WHAT HAPPENED YESTERDAY

As of New York Close 6 Mar 2020,

FX

U.S. Dollar Index, -0.75%, 96.09

USDJPY, -0.81%, $105.31

EURUSD, +0.40%, $1.1286

GBPUSD, +0.73%, $1.3050

USDCAD, +0.13%, $1.3424

AUDUSD, +0.57%, $0.6652

NZDUSD, +0.84%, $0.6357

STOCK INDICES

S&P500, -1.71%, 2,972.37

Dow Jones, -0.98%, 25,864.78

Nasdaq, -1.87%, 8,575.62

Nikkei Futures, -3.09%, 20,710.0

COMMODITIES

Gold Futures, +0.26%, 1,672.40

Brent Oil Futures, -9.44%, 45.27

SUMMARY:

FX markets continue to trade in risk aversion mode. JPY remains the currency of choice as investors seek refuge in times of uncertainty. USDJPY gapped lower more than 1.5% to hit a low of 103.50 in early Asian hours due to the relentless flow of bad news over the weekend.

The stock market ended a volatile week on a lower note with the S&P 500 (-1.71%) settling just above its low from Monday, Nasdaq (-1.87%) and Dow Jones (-0.89%). Expectations for another sharp rate cut remain in place with the fed funds futures market pointing to a 56.0% implied likelihood of a 75-basis point rate cut at or before the conclusion of the FOMC meeting on March 18.

Bank stocks suffered from the drop in Treasury yields while energy companies struggled as oil fell 9.44%, to $45.27/bbl. The energy component ended the day at its lowest level since mid-2016 after OPEC+ could not agree to a sharp production cut despite previous day’s reports to the contrary. Russia’s Energy Minister, Alexander Novak, said that OPEC+ countries are free to pump at will starting from April 1.

In retaliation, the world’s largest oil exporter engaged in an all-out price war on Saturday by slashing pricing for its crude by the most in more than 30 years. State energy giant Saudi Aramco is offering unprecedented discounts in Asia, Europe, and the U.S. to entice refiners to use Saudi crude.

U.S. 10yr Yields and U.S. 2yr Yields are down 25bp and 20bp (from NY close) in early Asian session due to all the bad news over the weekend and the gap down of nearly 4% in S&P futures .

U.S. JOBS NUMBERS

The US economy added 273,000 jobs (consensus 175,000) in February, far more than expected, and the unemployment rate returned to a 50-year low in a sign of recent strength as the world’s largest economy eyed the domestic spread of Covid-19.

The unemployment rate eased back to 3.5% (consensus 3.6%), a 50-year low, having ticked up slightly last month.

Speaking to reporters from the White House, Donald Trump said that people were “shocked” at how good the jobs numbers were. Larry Kudlow, the president’s chief economic adviser, appeared on CNBC to underline the administration’s economic approach to the virus: robust growth will need few interventions.

IMPACT: US stocks were not reassured. The S&P 500 sold off for a second straight day, down 1.7%, as stocks around the globe tumbled and government bond prices raced to historic highs. The fallout from China’s sharp downturn and the changes in US firms and households’ behaviour in response to the Covid-19 outbreak — including reduced travel — will doubtless take a toll on the service sector and broader US economic activity from March.

RUSSIA BREAKS OPEC OIL ALLIANCE

The three-year partnership that joined geopolitical rivals and halted the biggest crude price crash in a generation hit the buffers on Friday when Saudi Arabia-led OPEC and Russia failed to agree on deeper production cuts in response to the spread of Covid-19 that has hit the global economy and its demand for oil.

Russia’s view that rival North American producers would gain most from new efforts to prop up prices killed the deal, said people familiar with the negotiations. Saudi Arabia, unwilling to take on more cuts without Russia as a partner, launched a price war on Saturday (see below).

IMPACT: Brent crude, down about 30% since January, slumped a further 9% to $45 a barrel on Friday after Russian energy minister Alexander Novak said producers would soon be able to pump at will, ending three years of supply cuts designed to support prices. The impact on the oil price from the collapse of the Vienna negotiations could be severe, said analysts, with some predicting a drop to below $30 a barrel. Russia is not a member of OPEC but now holds huge sway over oil policy after joining the cartel in making production cuts three years ago.

IN RETALIATION, SAUDIS PLAN BIG OIL OUTPUT HIKE, BEGINNING ALL-OUT PRICE WAR

Saudi Arabia plans to boost oil output next month to well above 10 million barrels a day, as the kingdom responds aggressively to the collapse of its OPEC+ alliance with Russia. The world’s largest oil exporter engaged in an all-out price war on Saturday by slashing pricing for its crude by the most in more than 30 years. State energy giant Saudi Aramco is offering unprecedented discounts in Asia, Europe, and the U.S. to entice refiners to use Saudi crude.

