japan, and Italy to cancel or change their hotel bookings for free, updating a policy it has already rolled out for guests from mainland China, Hong Kong, Macau, and Taiwan.

Major airlines have also issued travel waivers, eliminating change fees, for flights to South Korea. So far U.S. airlines have only cancelled flights to China, a move that followed the U.S. State Department’s decision to elevate a travel advisory to the country to the same level as Afghanistan and Iraq.

IMPACT: American Airlines shares dropped 9.3% to $23.12 on Tuesday, below their price after the company emerged from Chapter 11 bankruptcy in 2013. The broader Dow Jones U.S. airline index lost 7%. Transport, Supply Chain dependent companies, and Consumerism will continue to bear the brunt of the damage as COVID-19 case counts increase.

DAY AHEAD

Australia’s capital expenditure print due tomorrow should provide some indication as to what to expect from Q4 GDP numbers due next week. It’s likely capital spending will have risen for the first time in a year in the December quarter, but given the new headwinds – the COVID-19 outbreak and the bushfires – facing the Australian economy in 2020, the data may not matter much for investors as panic grips the markets.

Any negative surprises in the numbers would likely raise fresh doubts about the robustness of the Australian economy, which is struggling to regain momentum as growth in China – Australia’s biggest trading partner – goes into low gear. They would also push up market expectations of interest rate cuts by the RBA. Investors are currently not pricing a full 25-basis point rate reduction before August, but weak data might change that, bringing the timing forward and dragging the Aussie lower.

The primary driver of markets will again be statistics on the spread of COVID-19. Data points that are considered information about the economy before the start of the COVID-19 outbreak will largely be ignored especially if they are on the stronger side (unless they are extreme outliers) as the fundamental outlook has changed substantially.

SENTIMENT

OVERALL SENTIMENT:

Sentiment continues to sour. The COVID-19 will continue to spread. Though the market may get desensitized to an increasing number of cases in time, infections occurring in new countries weaken confidence further. The economic consequences are yet to be fully appreciated.

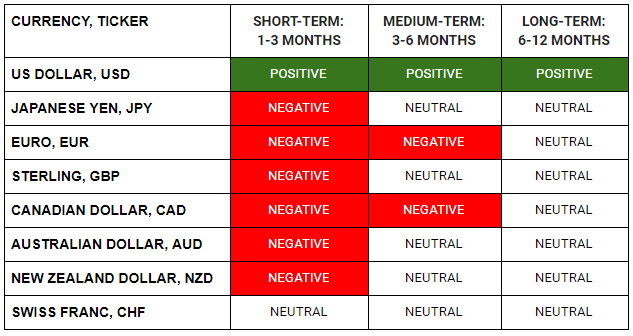

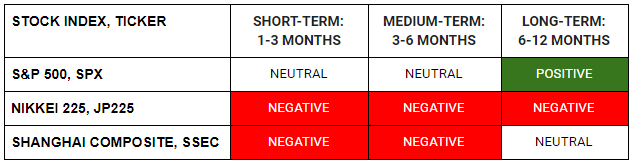

FX

MARKETS

TRADING TIP

Keep it Simple!

It is a mantra that should be remembered if one is to not only survive but thrive in volatile markets. In times of extreme volatility and heightened uncertainty, risk positions should be kept simple. These are not times, to try to be cute and structure complicated trades that depend on many variables to perform.

Keep doing what works, and get out of those which don’t, and avoid trades you don’t understand. There will be many opportunities, and now is not the time to try to be involved in everything.

Keep to your core competencies (eg. keep your trades to the markets you are familiar with), and keep it simple!