WHAT HAPPENED YESTERDAY

As of Fri 6 Mar, Singapore Time zone UTC+8

FX

U.S. Dollar Index, -0.76%, 96.60

USDJPY, -1.18%, $106.26

EURUSD, +0.78%, $1.1223

GBPUSD, +0.60%, $1.2950

USDCAD, +0.05%, $1.3392

AUDUSD, -0.16%, $0.6617

NZDUSD, +0.22%, $0.6312

STOCK INDICES

S&P500, -3.39%, 3,023.94

Dow Jones, -3.58%, 26,121,28

Nasdaq, -3.10%, 8,738.59

Nikkei Futures, +1.09%, 21,329.12

COMMODITIES

Gold Futures, +1.96%, 1,675.25

Brent Oil Futures, -1.92%, 51.15

SUMMARY:

USD sold off almost 1.2% against the JPY as more bad news on the Covid-19 front spooked the market. Gold rose close to 2% as traders flocked to safety and risk aversion gripped the equity market once again. The trends are strong, don’t fight them.

A volatile week continued on Thursday as the major averages surrendered the entirety of their big gains from Wednesday, with the S&P 500 (-3.39%) sliding back below its 200-day moving average (3051), Dow Jones (-3.58%) and Nasdaq (-3.10%).

Equities started the day well below yesterday’s closing levels as sentiment remained pressured by the continued uncertainty associated with the spread of the Covid-19 virus. The first couple of hours of action saw a rebound attempt, which ran out of steam after the S&P 500 briefly climbed above its opening mark.

These growth concerns, along with a continuation of negative news flow, kept the market heading southward. Italy reported that the number of deaths among patients diagnosed with Covid-19 increased to 148 from 107 on Wednesday while British Prime Minister, Boris Johnson, has reportedly been advised to expect a significant spread of Covid-19 in the U.K. In the U.S., community spread cases of the virus were reported in New York and San Francisco.

U.S. 10yr yields fell 13.8 basis points and U.S. 2yr yields fell 9 basis points, as curve flattened.

CALIFORNIA DECLARES EMERGENCY OVER COVID-19 AS DEATH TOLL RISES IN U.S.

The U.S. death toll from coronavirus infections rose to 11 on Wednesday as new cases emerged around New York City and Los Angeles, while Seattle-area health officials discouraged social gatherings amid the nation’s largest outbreak.

The first California death from the virus was an elderly person in Placer County, near Sacramento, health officials said. The person had underlying health problems and likely had been exposed on a cruise ship voyage between San Francisco and Mexico last month. Hours after the person’s death was announced, California Governor Gavin Newsom declared a statewide emergency in response to the coronavirus, which he said has resulted in 53 cases across the nation’s most populous state.

IMPACT: Negative development of the virus in the western hemisphere is putting pressure on the S&P500. Since the S&P500 is a global barometer for capital market health, it is driving the recent volatility in risk appetite around the world. It’s interesting to note that Chinese markets have been relatively bid as the west struggles to keep itself buoyant.

JAPAN COMMITTED TO HOSTING OLYMPICS ON SCHEDULE

Japanese Prime Minister Shinzo Abe on Thursday ordered a two-week quarantine for all visitors from China and South Korea in response to the widening coronavirus crisis, and his government signaled that the Tokyo Olympics would go ahead as planned.

The rapid spread of the virus has raised questions about whether Tokyo can host the Olympics as scheduled from July 24, especially with the effect it is having on other sporting events. The Japanese Rugby Football Union has said next month’s Asia Sevens Invitational, which doubles as a test event for rugby sevens at the Tokyo Olympics, had been canceled due to concerns over the outbreak.

IMPACT: The decision to go ahead with the Olympics despite clear failure of containment in Japan may be the biggest healthcare hubris. The Olympics may be an inflection point that sparks an asymmetric spike in viral spread and this will dampen global risk sentiment as tourists and athletes around the world will be affected, resulting in a synchronised health scare impact.

