- China-US With tensions now ebbing, and Trump looking to be in a deal-making mood, expect developments to be positive, at least until after China’s 1 Oct celebrations.

- US The Federal Reserve is expected to cut by 25bp (Wed, Thu). With the cut fully priced in, focus will be on the updated economic projections and the dot plot. Market pricing continues to be more dovish than Fed projections and comments. With the recent retracement of more than 40bp in the US 10-year govt yield off the lows, unexpected hawkishness from the Fed will lead to strong market reactions in the USD and bond markets, and likely angry Trump tweets.

- JPY BoJ is expected to keep policy unchanged (Thu) but they may do something to address the flat yield curve which is increasingly worrying them.

- GBP BoE is not expected to change policy (Thu) as Brexit drags on. The confusion that is Brexit continues with PM Boris Johnson now facing a challenge in Supreme Court that his prorogation of the Parliament is illegal. The govt has said that it will abide by the Supreme Court decision.

- CHF SNB meets (Thu) and although no change is expected, there is an outside chance of a surprise given ECB’s decision last week. However, with CHF not coming under unexpectedly strong appreciation pressure for now, they should be in no hurry to act.

- Macro US equity market continues to probe higher with all-time highs within reach as the trade war rhetoric dials down further. Continue to favour carry trades which have been beat up in recent months. Market remains under-invested and the asymmetric risk reward profile of risk-seeking trades (where good news causes a bigger reaction than bad news for now) is clearly demonstrated by the currency market’s tepid reaction to an almost 20% price surge due to the attacks in Saudi.

- China-US Trade tensions eased further as Trump announced a delay in the tariff increase on US$250 billion of Chinese imports from 1 Oct to 15 Oct, as a “gesture of goodwill” at the request of China because 1 Oct marks the 70th anniversary of the People’s Republic of China. Trump also tweeted that China is expected to buy large amounts of US agricultural goods soon.

