The US Federal Reserve hiked interest rates by 0.25% in its March policy meeting as market expected. What do you think from here?

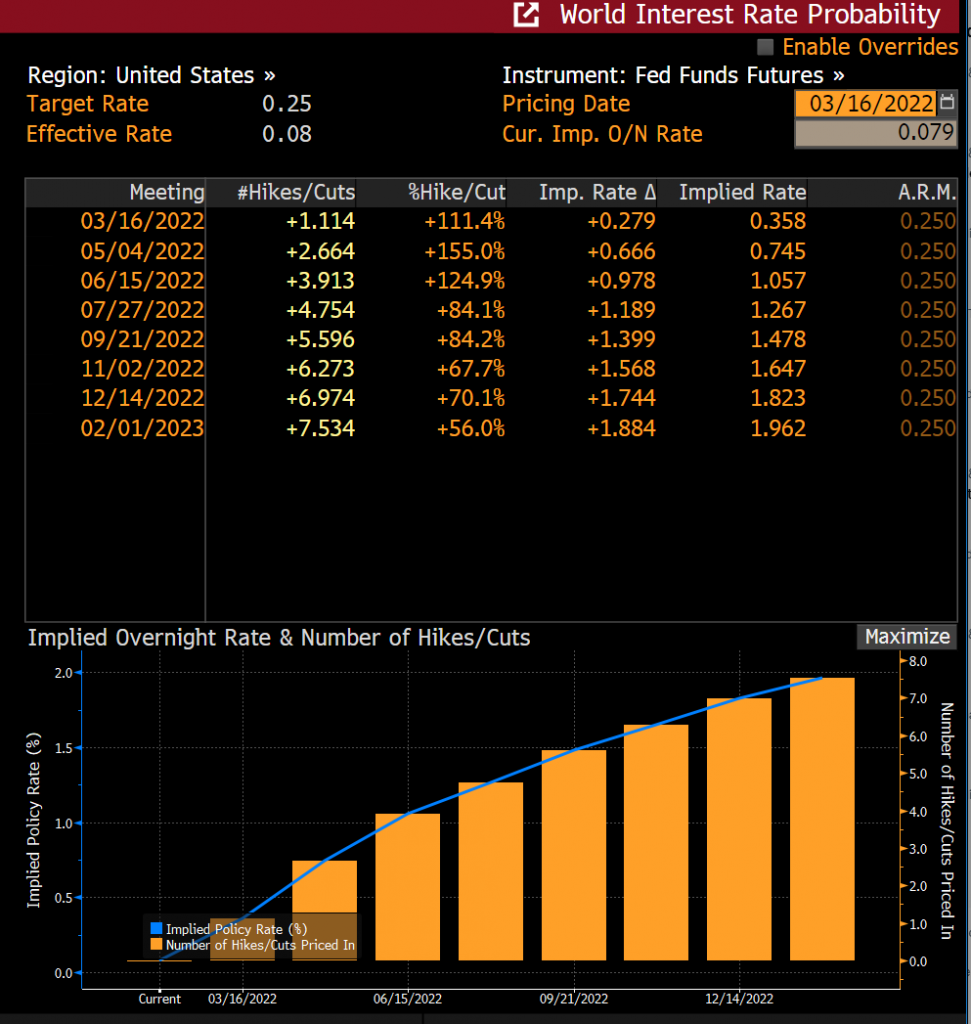

So, what happened was as markets have wildly expected, the US Federal Reserve increased the policy interest rates by a quarter of a percent and spoke of more interest rates hikes in the meetings going forward. And then, they also said that they will begin balance sheet reduction in the coming meeting. It doesn’t say when, but likely the next meeting, if data continues to hold up: inflation and employment and economic data continues to hold up strongly. So, the markets reacted very happily, I would say some markets were up within 2-3%, depending on the index that we’re looking at and more than three percent in fact for NASDAQ. And we also received their projections, the economic projections and the projected interest rate pathway forward. So, they project another 6 hikes of a quarter percent each for the rest of the year and he (Powell) did speak of the possibility of going to hiking 50 bps or half a percent instead of a quarter percent increment but is not more hawkish than what market has feared. It is basically delivering what the market expects. But prior to the meeting, the market was pricing for a total of seven rate hikes this year. And now, if we have one delivered, so if all things being equal, the market expects six hikes for the rest of the year. But instead now, it’s I think slightly more than six, at one point after the meeting, it was even closer to 7 again. So, including the one we had in the meeting, we would have been closer to eight for the whole year including the need latest hike. So the first instance was that interest rate markets took it as a very hawkish statement, very hawkish comment. But that interpretation has been taken back a little bit. My interpretation from what I hear from the press conference, the way they answered questions, was that it’s very data dependent. Every meeting is life, meaning they are considering everything, it’s not automatic hike and he did talk about the lagged effects of monetary policy. Meaning that even if you hike now, in fact, you will only be seen much later on. So you shouldn’t really be very aggressive unless you truly know what’s going to happen in the future. And because there’s so much uncertainty given the war, given the covid shutdowns in China, also high energy prices, supply chain destructions. Continuing still, that’s a lot of uncertainty. And more importantly, I believe more importantly, the data’s producer price index (a measure of inflation because it measures the prices that producers pay to get good that they need to manufacture goods) is lower than expected. It’s the first inflation metric to undershoot in the US for some time now. So I think it makes sense for the Fed to be gradual and be careful in the removal of accommodation. He stressed that these are emergency conditions that were put in place, which is correct, to address the Covid crisis. But now, the economy is very strong, the labour market is strong, inflation is above Target and they will bring it back down to within expected long-run inflation target, keeping inflation expectations anchored. So, I think it’s good news that we have taken the uncertainty our of the market. The decision had one dissent from Governor Bullard who essentially has been talking about wanting a half a percent hike for the longest time, but I think it’s good. It’s consistently one guy, so that’s again reaffirming what we really known so far so that’s good. And historically, rate hike cycles have started with strong Equity markets because usually when the Fed is ready to hike, economy is very, very strong. They always tend to err on the side of the economy and jobs situation for the last 20 plus years. So I think it’s good for risk assets unless there’s more bad news coming from the war front or more shutdowns in China, we are likely to see that the buy on dips mentality in the stock market will return. Many investors are under invested now, there’s a lot of cash on the sidelines and think it’s good. We shall be seeing more positive price action going forward.

