WHAT HAPPENED YESTERDAY

As of Fri 28 Feb, Singapore Time zone UTC+8

FX

U.S. Dollar Index, -0.62%, 98.39

USDJPY, -0.72%, $109.63

EURUSD, +1.06%, $1.0997

GBPUSD, -0.14%, $1.2888

USDCAD, +0.43%, $1.3389

AUDUSD, +0.57%, $0.6581

NZDUSD, +0.25%, $0.6310

STOCK INDICES

S&P500, -4.42%, 2,978.76

Dow Jones, -4.42%, 25,766.64

Nasdaq, -4.61%, 8,566.48

Nikkei Futures, -4.21%, 21,390.0

COMMODITIES

Gold Futures, +0.45%, 1,647.30

Brent Oil Futures, -4.51%, 51.02

SUMMARY:

It seems like Groundhog Day all over with the equity markets gyrating wildly and the currency markets remaining range-bound. The only thing of note was the EUR continuing its march higher to test above 1.10s as being one of the major currencies with the lowest interest rates, it has taken the place of JPY as the safe-haven currency. However, Eurozone will bear the brunt of the global recession that is to come, and in such a scenario in the longer term, fears of member countries wanting to pull out of the union will rise. For the shorter term, logic is on hold as the market remains in the grips of fear.

The stock market extended its recent sell-off by more than 4% on Thursday in a volatile session, as the widening spread of the Covid-19 heightened pessimism among investors. The day was filled with numerous relief rallies but each and everyone fizzled out quickly. The S&P 500 closed at session lows with a 4.42% decline. The Dow Jones Industrial Average (-4.42%), Nasdaq Composite (-4.61%), and Russell 2000 (-3.5%) experienced similar price action.

Regarding Covid-19, the U.S. Centers for Disease Control and Prevention (CDC) acknowledged the first Covid-19 case of “unknown origin” in the U.S., which raised concerns about a community spread of the virus. California’s governor fueled concerns by saying 28 people have tested positive and another 8,400 people are being monitored because of their travel.

The impact on global supply chains or consumer spending remains uncertain, but Goldman Sachs warned there could be no U.S. earnings growth in 2020 if the virus becomes widespread. Microsoft (MSFT 158.18, -11.99, -7.1%), meanwhile, was the latest high-profile company to issue a quarterly revenue warning, specifically for its More Personal Computing segment.

Current and past Fed officials offered their views on the matter. In an opinion piece for The Wall Street Journal, former Fed Governor Kevin Warsh argued that the Fed and other central banks should cut rates due to the Covid-19, while Chicago Fed President Evans reiterated the Fed’s stance that it is still premature to provide guidance without more data.

MIXED MESSAGES, TEST DELAYS HAMPER U.S. COVID-19 RESPONSE

Trump on Wednesday assured Americans that the risk of Covid-19 transmission in the United States was “very low.” Despite an explosion of cases in China over the past two months, it was only this week that the Trump administration put in a request for $2.5 billion to aid in the response, an amount both Republicans and Democrats have said is too small. The CDC this week for the first time advised American businesses, schools, hospitals, and families to prepare for a domestic acceleration of the virus, which has infected more than 80,000 people worldwide and killed nearly 3,000.

IMPACT: Trump’s administration is considering invoking special powers through a law called the Defense Production Act to quickly expand the domestic manufacturing of protective masks and clothing to combat the Covid-19 in the United States. With no Covid-19 vaccine or proven anti-viral medicine available, states are planning to isolate sick people in their homes, both to slow community spread and reduce pressure on hospitals, according to the CDC. The law grants the president the power to expand industrial production of key materials or products for national security and other reasons. The biggest producers of face masks in the United States include 3M Corp and Honeywell International Inc.

TURKEY, WITH MORE DEAD TROOPS, SAYS IT WON’T STOP SYRIAN REFUGEES REACHING EUROPE

Turkey, faced with a possible new wave of Syrian migrants and dozens of more dead Turkish soldiers in Idlib, will no longer stop Syrian refugees from reaching Europe, a senior Turkish official said as President Tayyip Erdogan chaired an emergency meeting. Nearly a million civilians have been displaced in Idlib near the Turkish border since December as Russia-backed Syrian government forces seized territory from Turkey-backed Syrian rebels, marking the worst humanitarian crisis of the country’s nine-year war. “We have decided, effectively immediately, not to stop Syrian refugees from reaching Europe by land or sea,” said the official, who requested anonymity. “All refugees, including Syrians, are now welcome to cross into the European Union.” The burden of hosting refugees “is too heavy for any single country to carry,” the official said.