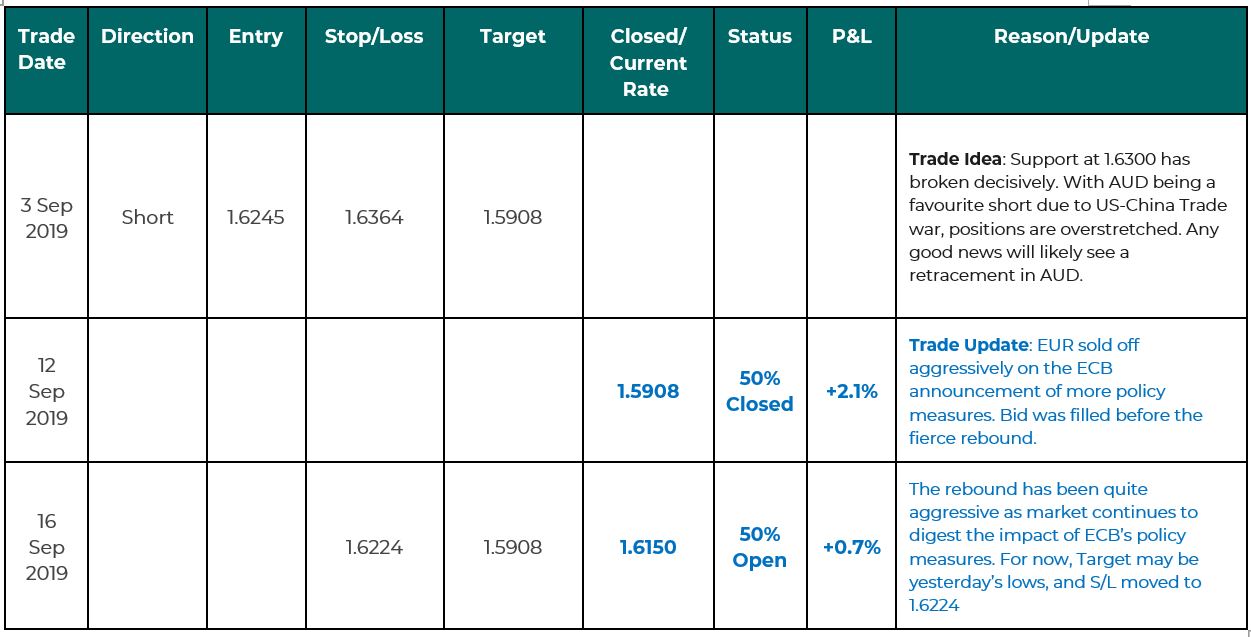

- EUR The ECB rolled out more stimulus measures in Draghi’s final meeting as the governor. The measures were 1) 10bp cut in deposit rate to -0.5% 2) Stronger forward guidance for keeping rates low 3) Resumption of QE with open-ended bond purchase of EUR20 billion/month 4) Improved conditions of TLTRO, removing the 10bp spread and extending maturity from 2 to 3 years. 5) Introduced a 2-tier reserve system which where the first tier would exempt up to 6 times minimum reserve holdings from the punitive -0.5% and charged instead at 0%. The tiering is effectively a rate hike on some banks in the core countries, as pointed out in the intra-week update, and will help banks’ profitability. The key message from ECB was that govts which are able to will now need to pull their weight by introducing more fiscal stimulus as monetary policy may now be at its limits. EUR bounced off the lows of 1.09 levels aggressively as market digested the confusing ECB policy measures. Headlines that Germany is considering a “shadow budget” which aim to increase public investments beyond the restrictions of national debt rules helped support the EUR later in the week too.

- US CPI data was a mixed bag with headline inflation a touch lower than expected at +1.7% YoY (exp 1.8%) and the core measure 0.1% higher than expected at +2.4% YoY (vs exp 2.3%). Retail Sales which grew 0.4% MoM (vs exp +0.2% and previous month revised 0.1% higher at 0.8%) continue to show a robust economy.

- Oil Saudi Arabia had half of its oil production capacity (5% of global supply) taken out as suspected drone attacks hit its production facilities over the weekend. While Yemen’s Houthi rebels have claimed responsibility, the US Secretary of State, Pompeo, pinned the blame on Iran via a few tweets without providing evidence. Oil prices shot up on Mon open with Brent crude up nearly 20%, hitting more than $71, but has since given up more than half its gains to settle around $64.50 as news that production facilities will be brought back online within the next few days. Trump has said that the SPR has been authorised to help temper any price rise due to this attack. The FX market reacted pretty tamely with AUDJPY down less than 1% at its lowest and has spend the day recouping the loss.

Trades in our portfolio

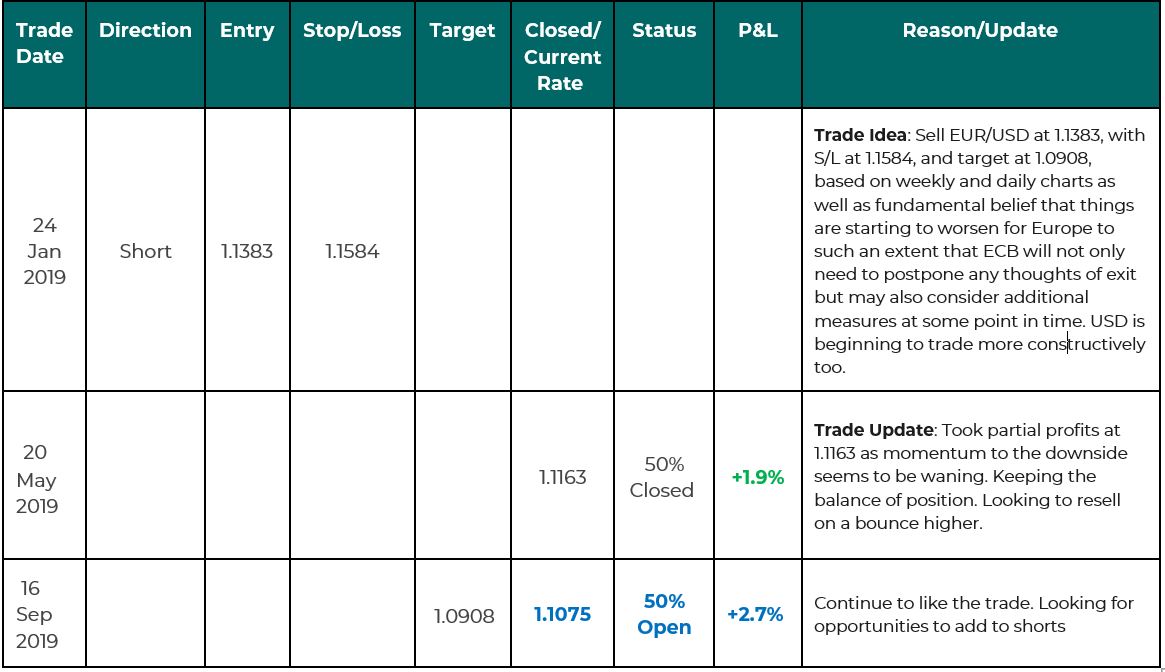

1) Short EUR/USD : Currently +3.3% (Alpha of [4.6%/2] + Carry of 1.0%)

