WHAT HAPPENED YESTERDAY

As of New York Close 20 Mar 2020,

FX

U.S. Dollar Index, -0.16%, 102.82

USDJPY, +0.09%, $110.82

EURUSD, +0.38%, $1.0695

GBPUSD, +1.35%, $1.1643

USDCAD, -1.02%, $1.4365

AUDUSD, +0.99%, $0.5799

NZDUSD, +0.65%, $0.5710

STOCK INDICES

S&P500, -4.34%, 2,304,92

Dow Jones, -4.55%, 19,173.98

Nasdaq, -3.79%, 6,879.52

Nikkei Futures, -1.25%, 16,920.0

COMMODITIES

Gold Futures, +1.85%, 1,501,15

Brent Oil Futures, -5.23%, 26.98

SUMMARY:

The U.S. Dollar had some fatigue set in on Friday after a week of strong performance, allowing other currencies to recover some ground. In the midst of a global capitulation in both risk and safe-haven assets, the U.S. Dollar will continue to be favoured but the moves are unlikely to be as ferocious as much of the capitulation should be done. The rinse in Emerging Markets, however, should continue.

The Nasdaq futures hit limit up briefly during Asian hours, but the S&P 500 futures could not even breach the psychological level of 2498 (which was the limit up level during Asian hours on Tue which failed later on in the day). Stock market volatility as measured by the Vix index fell from 80+ to 57 during the morning session, signalling the market’s expectations that it was going to be an orderly and positive day for the stock market. However, that was not to be. An early rebound effort quickly turned into losses as investors continued to grapple with the persistent shutdown of the economy. California ordered residents to stay at home and not to go out except for essential needs, until further notice, but stocks started the day’s session on a higher note amid hopes for a rebound. It wasn’t until New York announced similar stay-at-home restrictions that optimism started to unravel, as it contributed to the notion that more states will follow suit to limit the spread of Covid-19.

The major indices sold off as the trading hours waned to close at the lows with the S&P 500 (-4.34%), Dow Jones Industrial Average (-4.55%), and Russell 2000 (-4.2%) declining more than 4.0%, while the Nasdaq Composite declined 3.79%. U.S. 2yr Yields fell 7bp and U.S. 10yr Yields fell 20bp.

The Fed remained active in trying to further support the financial system. On Friday, the Fed expanded its Money Market Mutual Fund Liquidity Facility (MMLF) to accept municipal debt and stepped up its purchases of Treasury and mortgage-backed securities. The New York Fed said it will now conduct two repo operations totaling $1 trillion for the rest of the month. The Fed also increased the frequency of its USD swap line arrangements with the other major central banks to daily from weekly operations. That should help the USD funding issues that have been plaguing the market. The Fed’s resolve is strong and they will do whatever it takes until the market normalises.

In early asian trading on Monday, US markets gapped lower (-2.04%) as Mnuchin’s $4 Trillion Covid-Bill was rejected and the unceasing flow of bad news on the Covid-19 front. Ongoing negotiations will take place today.

CHINA TO RAMP UP SPENDING TO REVIVE THE ECONOMY

China is set to unleash trillions of yuan of fiscal stimulus to revive an economy expected to shrink for the first time in four decades amid the Covid-19 pandemic, while a planned growth target is likely to be cut. The ramped-up spending will aim to spur infrastructure investment, backed by as much as 2.8 trillion yuan ($394 billion) of local government special bonds.

Beijing is targeting infrastructure investment as a recovery in consumption could be slowed by rising job losses, while exports could be hit as the global economy reels from the pandemic, policy sources said. Local governments will be allowed to issue more special bonds, which could hit 2.5-2.8 trillion yuan this year, compared with 2.15 trillion yuan in 2019. The government aims to speed up the construction of planned key infrastructure projects as well as to launch some new projects for public health, emergency materials supply, 5G networks and data centers that have been endorsed by top leaders.

IMPACT: As China recovers from Covid-19, a well timed and targeted fiscal stimulus package will be effective in jump starting the economy. China may be one of the first few economies to make a recovery, keep an eye on China A50 Futures for any abatement in selloffs.

