WHAT HAPPENED YESTERDAY

As of New York Close 10 Mar 2020,

FX

U.S. Dollar Index, +1.47%, 96.29

USDJPY, +2.62%, $105.04

EURUSD, -1.18%, $1.1314

GBPUSD, -1.73%, $1.2905

USDCAD, +0.21%, $1.3732

AUDUSD, -1.40%, $0.6495

NZDUSD, -1.15%, $0.6264

STOCK INDICES

S&P500, +4.94%, 2,882.23

Dow Jones, +4.89%, 25,018.16

Nasdaq, +4.95%, 8,344.25

Nikkei Futures, +0.39%, 19,485.0

COMMODITIES

Gold Futures, -1.40%, 1,652.30

Brent Oil Futures, +10.10%, 37.83

SUMMARY:

The USD roared back with a vengeance as risk assets retraced aggressively on news the US was going to unveil massive fiscal stimulus to help the economy mitigate the economic damage of Covid-19. The U.S. Dollar Index rose 1.47% to 96.45 with JPY bearing the brunt of the day. Risk sentiment was helped in Asian time zone with Japanese officials quoting that they were ready to support the market as with various measures including more purchase of ETFs.

The stock market rebounded about 5% while Treasuries sold off in Tuesday’s volatile session as investors weighed the possibility of a fiscal stimulus package. The major indices started the session up nearly 4%, then briefly dipped negative as investors sold into strength, and later staged a strong rally into the close.

The S&P 500 rose 4.94%, the Dow Jones Industrial Average rose 4.89%, and the Nasdaq Composite rose 4.95%. The small-cap Russell 2000 increased just 2.9%. Sector gains ranged from 1.0% (utilities) to 6.6% (information technology).

Trump said last night he wanted payroll tax cuts and support for hourly workers to help mitigate the impact and spread of Covid-19. Trump added that he also wants to protect airlines, cruise ships, and shipping industries. On top of that, CNBC reported he pitched the idea of a 0% payroll tax rate for the rest of the year. Republican Senate Leader McConnell (R-KY) reportedly said he didn’t like the idea of a payroll tax cut, but Treasury Secretary Mnuchin said he thinks there’s bipartisan interest in getting something done. The market appeared to side with Mnuchin’s optimism, and Trump’s urgency, although there was some skepticism about the efficacy of tax relief in improving consumer confidence.

The 2-yr yield finished 12 bp higher at 0.50%, and the 10-yr yield finished 23 bp higher at 0.76%.

Separately, oil rebounded from its worst day since 1991 after reports indicated that Russia could be interested in discussions to stabilize oil markets, Brent Oil Futures, +10.10%, 37.83.

U.S. ‘FAR BEHIND IN COVID-19 TESTING AS CASES RISE: SENATE DEMOCRAT

The White House has come under attack for relying on kits provided by the U.S. Centers for Disease Control and Prevention (CDC) at the outset of the outbreak. Some of those tests had a glitch that delayed confirmation of results.

“This is a healthcare crisis, it demands a healthcare solution,” Senator Chuck Schumer, a Democrat, said on the floor of the Senate as lawmakers considered measures to protect the economy from a sharp contraction due to the outbreak. Schumer accused President Donald Trump of being focused more on the sharp sell-off on Wall Street than helping American families.

IMPACT: The full and imminent impact of the virus is yet to be realized by the U.S and if it comes to the case where lockdowns need to be implemented, there might be a negative repricing of risk assets as the U.S. is still generally sanguine about its potential threat. If Asia and currently Europe is any leading indicator, the U.S. is still in the early innings of a now very much predictable storm.

SAUDI ARABIA, RUSSIA RAISE STAKES IN OIL STANDOFF

Saudi Arabia will raise its crude supply to a record high in April, the kingdom announced on Tuesday, as it ratcheted up a standoff with Moscow over market share and appeared to reject Russian overtures for new talks. Amin Nasser, CEO of Saudi Aramco(2222.SE) said the oil giant will increase supply to 12.3 million barrels per day (bpd) in April for customers inside the kingdom and abroad.

That’s 300,000 bpd above its maximum production capacity, indicating Aramco may also free up crude from storage. Saudi Arabia has also agreed with Kuwait to resume output from jointly operated oilfields in the so-called Neutral Zone, production which is not accounted for under Aramco’s output capacity of 12 million bpd. U.S. Treasury Secretary Steven Mnuchin told Russia’s ambassador to the United States on Monday that energy markets needed to stay “orderly” amid rising concerns that extra supply from Saudi Arabia and Russia could trigger bankruptcies among higher-cost U.S. shale oil producers.

