Notable Moves

- U.S. JOLTS Job Openings at 7.01M vs expected 7.09M. Japanese Household Spending y/y at -1.6% vs expected 1.6%. U.S. Treasury yields inched higher with the 2-yr yield adding two basis points to 2.92% and the 10-yr yield increasing one basis point to 3.21%. In midterm elections, results will not be made clear until the early hours (EST), most polls show the Democrats regaining control of the House, while Republicans are expected to retain majority control of the Senate. USDJPY up 0.13%, $113.34.

- German Final Services PMI at 54.7 vs expected 53.6. E.U. Final Services PMI at 53.7 vs expected 53.3. Euro up 0.30%, $1.1441. In Brexit, the Times reported that the Union is preparing to offer an “independent mechanism” which allows Britain to end a temporary customs arrangement with the bloc. While not a final solution, it will be enough to break the stalemate in negotiations, and grant a deal split by March next year. Sterling up 0.55%, $1.3114.

- RBA shrugs off falling house prices, weak inflation to keep rates on hold at 1.5% (expected). On the flip side of weak inflation and falling house prices, the jobs market remains strong with the unemployment rate falling to 5%, the lowest level since early 2012, and the economy is growing in line with the RBA’s forecasts. The RBA retained an upbeat stance in its post decision statement noting: “Forecasts for economic growth in 2018 and 2019 have been revised up a little.” Aussie up 0.44%, $0.7243.

- N.Z. Employment Change q/q at 1.1% vs expected 0.5%. Unemployment Rate at 3.9% vs expected 4.5%. The fall was completely unexpected by economists, who had generally been forecasting a figure of about 4.5% and inevitably there will be questions as to whether this is a ‘rogue’ result, though Stats NZ has immediately defended the veracity of the data, saying they are “confident” of the result and by stating that large changes in the rate – both up and down – have occurred before, while labour market figures tend to lag other economic indicators. The number was particularly impressive because the participation rate rose 0.2% QoQ to 71.1 percent in the September quarter. Kiwi up 1.17%, $0.6740..

- S&P 500 up 0.63%, 2,755.45. Nasdaq up 0.75%, 6,988.85. Nikkei up 1.14%, 22,147.75.

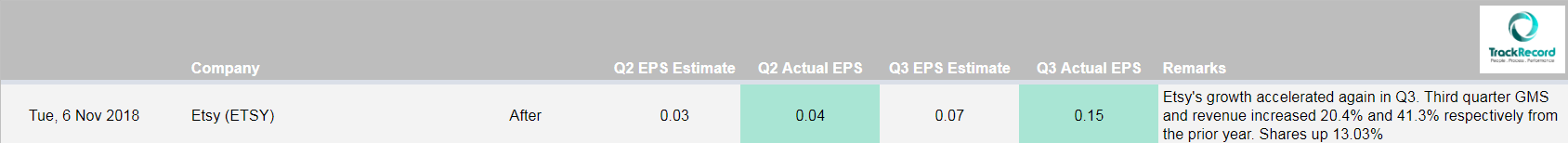

- In earnings, results were mostly positive with CVS (CVS 77.90, +4.21) climbing 5.7% after it reported above-consensus profits. Eli Lilly (LLY 105.90, -4.24) also beat earnings estimates but lost -3.9%, while Booking Holdings (BKNG 1949.46, +78.34) gained 4.2% despite missing earnings estimates. Booking’s results were above its prior guidance, though. Health care company Mylan N.V. (MYL 36.43, +5.06) after it surged 16.1% after it reported better-than-expected earnings.

- WTI crude dropped -1.5% to settle at $62.19/bbl after Trump granted temporary waivers on Monday to eight countries that import oil from Iran. The decision fueled an already weakening oil market that has seen crude prices decline nearly -20.0% from its recent four-year high in October. Despite the drop in crude, the oil-sensitive energy sector ticked higher by 0.3%, although it was down as much as -0.8% intraday.

BLOCKCHAIN & CRYPTOCURRENCY NEWS

After ‘Negligible’ Mining-Related Sales, AMD Launches 8 New ‘Blockchain Compute Solutions’

AMD, a California-based semiconductor manufacturer, has partnered with seven major tech companies to produce eight new cryptocurrency mining rigs. the firm has partnered with Sapphire, ASROCK, ASUS, MSI, Biostar, TUL and Rajintek to issue eight different rigs boasting “Ultimate stability,” “24/7 performance” and “Enterprise-level quality.” The price for the equipment has not yet been specified at press time. According to AMD’s notice, partnership will bring new blockchain compute solutions to the market, designed to meet the various aspirations of “innovative blockchain platforms.” The move comes just a week after AMD released its third quarter 2018 financial report, where the company stated that the “blockchain-related GPU sales in the third quarter were negligible.

Deloitte Partners With Startup for Gov’t-Level Blockchain Identity Management

“Big Four” accounting firm Deloitte has partnered with identity management company Attest Inc. to develop a blockchain-based digital identity system. The collaboration will purportedly develop a digital identity offering for government-compliant identifiers that can be used by Deloitte’s clients based on Attest’s existing products. The first product, Attest Wallet, is a cryptographically secured identity storage like a cryptocurrency wallet and it will reportedly enable users to store digital versions of government and business IDs in one place and control access to stored information. The second solution is called Attest Enterprise and comprises two application programming interfaces (APIs), which allow users to verify their identity, authorize third parties and provide consent to others to manage their data on their behalf.

Thai Revenue Department to Track Tax Payments Using Blockchain

The Thai Revenue Department has revealed its plans to track tax payments using blockchain and maсhine learning and the blockchain will be used to verify the validity of taxes paid and to speed up the tax refund process. Machine learning, in its turn, will help reveal tax fraud and create more transparency. Ekniti Nitithanprapas, the Revenue Department’s director-general who has also been International Economic Advisor of Fiscal Policy Office for the country’s Ministry of Finance since 2015, did not reveal when exactly the Department’s experiment with blockchain was going to start or which particular solutions it would use. Allegedly, blockchain feasibility studies would refer to processing digital IDs, IP registration management, and security, along with smart contracts.