WHAT HAPPENED YESTERDAY

As of New York Close 19 Mar 2020,

FX

U.S. Dollar Index, +1.80%, 102.99

USDJPY, +2.73%, $111.32

EURUSD, -2.64%, $1.0655

GBPUSD, -0.98%, $1.1494

USDCAD, +0.12%, $1.4502

AUDUSD, -0.84%, $0.5742

NZDUSD, -0.50%, $0.5685

STOCK INDICES

S&P500, +0.47%, 2,409.39

Dow Jones, +0.95%, 20,087.19

Nasdaq, +2.30%, 7,150.58

Nikkei Futures, +3.79%, 17,135.0

COMMODITIES

Gold Futures, -0.27%, 1,473.95

Brent Oil Futures, +12.90%, 28.09

SUMMARY:

Massive day of volatility in FX. AUD first went down more than 5%, bounced 8% from the lows and after inflicting pain on the shorts, fell almost 4% off the highs. Volatility is high, and both bulls and bears will not be spared if they are not adapted to the new trading regime. Adjust your trading sizes accordingly!

Dollar reigns supreme again and this trend will continue until governments get the virus under control and supply chain disruptions are figured out. The effect on the global economy is going to be protracted. Bear in mind that a strong Dollar is putting a lot of stress on emerging markets and this will feed into more elevated volatility later on in the cycle as EM economies capitulate under stress.

The S&P 500 advanced 0.47% on Thursday in a volatile session that saw the benchmark index fall as much as 3.3% in early action and gain as much as 2.9% in the afternoon. The Dow Jones Industrial Average rose 0.95%, while the Nasdaq Composite (+2.3%) and Russell 2000 (+6.8%) were the big movers today amid strong gains in technology and small-cap stocks. U.S. 2yr Yield fell 10bp to 0.44% and U.S. 10yr Yield fell 6bp to 1.12%.

The news cycle wasn’t entirely positive with the number of Covid-19 cases continuing to surge globally, leading more companies to withdraw guidance, suspend dividends, and temporarily lay off workers. The latter started to be quantified in the weekly initial claims, which increased by 70,000 to 281,000 (consensus 220,000) for the week ending March 14.

To mitigate the negative impact of Covid-19, central banks continued to ramp up stimulus efforts, Congress continued to deliberate on the proposed $1.3 trillion fiscal stimulus package, and clinical trials for new therapies remained in progress, according to Trump. The latest central bank moves included the Fed establishing a Money Market Mutual Fund Liquidity Facility (MMLF), the ECB and Bank of Japan announcing emergency bond-buying programs, and the Bank of England issuing a surprise rate cut and raising its daily asset purchases. Although not market-moving, there was an appreciation for the urgency to ease the intense strains on financial markets.

Oil prices were aided by comments from Trump, who said that he will get involved in the price war between Russia and Saudi Arabia at “the appropriate time.” An afternoon report from The Wall Street Journal noted that Texas is considering cutting oil production.

‘WHATEVER IS NECESSARY”, AUSTRALIA DIVES INTO QE / BOE SAYS WILL BUY GILTS AT PACE IN NEW STIMULUS / SWISS NATIONAL BANK BOOSTS FX INTERVENTIONS TO SLOW FRANC RISE

– RBA: Australia made a historic foray into quantitative easing on Thursday and said it would do “whatever is necessary” to ensure funding costs are low and credit is freely available as the coronavirus (Covid-19) pandemic jolts businesses. Following an out-of-schedule meeting, the Reserve Bank of Australia (RBA) reduced its cash rate (-25bp) to an all-time low of 0.25% and said the board would not tighten policy until it achieves its employment and inflation goals. It also set a target for the yield on three-year Australian government bonds at around 0.25%, which it plans to achieve by purchases in the secondary market beginning today. They also said that there was no limit to the purchase amount and it would be unsterilised (i.e. the AUD they use to pay for the bonds will be left in the system).