China stock markets rallied strongly off the lows since Wednesday, what’s going on here?

China’s stock market is very interesting. So what happened was it had a big selloff on Tuesday. It’s been selling off for the longest time because of Chinese government cracking down on education, technology companies, construction as well as various other sectors in the name of the common prosperity target – basically wanting to have a more equitable society. So they are trying to reduce dominance in any particular industry by big companies. Then we had the problem of the US wanting to delist Chinese stocks because of security concerns citing that there’s many connections to the government, maybe they’re taking data and it’s not protected from the government. So a lot of reasons for that and also then we had renewed fear of more lockdowns in China. So, that’s from the weekend, the last few days, there was a lot of panic selling on Tuesday. But on Wednesday morning, the Chinese government officials came out with a very strong statement about ensuring that policies going forward is to stabilize market, not to scare markets. I think they are announcing the end of cracking down on any particular Industries and more importantly, they say that long-term investors should buy stocks now, right? So basically, they’re saying the national team – the Pension funds, the government controlled funds, all the connected people should be buying now because this is it, right? They are going to e d the policy of cracking down on different sectors. And also they are going to promote policies that will stabilize the economy and help the economy grow, ensure that liquidity is sufficient for the economy to stay stable. And stable means up for stock markets so that’s great. So, a big rally off the lows happened, Hong Kong was almost 20% off the lows. And I think also the positive risk sentiment from the Fed’s decision fed into the Asian markets as well. So we’re seeing a double boost and we see how Hang Seng index up 37% today, so I believe many people have capitulated. So a lot of those getting out are underinvested. I think again, this is going to be the low of the Chinese and the Hong Kong stock markets. And unless there’s worse news in store, for them on the covid front. But I think each time there’s bad news is going to be supported or met with more response from the government to help stabilize the market.

So, in conclusion, I think we are now at the tail end of the selloff in risk assets since the end of last year. I believe barring any drastic bad news from the war front from Ukraine-Russia situation. We are likely to see in the lobes and the Buy on Dips mentality will be returning soon if it’s not already returned. Okay. I think it’s very interesting markets. Volatility will remain high because many people will interpret the same news very differently given previously held views but I will stick with the side of history where early on in the rate hike Cycles, we have risk assets continuing to do well. Even though the Fed has hiked by one time of a quarter percentage point, risk conditions are still very easy. And they also stated that reduction of balance sheet can be considered a rate hike as well if it should happen. So, I don’t think they’re going to go over aggressive with reducing the balance sheet. All right, as always stay true to the process and eventually you’ll be profitable.