WHAT HAPPENED YESTERDAY

As of New York Close 18 Mar 2020,

FX

U.S. Dollar Index, +1.34%, 100.91

USDJPY, +0.63%, $108.37

EURUSD, -0.49%, $1.0943

GBPUSD, -3.69%, $1.1608

USDCAD, +1.99%, $1.4484

AUDUSD, -3.49%, $0.5791

NZDUSD, -3.73%, $0.5713

STOCK INDICES

S&P500, -5.18%, 2,398.10

Dow Jones, -6.30%, 19.898.92

Nasdaq, -4.70%, 6,989.84

Nikkei Futures, -1.68%, 16,726.55

COMMODITIES

Gold Futures, -1.68%, 1,500.15

Brent Oil Futures, -7.90%, 26.46

SUMMARY:

“Dollar Smile” (attached image below for explanation) effect is going to be a consistent theme as global economies capitulate and find respite in the “safest haven” and that is in cash. The Euro which also appeared to take on the role of a safe haven currency in the early innings of the meltdown is fast weakening against the Dollar. Despite promise of a large fiscal stimulus, the single-currency being unable to hold on to gains despite such unprecedented policies out of the Eurozone, is a sign that sentiment is rapidly changing towards all other currencies. When global central banks are all out in synchrony, the Dollar appears to be the cleanest dirty shirt in the basket.

The S&P 500 fell 5.18% on Wednesday, although it did drop as much as 9.8% intraday as pandemic fears continued to hit not only stocks but also Treasuries and commodities. Dow Jones Industrial Average (-6.3%), Nasdaq Composite (-4.7%) and Russell 2000 (-10.4%). US 2yr Yield rose 7bp to 0.54% and US 10yr Yield rose 16bp to 1.18%.

Despite the coordinated stimulus packages announced by central banks and the massive stimulus plans laid out by Washington, confidence was lacking due to the growing outbreak of COVID-19 and the continued shutdown of the economy. Shortly before the close, the Senate finally passed the House bill that provides unemployment and sick leave benefits.

As part of the proposed $1 trillion stimulus package, the Treasury Department clarified today it will seek $300 billion for small business interruption and a secured lending facility of $50 billion for airlines. Separately, the FHFA announced the suspension of foreclosures and evictions for 60 days for enterprise-backed mortgages.

New measures taken to contain the virus includes the closure of the U.S.-Canadian border for non-essential traffic and President Trump invoking the Defense Production Act, which gives the White House the right to require companies to manufacture medical supplies in short supply.

ECB TO GOBBLE UP 750 BILLION EUROS OF DEBT IN EMERGENCY MOVE TO COMBAT VIRUS HIT

The European Central Bank launched a 750 billion euro (US$820 billion) emergency bond purchase scheme after an unscheduled meeting on Wednesday, attempting to stem a spiraling economic and financial crisis.

“Extraordinary times require extraordinary action,” ECB President Christine Lagarde said. “There are no limits to our commitment to the euro. We are determined to use the full potential of our tools, within our mandate.” The bond purchases will continue until the “crisis phase” of the epidemic is over and non-financial commercial paper will also be included for the first time among eligible assets, the ECB said.

Although the ECB’s purchases will be done according to each country’s shareholder in the bank (the so-called capital key), the ECB said it will be flexible and may deviate from this rule, a hint that it will not tolerate a surge in yield spreads between eurozone members. The purchases will also include for the first time debt from Greece, which has been shut out of ECB buys because of its low credit rating.

IMPACT: Euro and S&P 500 futures made a brief spike on the back of ECB’s announcement, but could not hold onto gains and reversed shortly after. Markets are beginning to understand that demand destruction is not going to be solved with credit and each spike higher is a good opportunity to sell into, there is a good chance risk assets will be repriced lower again.