– BoE: The Bank of England said it would buy British government bonds at a much faster pace than normal in response to the Covid-19 outbreak, part of a major stimulus package it announced on Thursday. The BoE cut interest rates (-15bp) to 0.1% on Thursday, its second emergency rate cut in just over a week, and promised 200 billion pounds of additional bond purchases in a fresh attempt to shield Britain’s economy from the impact of the outbreak.

– SNB: The Swiss National Bank (SNB) said on Thursday it was stepping up its currency interventions to prevent the rise of the Swiss Franc, which the central bank said had become “even more highly valued” due to the coronavirus outbreak. The SNB kept its policy rate at -0.75% (as expected) and also maintained the interest rate it charges on overnight deposits it holds for commercial banks at -0.75%. The government, central bank and market supervisor are readying an aid package worth 40 billion to 100 billion Swiss francs ($103.33 billion) to help the economy deal with the fallout, the newspaper Tages-Anzeiger reported. The government, which has promised more steps by today, has already announced an aid package worth 10 billion francs, mostly for workers on short hours because of the spread of the virus.

IMPACT: More of the same pill with no positive effects to show for. Note that unsterilised QE that Australia is embarking on weakens currency in the long run but the AUD which has been battered over the last few sessions rallied as weak shorts were taken out when RBA also noted that they will intervene in the FX market if required.

COVID-19 DEATHS IN ITALY OVERTAKE CHINA AS ECONOMIC DAMAGE MOUNTS

The world’s richest nations poured unprecedented aid into the global economy on Thursday as Covid-19 cases ballooned in the new epicentre Europe, with the number of deaths in Italy outstripping those in mainland China, where the virus originated.

“This is a moment that demands coordinated, decisive, and innovative policy action from the world’s leading economies,” Guterres told reporters via a video conference. “We are in an unprecedented situation and the normal rules no longer apply.”

IMPACT: At least someone gets it, we are truly living in unprecedented times and until more politicians and leaders get around the fact that we need a whole new playbook, we are driving ourselves into the ground.

DAY AHEAD

U.S. Senate Majority Leader Mitch McConnell introduced emergency legislation to stem the economic fallout of the Covid-19 pandemic on Thursday and said Republicans were ready to meet their Democratic counterparts later today to seek an agreement. The $1 trillion-plus package will include direct financial help for Americans, relief for small businesses and their employees, steps to stabilize the economy, and new support for healthcare professionals and coronavirus patients, McConnell said.

SENTIMENT

OVERALL SENTIMENT:

The good news is we are going to bail out some companies and give you free money, but the bad news is many of your friends will get infected, some will be in need of critical care and a few might even die.

How do you feel about that?

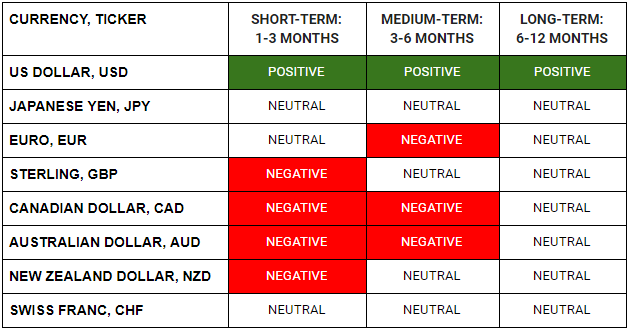

FX

STOCK INDICES

TRADING TIP

In order to Thrive, you need to first, Survive

The volatility we are seeing in the market is extremely high and is unprecedented. Some look at past history and say, “Ah ha! Volatility at these levels have always been the highs, so it must be a good sell!”

Sure, that works if there was ever a global pandemic with historical data for you to compare with. There are many opportunities in this market. Try not to lock yourself into trades with limited upside and unlimited downside.

Click to hear more about what I think about this crisis and what the future holds.