WORK FROM HOME

EY (Ernst & Young) sends around 3,000 Madrid workers home after coronavirus case confirmed

- Accounting and consulting firm EY on Thursday sent around 3,000 employees from its offices in Madrid home after a case of Covid-19 was confirmed among its staff, a company spokesman told Reuters.

Amazon, Facebook ask Seattle employees to work from home over Covid-19 fears

- Amazon.com Inc and Facebook Inc on Thursday joined Microsoft Corp in recommending employees in the Seattle area to work from home after several people in the region were infected with the Covid-19. The companies’ work from home recommendation will affect more than 100,000 people in the Seattle area, as both Microsoft and Amazon employ over 50,000 each. Facebook has more than 5,000 employees in the area.

IMPACT: The global move to offsite work have and will continue to benefit companies like Zoom Video Communications, it’s a risk asset that is trading like a safe haven at this point in time, with the bonus of benefiting from easier monetary policy should the Fed decide to provide more stimulus. Zoom Video Communications Inc.‘s shares gained more than 7% yesterday, as analysts welcomed better-than-expected fourth-quarter earnings and forecast that the Covid-19 will drive demand for the company’s remote-work tools.

DAY AHEAD

Attention turns to the all-important nonfarm payrolls report later today. After a solid gain of 225k jobs in January, the US economy is projected to have added 178k jobs in February. This would represent a notable slowdown but nothing worrying just yet about the labour market. Average hourly earnings are forecast to have risen by 3.2% year-on-year, while the jobless rate is predicted to hold at 3.6%.

This number though does not really account for the full impact of the Covid-19 situation. However, if it should be much weaker than expected, sentiment will worsen even more dramatically.

SENTIMENT

OVERALL SENTIMENT:

No reprieve for the bulls as the bears returned in force. The news flow from the Covid-19 front will continue to get worse, while governments and central banks can only do what they have always done – open the fiscal pipes and cut rates/print money. This is still with mild revisions to economic forecasts. Imagine what happens when the cracks really start to show…

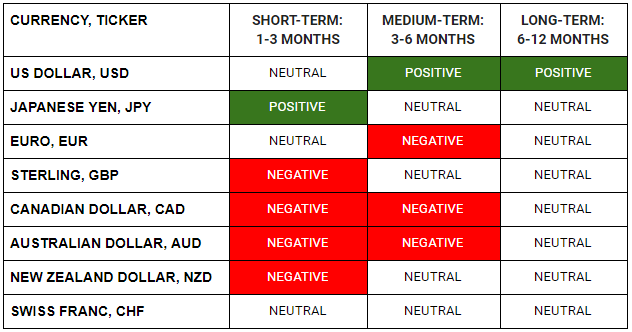

FX

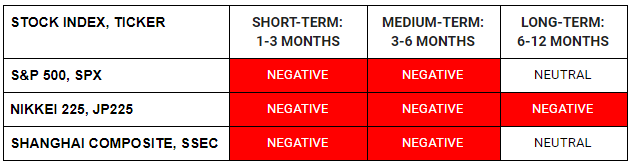

STOCK INDICES

TRADING TIP

Buy the Strong, Sell the Weak

This may sound obvious, but many are conditioned to do just the opposite, because the reference points they use for prices are what they can remember from recent history.

So, something that has come down 10% in price will seem cheap to them, and they are more likely to buy it than to sell it. This works if we are talking about a pack of candy in the supermarket.

If a stock is down 10%, the tendency of many is to say, “Ah, it’s come down so much, so I should buy some soon”. They will have it impossible to sell because they are always rueing the fact that they could have sold 10% higher.

In financial markets, the questions you need to ask first and foremost, is that, “Is the price move justified by a change of facts?” and “Is this change temporary or will it persist and continue to exert itself on prices?”

For example, if Covid-19 stays bad or worsen, can you imagine yourself going to cinemas to watch a movie or booking your family on a cruise anytime in the near future? Will you be getting more of your entertainment and more of your work done via the internet?

Ask yourself, what are the change of habits that are required and will likely persist? Multiply that by what hundreds of millions and billions of people will be doing and you can imagine who are the winners and the losers of the world that is to come.