TRUMP SAYS HE WILL INVOKE WARTIME ACT TO FIGHT ‘ENEMY’ COVID-19

Trump moved on Wednesday to accelerate production of desperately needed medical equipment to battle the coronavirus pandemic and gave an estimate that U.S. unemployment could conceivably reach 20 percent in the worst-case scenario.

Scrambling to address the virus after initially playing it down, Trump said he is invoking the Defense Production Act, putting in place a law that will allow the U.S. government to speed up production of masks, respirators, ventilators and other needed equipment.

“We’re going to defeat the invisible enemy,” said Trump, who said the unfolding crisis had basically made him a “war-time president.”

IMPACT: The law, which dates back to the Korean War of the 1950s, grants the president broad authority to “expedite and expand the supply of resources from the U.S. industrial base to support the military, energy, space, and homeland security programs.

DEATHS SURGE IN ITALY & FRANCE

There was particular alarm in Italy, which has experienced an unusually high death rate – nearly 3,000 from 35,713 cases. It has called on students and retired doctors to help an overwhelmed health service. On Wednesday Italy reported 475 new deaths, the biggest increase since the outbreak started and the highest one-day total posted by any nation. France also reported a spike in deaths – rising by 89, or 51%, to a total of 264 in 24 hours.

IMPACT: Italy and France have a generally older population who is more susceptible to the virus and this is coupled with the lack of experience as compared to Asian countries to deal with a pandemic.

DAY AHEAD

In SNB later today, markets put a 90% probability of a 25-bps rate cut to -1.0%. However, pushing borrowing costs below record lows may not significantly aid the economy. Besides, if the bank was rushing to slash rates, it would have called an emergency meeting like its EU and US counterparts did earlier this month. Hence, policymakers in response to the ECB’s neutral response on rates could follow suit by leaving rates steady and announcing other measures that will help banks keep lending to the economy while continuing the FX intervention. Note that no press conference is scheduled at this policy meeting.

SENTIMENT

OVERALL SENTIMENT:

When a day where the stock market did not close at the lows but was still down on the day is a good day, you know how bad things are getting. Fundamentals continue to deteriorate. Some “experts” are finally coming round to the math that if every country has to shut down production for at least a few weeks, and will likely to suffer a longer period of demand destruction then it will likely lead to not just a slowdown but a downright contraction of significant proportions. Accounting for the fear factor of seeing your friends get infected and having to keep away from everyone, a recession is a certainty and a depression is a possibility – be prepared.

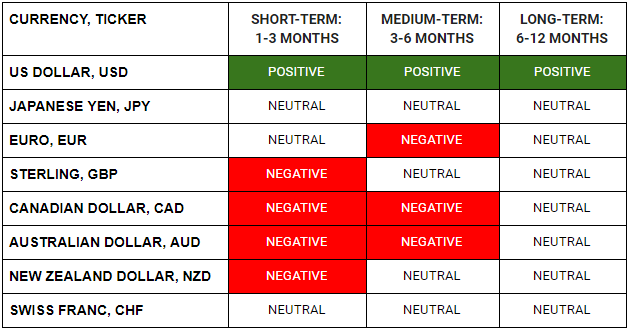

FX

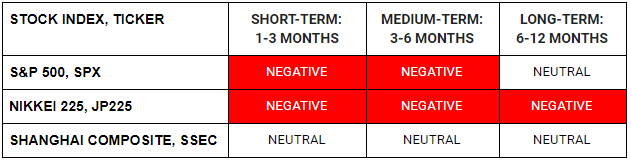

STOCK INDICES

TRADING TIP

Resistance is Futile

In times of crisis, many things will stop making “fundamental” sense. Outsized moves will seem like “It’s too much” and you will be tempted to fade it, because surely it cannot go any further?! Sure, you will eventually be right, but until then you will likely be trampled by the rampaging herd.

When the margin clerk calls, you got to get out of everything even if you do not want to. Do not fight trends you do not understand. The point is to get rich, not to be right. Just go with it…