IMPACT: The threat to open the way for refugees to Europe would, if executed, reverse a pledge Turkey made to the European Union in 2016 and could quickly draw Western powers into the standoff over Idlib and stalled negotiations between Ankara and Moscow. Turkey hosts some 3.7 million Syrian refugees and has repeated it cannot handle more. Under a deal agreed in 2016, the European Union has provided billions of euros in aid in return for Ankara agreeing to stem the influx of migrants into Europe.

DEVELOPER CONFERENCES CANCELLED AS TECH COMPANIES RESPOND TO THE VIRUS

The U.S. Centers for Disease Control and Prevention on Wednesday reported a Covid-19 case of unknown origin in northern California, where some of the world’s biggest tech companies are based. It is potentially the first incident of the virus spreading within U.S. communities. California Governor Gavin Newsom said on Thursday that the state is monitoring more than 8,400 people for Covid-19 symptoms after arrival on commercial flights, but California lacks test kits and is being held back by federal testing rules.

IMPACT: Facebook Inc said on Thursday it would cancel its annual developer conference due to fears over the Covid-19, as growing concerns about the economic impact of the global outbreak drove Wall Street to tumble for a sixth straight day. Earlier this month, The Mobile World Congress (MWC), the annual telecoms industry gathering in Barcelona, was called off after a mass exodus by exhibitors due to fears over the Covid-19. AT&T Inc, Verizon Communications Inc and IBM earlier withdrew from the RSA cybersecurity conference, taking place this week in San Francisco, citing Covid-19 concerns.

DAY AHEAD

New Zealand said today that it would release provisional data on its trade with China in the four weeks to Feb. 23, in a special release prompted by heightened interest in the impact on businesses from the Covid-19 epidemic. Statistics New Zealand will release the data which will provide an initial snapshot of trade with China in those weeks compared with the same period last year. This data will include total trade value with China as well as key exports of meat, fish, dairy and forestry products.

As we’ve said before, good data representing pre-Covid-19 information will largely be ignored. However, negative news will increase fear.

SENTIMENT

OVERALL SENTIMENT: Fear reigns as market participants seem to have a SELL button that is substantially larger than the Buy button. With only good news on the virus situation likely to calm the markets as leverage continues to be unwound, expect sentiment to remain fragile.

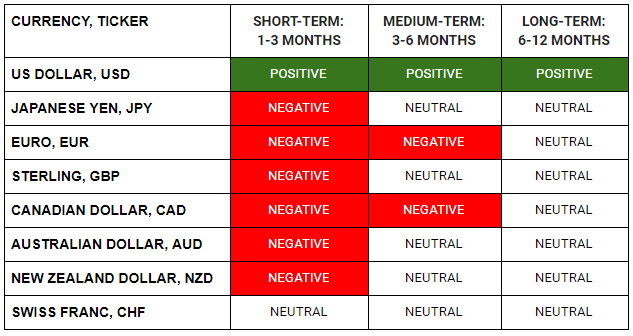

FX

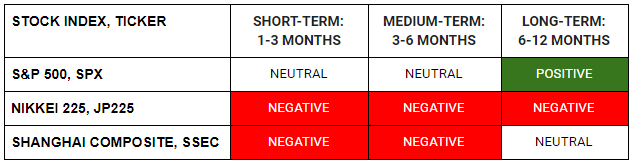

MARKETS

TRADING TIP

Don’t stand in front of a rampaging mob

The temptation to go against a move that you don’t understand is high. In a big sell-off, the retracements will be quick and sudden. Every time that it bounces fiercely, you will tell yourself, “Ah, I knew it! I should have bought the dip!”

All the other times that it continues to free-fall, you might breathe a sigh of relief that you didn’t give in to the temptation, but that relief will be fleeting and soon forgotten in the midst of the wild gyrations.

As such, every dip is an “I told you so!” moment when it proves to be a temporary dip. You will say, “Ah, if I bought it, I could have sold it here now!” Be honest with yourself. The likelihood of you buying every dip and rally is very low.

Choose the weaker side and trade against that. If you have no clue which is the weaker side, the place to be is on the side-lines!