WHAT HAPPENED YESTERDAY

As of 2 Mar, Singapore Time zone UTC+8

FX

U.S. Dollar Index, -0.39%, 98.13

USDJPY, -1.38%, $108.08

EURUSD, +0.24%, $1.1026

GBPUSD, -0.50%, $1.2821

USDCAD, +0.05%, $1.3398

AUDUSD, -0.90%, $0.6510

NZDUSD, -0.87%, $0.6253

STOCK INDICES

S&P500, -0.82%, 2,954.22

Dow Jones, -1.39%, 25,409.36

Nasdaq, +0.01%, 8,567.37

Nikkei Futures, -3.52%, 21,080.0

COMMODITIES

Gold Futures, -4.61%, 1,566.70

Brent Oil Futures, -3.18%, 50.51

SUMMARY:

FX started to break out of range with AUD and NZD testing new lows. USD/JPY fell as JPY reiterated its status as the safe-haven currency. Powell comments (elaborated on below) led to a retracement in the risk aversion move. Gold fell out of bed despite the negative risk sentiment as it has been trading week for the past few sessions despite the continuous selling in equity indices. Speculators who were long Gold to hedge their underwater risk assets and leveraged longs finally had to capitulate as margin calls need to be answered. Traditional correlations (gold tends to go up when equities are down and yields are lower) break down when your broker calls up for cash.

The stock market put up a bit of a fight on Friday, but when the dust settled, it was still the worst week for equities since late 2008, as the S&P 500 fell -0.82% on the day for a total loss of -11.5% since last Friday.

The benchmark index recorded its seventh consecutive day of losses, falling to its lowest level since early October as Covid-19-related fears kept participants on edge. Today’s action saw a sharply lower start, followed by an intraday churn as the market attempted a rebound after more than a week of losses.

Various U.S. officials offered reassurances throughout the day, but their comments did little to dispel the uncertainty associated with a disease that has a long incubation period and a seemingly high propensity to spread. The World Health Organization, for its part, raised its risk assessment of Covid-19 to “very high.”

Afternoon action saw the release of the following statement from Fed Chairman Jay Powell: “The fundamentals of the U.S. economy remain strong. However, the Covid-19 poses evolving risks to economic activity. The Federal Reserve is closely monitoring developments and their implications for the economic outlook. We will use our tools and act as appropriate to support the economy.”

Besides the mention of the Covid-19, the statement was essentially a carbon copy of comments that Fed Chairman Jay Powell has been making throughout his tenure. The softly worded statement was particularly underwhelming because it was drowned out by a screaming bond market. The 10-yr yield fell another 17 basis points to a fresh record low of 1.13% while the 30-yr yield slid 11 basis points to 1.67%. Upfront, the 2-yr yield fell 22 basis points to 0.88%. Thanks to these moves, the day ended with the fed funds futures market pointing to a 96.0% implied likelihood of a 50-basis point rate cut in March, followed by a 74.0% implied probability of another 25-basis point rate cut in April.

COVID-19 CASES IN GERMANY JUMP TO 117

The number of confirmed Covid-19 cases in Germany has jumped to 117 from 66, the Robert Koch Institute for disease control said on Sunday. A German government crisis committee has widened cross-border travel guidelines and cancelled major international events, and the health minister has advised people with cold symptoms to stay away from mass events.

More than half of the cases are in North Rhine-Westphalia, Germany’s most populous state where several schools and daycare centers will be closed on Monday to try to prevent the spread of the virus after staff members tested positive.

IMPACT: Finance Minister Olaf Scholz said in remarks published on Sunday that Germany would be in a position to introduce fiscal stimulus measures should the Covid-19 spark a global economic crisis. Fiscal Measures benefit main street in a more direct fashion because governments will be spending directly into the economy, rather than through capital market mechanisms. This, in turn, will make the private sector more affluent over time and potentially impact wages positively. This should generally be good for risk assets and the Euro.

ERDOGAN ASKS PUTIN TO STEP ASIDE IN SYRIA

Turkish President Tayyip Erdogan said on Saturday that he had asked President Vladimir Putin for Russia to step aside in Syria and leave Turkey to deal with Syrian government forces alone after 34 Turkish soldiers were killed this week. Government forces, backed by Russian airpower, have waged a major assault to capture the northwest province of Idlib, the last remaining territory held by rebels backed by Turkey.

With diplomacy sponsored by Ankara and Moscow to ease tensions in tatters, Turkey has come closer than ever to a confrontation with Russia on the battlefield.

IMPACT: Russia’s Foreign Ministry said on Saturday that the two sides agreed in this week’s talks to reduce tensions on the ground in Idlib while continuing military action there. After the death of its soldiers in a Syrian government airstrike on Thursday, Turkey said it would allow migrants it hosts to freely pass to Europe.