IMPACT: The company’s shares plunged 9% in Riyadh on Sunday, the first time the stock slumped below its initial offering price. Aramco traded at 29.95 riyals, giving it a market value of 6 trillion riyals ($1.6 trillion). The Saudi government sold 1.5% of the energy giant’s shares at 32 riyals each in December.

The Saudi strategy could be an attempt to impose maximum pain in the quickest possible way to Russia and other producers, in an effort to bring them back to the negotiating table, and then quickly reverse the production surge and start cutting output if a deal is achieved. In a sign that both sides remain in talks, the OPEC+ Joint Technical Committee(JTC), a body of senior oil officials who advise ministers, plans to meet on March 18 to review the global oil market, according to delegates. Saudi and Russian officials are part of the JTC.

ITALY ORDERS LOCKDOWN ON COVID-19 SPIKES, 16 MILLION AFFECTED

Italy ordered a virtual lockdown across much of its wealthy north, including the financial capital Milan, in a drastic new attempt to try to contain an outbreak of Covid-19 that saw the number of deaths leap again sharply on Sunday. The new measures say people should not enter or leave Lombardy, Italy’s richest region, as well as 14 provinces in four other regions, including the cities of Venice, Modena, Parma, Piacenza, Reggio Emilia, and Rimini.

Italy has been hit harder by the crisis than anywhere else in Europe so far and Sunday’s latest figures showed that starkly. The number of coronavirus cases jumped 25% in a 24-hour period to 7,375, while deaths climbed 57% to 366 deaths. It was the largest daily increase for both readings since the contagion came to light on Feb. 21.

IMPACT: If containment in Italy fails and the virus spreads to the rest of Europe and manufacturing powerhouse Germany, another domino in the global supply chain and linchpin of Europe will fall, bringing the EU deeper into contraction territory and closer to fiscal measures.

DAY AHEAD

Markets are starting the Asian session in the grips of risk aversion as Covid-19 continues to spread widely. Adding the oil price war to the mix is not helping matters.

The main event this week will be the European Central Bank (ECB) policy meeting, where markets are pricing in a 90% probability for a rate cut even though economists forecast no action. It’s a close call, but the fragmented ECB may opt for more targeted lending measures to shield the economy from the virus fallout, not a rate cut. There’s also a raft of economic data coming up, alongside the UK government budget. All told, markets will continue to dance to the tune of news about the virus.

SENTIMENT

OVERALL SENTIMENT:

Risk aversion rules. Market is running scared while policymakers, especially those working for the White House, try repeatedly to talk up the stock markets when they should be concentrating on containing the virus spread. The race of rates to negative continues and rallies in asset markets will be sold.

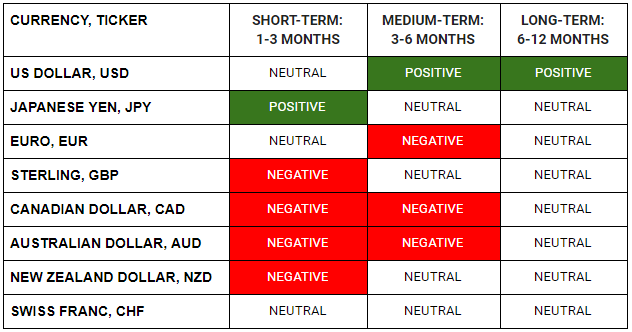

FX

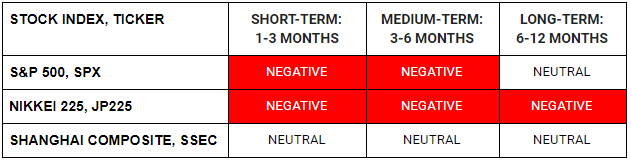

STOCK INDICES

TRADING TIP

Remove Hope and Fear

This was the piece of trading advice that my trading mentor gave me early on in my career. He was the head of trading at JPM Seoul at the height of the Asian crisis and made hundreds of millions of USD for the bank in those days of crazy volatility.

In times of “abnormal market’ moves, many of us will find it hard to be objective about what are the likely outcomes as our judgement will be swayed by hopes and clouded by fears. Markets are now both hoping for policymakers to come to the rescue, and fearing that anything they do will all be futile.

What are the facts of the current situation and what are the likely outcomes? Keep your hopes and fears out of this process, and it will be easier to find the clarity that you need.