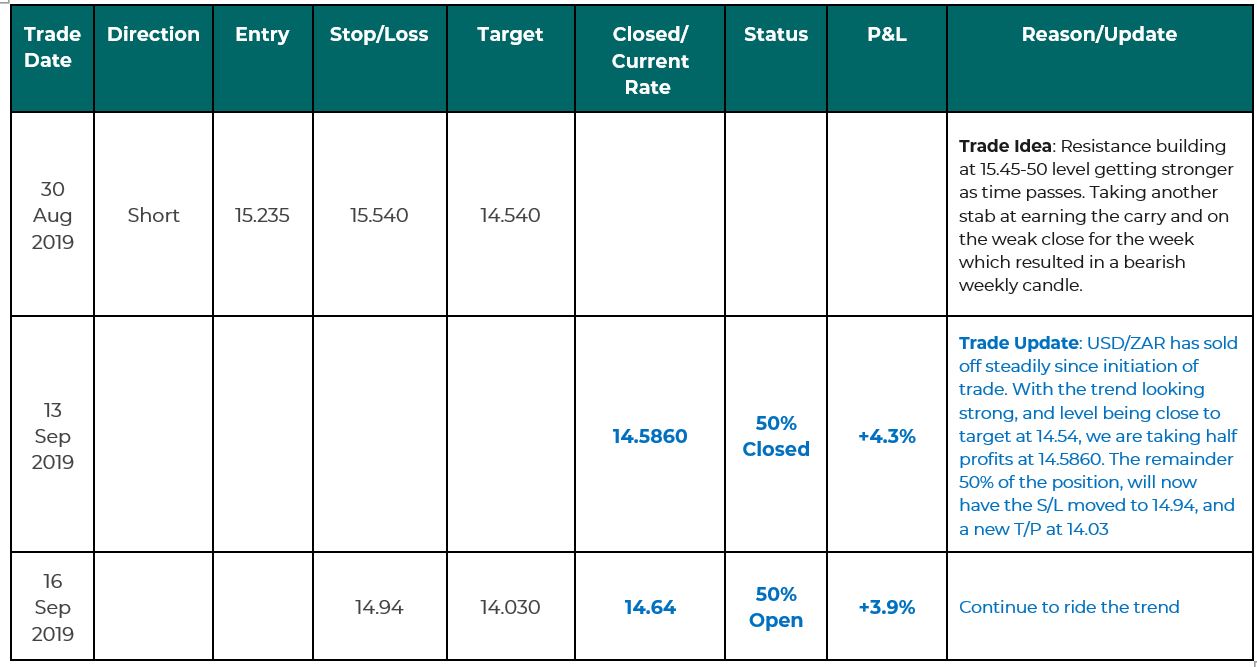

2) Short USD/ZAR : Currently +4.2% (Alpha of [8.2%/2] + Carry of 0.1%)

3) Short EUR/AUD : Currently +1.4% (Alpha of [2.8%/2] + Carry of 0%)