$4 TRILLION COVID-19 AID BILL PROPOSED, BUT HITS A SNAG

The much-discussed fiscal stimulus went from 1 trillion to 2 and now the floated figure is US$4 trillion but this includes $2 trillion of loans that the Fed can make to inject liquidity into the system on the back of guarantees from the US Treasury. However, the Democratic party voted against it and a re-vote will be held on Mon morning 9.45 EST.

IMPACT: In a highly-leveraged system, if borders are closed & stores are closed, financial markets will be under stress and markets will likely become a source of cash, the world over. Everything would likely be sold for cash (even sovereign debt) until either a) Markets are closed for a time, or b) Monetary & fiscal authorities print “enough” money to stabilise the panic.

FED INCLUDES MUNICIPAL DEBT IN MONEY-MARKET LENDING BACKSTOP

The battered U.S. municipal bond market could get a limited boost from the Federal Reserve’s announcement it was expanding its money market support program to include short-term municipal debt as collateral, analysts said on Friday. Yields in the $3.8 trillion market where states, cities, schools and other issuers sell debt, have climbed dramatically amid a selling frenzy by investors scrambling for cash as Covid-19 fears wreak havoc on markets.

IMPACT: We might soon see the twin bazookas of the Fed buying enormous amounts of corporate bonds and TARP 2.0. The former effort is almost sure to materially bring down credit spreads (likely through some kind of deal with the Treasury to get around restrictions or perhaps with a special Congressional authorization) while the latter will save vital companies and industries from widespread bankruptcies, avoiding mass layoffs. Moreover, the government will be even better positioned (by firing both bazookas) to realize some gains on viable companies once the worst of Covid-19 passes. This will help fund all the transfer payments to individuals and small businesses being proposed.

DAY AHEAD

With not much on the economic calendar to enthuse markets this week, the virus and its impact on economies globally are likely to remain the primary driver of risk sentiment. Still, there are some important indicators worth keeping an eye on (i.e. Pace of Fed Balance Sheet Expansion, U.S. 2yr-10yr Spread, Size of Fiscal Package / Country’s GDP, Overnight Interbank Funding Rates). Overall, there’s little to suggest that the slide in equities is about to end though the policymakers will try their utmost to introduce measures to stabilise the market. Later today, there will be a teleconference call among the G20 policymakers.

SENTIMENT

OVERALL SENTIMENT:

As the US congress argues about the fiscal stimulus plan, the situation continues to worsen with the relentless spread of the Covid-19 virus across the US. The people that were exposed to the virus during the Super Tuesday US Presidential primaries for the Democratic party should be starting to show symptoms this week.

If even US Senator Rand Paul, who was tested positive for Covid-19 today, was gallivanting around, going to the gym and having lunches with other members of the Congress after knowing he might have been exposed to Covid-19, what can be expected of ordinary Joe?

It is bad, but this gets worse.

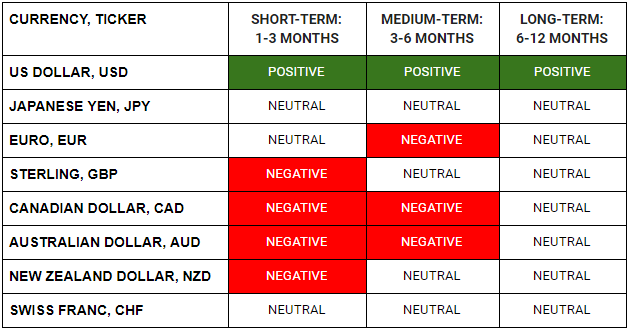

FX

STOCK INDICES

TRADING TIP

“This time, it is different…”

Of the many famous last words spoken in the financial markets, “This time, it is different” is likely one of the most spoken by traders at various junctures of their careers. However, that doesn’t mean it is never true.

Many market commentators and experts are still downplaying the economic consequences of this crisis as temporary and assume that there will soon be a V shaped recovery immediately after. Policy makers in the US are so focused on implementing fiscal policies to save the stock markets that the NY governor had to plead for coordination by the Federal government for a coherent response to containing the outbreak.

In addition to the freezing up of the credit markets, we are also witnessing the wholesale destruction of entire industries that depend on tourists and people gathering in groups to socialise. If this continues, and the likelihood is that it will, this time, indeed, it will be different.