Erdogan said in Istanbul on Saturday that 18,000 migrants have crossed the border, without providing evidence, adding that the number could rise to 25,000-30,000 on Saturday. Greek police fired teargas toward migrants who were gathered on its border with Turkey and demanding entry on Saturday. Turkey’s borders to Europe were closed to migrants under an accord between Turkey and the European Union that halted the 2015-16 migration crisis when more than a million people crossed into Europe on foot. Any escalation of the migrant crisis into Turkey will put downward pressure on the Turkish Lira as the economy is not in the right shape to support the humanitarian crisis.

CHINA FACTORY INDEX HITS RECORD LOW ON COVID-19

Manufacturing activity in China plunged in February to 35.7 (Consensus 45.1, Prev 50.0), according to one of the first official economic indicators published since the Covid-19 outbreak, while the US Federal Reserve signalled that the central bank was considering cutting interest rates in response to “evolving risks” to the US economy. The collapse in China’s manufacturing activity, which exceeded its collapse during the global financial crisis of 2008, shows the severity of the problem faced by President Xi Jinping in restarting the world’s second-largest economy. Last weekend, Xi told local officials that low-risk areas should “resume full production and normal life”.

IMPACT: Local officials face two conflicting objectives. They must control the outbreak, which has killed 2,835 people in China and also get the country back to work after the extended lunar new year holidays when most of the migrant workers upon whom China’s factories depend return to their rural homes. Based on migration data, ANZ said the Chinese economy was operating at 20 percent capacity, with about 50 percent of workers back at their posts as of this weekend. As China continues to remain shut, companies that rely on supply chains continue to accrue the impact, the potential trifecta of China, South Korea and Japan going into shutdown concurrently is a looming risk for markets and the effect may cause risk appetite to be repriced much lower.

DAY AHEAD

Central banks in Australia and Canada will hold policy meetings this week – the first since the outbreak of the Covid-19 escalated into a global crisis. But with policymakers having limited firepower, they will probably maintain a wait-and-see approach until a clearer picture starts emerging about the impact of the virus, whose spread has multiplied several-fold in the past week. Investors will also be waiting anxiously for the latest Non-Farm Payrolls report out of the United States as they push up their bets that the Federal Reserve will be compelled to slash interest rates soon. OPEC will come under the spotlight too as it meets to decide if there is a need for additional output cuts.

SENTIMENT

OVERALL SENTIMENT:

Sentiment turned extremely weak and every trade is now watching Covid-19 updates with fear. Hopes of Fed rate cuts and possible coordinated easing by global central banks are what the markets are banking on to keep asset prices afloat. The virus is relentless, the spread is inevitable. US Presidential primaries to select the Democratic candidate are getting voters out and increasing the risk of exposure. That is not good.

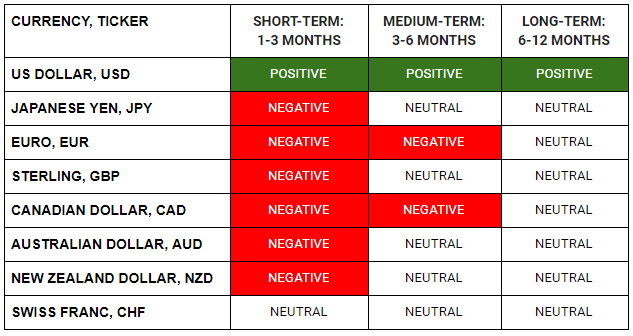

FX

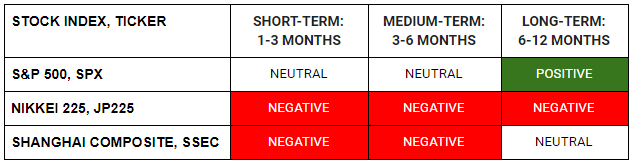

MARKETS

TRADING TIP

What has always been, will not always be

That’s what gold traders rudely found out on Friday when Gold collapsed more than 4% in spite of the weakness in equities. The relationship has always been that when equities are extremely weak, the fear among investors is high, and hence Gold as a safe haven asset should be doing well as investors seek refuge.

However, what matters as well is market positioning. Gold has been going up, and speculators are leveraged long, and investors with equity positions that are losing money have been hedging their risk with purchases of Gold (hoping that profits from Gold will make up for the losses in the equity sell-off). That works till it doesn’t.

When the rise in Gold started to stall as equities continued to sell off, everyone that was long Gold started to worry. As price action weakened, nervous longs started to sell. As Gold prices started to fall even as equities continued to fall, everyone started to unload their positions and the frenzy intensifies!

Correlations are relationships that hold over the long run, but in the short run, anything can happen especially in an environment of high volatility and fear.