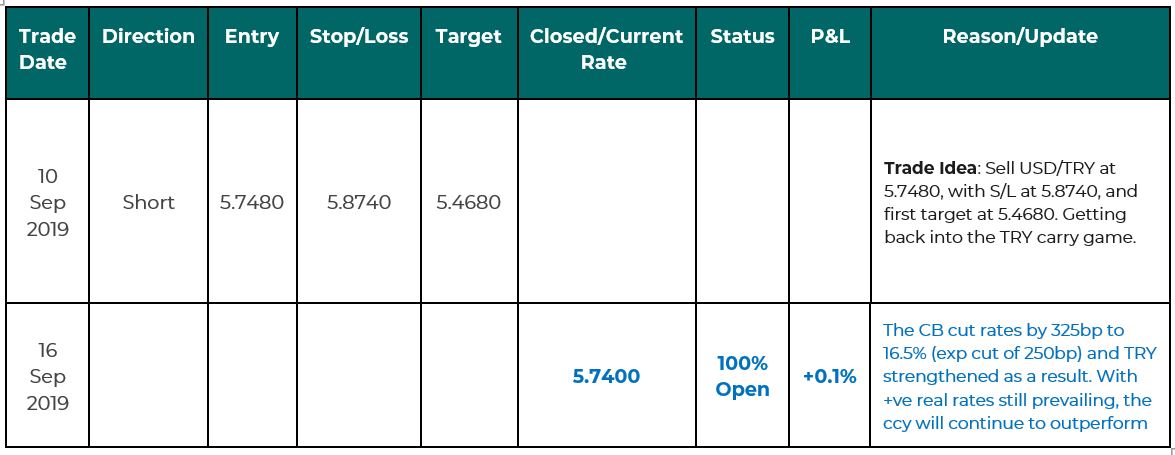

4) Short USD/TRY: Currently +0.3% (Alpha of 0.1% + Carry of 0.2%)

USD/ZAR Daily Candlesticks & Ichimoku Chart – SHORT

30 Aug: New Trade: Sell USD/ZAR at 15.235, with S/L at 15.54, and T/P at 14.54. Resistance building at 15.45-50 level getting stronger as time passes. Taking another stab at earning the carry and anticipating a weak close for the week will result in a bearish weekly candle.

13 Sep: Trade Update: USD/ZAR has sold off steadily since initiation of trade. With the trend looking strong, and level being close to target at 14.54, we are taking half profits at 14.5860. The remainder 50% of the position will now have the S/L moved to 14.94, and a new T/P at 14.03.

More weakness will lead to a close below the daily ichimoku cloud and we will be looking to sell into rallies should that happen.