Brent oil prices jumped 10% on Tuesday above $37 per barrel after Russian energy minister Alexander Novak said Moscow was ready to discuss new measures with OPEC, effectively offering an olive branch to Riyadh. But Saudi Arabia’s energy minister Prince Abdulaziz bin Salman appeared to rebuff the idea.

IMPACT: Russia and Saudi Arabia have both accumulated vast financial cushions that will help them weather a lengthy price war. But the sharp drop in oil prices, if sustained, is likely to hit the sovereign ratings of exporting countries with weaker finances, especially those with pegged exchange rates. Russia’s energy ministry has called a meeting with oil companies later today to discuss future cooperation with OPEC.

AUSTRALIA CENTRAL BANK HOPEFUL COMBINED STIMULUS WILL BLUNT COVID-19 IMPACT

The full impact of the Covid-19 outbreak on Australia’s economy was still uncertain but the combined effect of fiscal and monetary policy would support activity in the meantime, a top central banker said on Wednesday.

Reserve Bank of Australia (RBA) Deputy Governor Guy Debelle said the bank would consider unconventional policy should interest rates be cut by a further quarter-point to an effective floor of 0.25%. “The combined effect of fiscal and monetary policy will help us navigate a difficult period for the Australian economy. They will also help ensure the Australian economy is well placed to bounce back quickly once the virus is contained,” Debelle (Top Central Banker) said in a speech.

IMPACT: If a blended measure of fiscal and monetary policy comes to fruition, it will be bullish for the Aussie Dollar as fiscal policies are usually inflationary in nature. As RBA openly flirts with this unconventional monetary policy, it’s likely that the establishment is priming the market for such a move on their part. Quantitative easing, however, will be bearish for the currency.

DAY AHEAD

In Brexit land, the key event will be the unveiling of the government’s budget later today. With the UK economy slowing down and the virus threatening to dampen growth even further, investors will scrutinize how expansionary this budget is. A budget that includes a big boost to public spending might see the Sterling gain, by fueling expectations that the Bank of England (BoE) may not have to cut rates aggressively to stimulate the economy by itself. The BoE is unlikely to cut rates as aggressively as markets think. A quarter-point rate cut at the March 26 meeting is now fully priced in, and markets are also pricing in a 40% probability for a larger, half-point cut.

SENTIMENT

OVERALL SENTIMENT:

Sentiment improved on the day with talk of fiscal measures from various countries, but that is unlikely to stop the spread of the virus. As we have said many times, the virus does not care about tax cuts or mortgage relief.

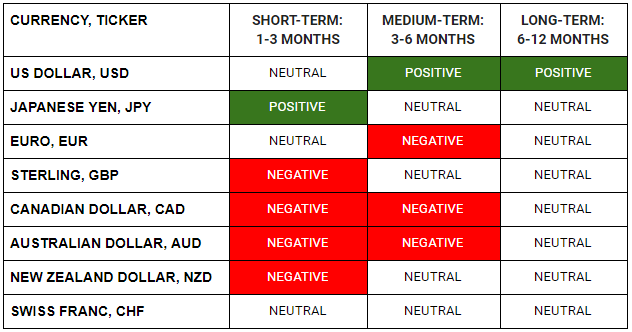

FX

STOCK INDICES

TRADING TIP

History Repeats Itself

One of the reasons why trading can be profitable is because human participants drive many of the macro developments that ultimately influence asset prices. Human reactions can, fortunately and unfortunately, be predictable in most instances.

When the story about how Covid-19 infections have spread uncontrollably in Wuhan, many people around the world scoff at the idiocy of Chinese officials and dismissed the tragedy as entirely preventable if only they were more transparent and honest with the citizens. Many commented that if only the authorities had focused on measures to stop the virus, deaths and much untold suffering could have been avoided.

Yet, that is how many countries in the world are dealing with the Covid-19 outbreak at this very moment. Trump is focused entirely on talking up the stock market and assigning blame to everyone else. The speed at the spread of the virus in Italy Is proof that this virus is unstoppable.

The only way to prevent what ultimately happened in Wuhan is social distancing, and Trump is making things up as he goes along, even to the extent of advising the sick that they can go to work. Given that it is obvious that his priority is to keep the stock market up, and take credit for the strong economy going into the elections later this year, how likely is it that he will have the stomach for the draconian measures of social distancing that will be required to stop US from turning out like how Wuhan did?

He said, “So last year 37,000 Americans died from the common Flu. It averages between 27,000 and 70,000 per year. Nothing is shut down, life & the economy go on. At this moment there are 546 confirmed cases of Coronavirus, with 22 deaths. Think about that!”

“It is just the flu!”, I hear many an armchair analyst proclaim. How does anyone know this? At the beginning of every major epidemic which eventually lead to catastrophic losses, there will also be a point where “only 546” cases are infected, and there will also be a point where “only 22” are dead.

Think about that, Mr. President.