Monday (16 September 2019) |

Prev |

Exp |

Remarks |

||

|

10:00 AM |

CNY |

Fixed Asset Investment (YTD) YoY AUG |

5.7% |

5.6% |

Act 5.5% |

|

10:00 AM |

CNY |

Industrial Production YoY AUG |

4.8% |

5.2% |

Act 4.4% |

|

10:00 AM |

CNY |

Retail Sales YoY AUG |

7.6% |

7.9% |

Act 7.5% |

|

03:00 PM |

TRY |

Unemployment Rate JUN |

12.8% |

||

|

08:30 PM |

USD |

NY Empire State Manufacturing Index SEP |

4.8 |

4 |

|

Tuesday ( 17 September 2019) |

Prev |

Exp |

Remarks |

||

|

9:30 AM |

AUD |

RBA Meeting Minutes |

|||

|

9:30 AM |

AUD |

House Price Index YoY Q2 |

-7.4% |

||

|

9:30 AM |

CNY |

House Price Index YoY AUG |

9.7% |

||

|

5:00 PM |

EUR |

ZEW Economic Sentiment Index SEP |

-43.6 |

||

|

5:00 PM |

DEM |

ZEW Economic Sentiment Index SEP |

-44.1 |

||

|

5:00 PM |

DEM |

ZEW Current Conditions SEP |

-13.5 |

-16 |

|

|

9:15 PM |

USD |

Industrial Production YoY AUG |

0.5% |

||

|

10:00 PM |

USD |

NAHB Housing Market Index SEP |

66 |

66 |

|

Wednesday (18 September 2019) |

Prev |

Exp |

Remarks |

||

|

6:45 AM |

NZD |

Current Account Q2 |

NZ$0.68B |

NZ$-1.117B |

|

|

7:50 AM |

JPY |

Balance of Trade AUG |

¥-249.6B |

¥-355.9B |

|

|

7:50 AM |

JPY |

Exports YoY AUG |

-1.6% |

-10.9% |

|

|

4:00 PM |

SAR |

Inflation Rate YoY AUG |

4% |

4.3% |

|

|

4:30 PM |

GBP |

Inflation Rate YoY AUG |

2.1% |

1.9% |

|

|

4:30 PM |

GBP |

PPI Input YoY AUG |

1.3% |

-0.1% |

|

|

4:30 PM |

GBP |

Core Inflation Rate YoY AUG |

1.9% |

1.7% |

|

|

5:00 PM |

EUR |

Construction Output YoY JUL |

1% |

||

|

5:00 PM |

EUR |

Core Inflation Rate YoY Final AUG |

0.9% |

0.9% |

|

|

5:00 PM |

EUR |

Inflation Rate YoY Final AUG |

1% |

1% |

|

|

7:00 PM |

SAR |

Retail Sales YoY JUL |

2.4% |

2.3% |

|

|

8:30 PM |

CAD |

Inflation Rate YoY AUG |

2% |

2% |

|

|

8:30 PM |

CAD |

Core Inflation Rate YoY AUG |

2% |

||

|

8:30 PM |

USD |

Building Permits AUG |

1.336M |

1.3M |

|

|

8:30 PM |

USD |

Housing Starts AUG |

1.191M |

1.247M |

|

Thursday (19 September 2019) |

Prev |

Exp |

Remarks |

||

|

2:00 AM |

USD |

Fed Interest Rate Decision |

2.25% |

2% |

Market expects a 25bp cut |

|

2:00 AM |

USD |

FOMC Economic Projections |

USD could react strongly if Fed is unexpectedly hawkish |

||

|

6:45 AM |

NZD |

GDP Growth Rate YoY Q2 |

2.5% |

2% |

|

|

7:00 PM |

AUD |

Unemployment Rate AUG |

5.2% |

5.3% |

|

|

9:30 AM |

AUD |

RBA Bulletin |

|||

|

9:30 AM |

AUD |

Part Time Employment Chg AUG |

6.7K |

||

|

9:30 AM |

AUD |

Marginal Lending Rate |

0.25% |

||

|

9:30 AM |

AUD |

Employment Change AUG |

41.1K |

10K |

Outperformance will help AUD recover further |

|

8:30 PM |

AUD |

Full Time Employment Chg AUG |

34.5K |

||

|

11:00 AM |

JPY |

BoJ Interest Rate Decision |

-0.1% |

-0.1% |

No change expected but BoJ may address the increasingly flat yield curve |

|

12:30 PM |

JPY |

All Industry Activity Index MoM JUL |

-0.8% |

||

|

03:30 PM |

CHF |

SNB Interest Rate Decision |

-0.75% |

0.75% |

No change expected, but may surprise following ECB’s decision |

|

4:30 PM |

GBP |

Retail Sales ex Fuel YoY AUG |

2.9% |

2.6% |

|

|

4:30 PM |

GBP |

Retail Sales YoY AUG |

3.3% |

2.9% |

|

|

7:00 PM |

TRY |

MPC Meeting Summary |

|||

|

7:00 PM |

GBP |

BoE Quantitative Easing |

£435B |

£435B |

|

|

7:00 PM |

GBP |

MPC Meeting Minutes |

|||

|

7:00 PM |

GBP |

BoE Interest Rate Decision |

0.75% |

0.75% |

Should be no change as Brexit continues to take centerstage |

|

7:00 PM |

GBP |

BoE MPC Vote Cut |

0/9 |

0/9 |

|

|

7:00 PM |

GBP |

BoE MPC Vote Unchanged |

9/9 |

9/9 |

|

|

7:00 PM |

GBP |

BoE MPC Vote Hike |

0/9 |

0/9 |

|

|

8:30 PM |

CAD |

ADP Employment Change AUG |

73.7K |

||

|

8:30 PM |

USD |

Current Account Q2 |

$-130.4B |

$-127.5B |

|

|

8:30 PM |

USD |

Philadelphia Fed Manufacturing Index SEP |

16.8 |

11 |

|

|

9:00 PM |

SAR |

Interest Rate Decision |

6.5% |

6.5% |

|

Friday (20 September 2019) |

Prev |

Exp |

Remarks |

||

|

7:30 AM |

JPY |

Inflation Rate YoY AUG |

0.5% |

||

|

7:30 AM |

JPY |

Core Inflation Rate YoY AUG |

0.6% |

0.5% |

|

|

09:30 AM |

CNY |

Loan Prime Rate 1Y |

4.25% |

||

|

9:30 AM |

CNY |

Loan Prime Rate 5Y |

4.85% |

||

|

2:00 PM |

DEM |

PPI MoM AUG |

0.1% |

-0.2% |

|

|

3:00 PM |

TRY |

Consumer Confidence SEP |

58.3 |

1.3% |

|

|

7:00 PM |

GBP |

BoE Quarterly Bulletin |

|||

|

8:30 PM |

CAD |

Retail Sales MoM JUL |

0% |

0.6% |

|

|

10:00 PM |

EUR |

Consumer Confidence Flash SEP |

-7.1 |

-7.0 |

|