WHAT HAPPENED YESTERDAY

As of New York Close 09 Mar 2020,

FX

U.S. Dollar Index, -1.10%, 94.89

USDJPY, -2.12%, $103.08

EURUSD, +1.00%, $1.1399

GBPUSD, +0.18%, $1.3073

USDCAD, +1.77%, $1.3662

AUDUSD, -0.81%, $0.6598

NZDUSD, -0.30%, $0.6338

STOCK INDICES

S&P500, -7.60%, 2,746.56

Dow Jones, -7.82%, 23,844.73

Nasdaq, -7.29%, 7,950.68

Nikkei Futures, -7.73%, 19,107.5

COMMODITIES

Gold Futures, -0.34%, 1,666.75

Brent Oil Futures, -26.40%, 33.32

SUMMARY:

The USD sold off aggressively as the perfect storm hit the markets. The oil price war and all the bad news on the Covid-19 front led to a gap in risk assets in early Asian hours with S&P500 futures hitting the intraday downside limit down of 5% for most of the hours before US open. USDJPY hit an intraday low of 101.15 before fighting its way back to end just down slightly more than 2%. AUD had a flash crash to touch the low of around 0.6313, almost 4.5% lower than previous close, before creeping back slowly throughout the day to almost flat. EUR/AUD had massive daily reversal candles as it rallied almost 7% during Asian hours before giving up most of the gains towards the end of US trading hours.

The S&P 500 dropped 7.6%, oil prices tanked around 25%, and Treasury yields continued to fall to unprecedented levels on Monday after Saudi Arabia initiated a price war and Covid-19 cases accelerated. The Dow Jones Industrial Average (-7.8%) and Nasdaq Composite (-7.3%).

Saudi Arabia lowered its oil price for April delivery by $6-$8/bbl and signaled production boosts for an oversupplied market after Russia failed to agree to production cuts last Friday. WTI crude settled the session down 24.8%, or $10.23, to $31.09/bbl for its worst decline since 1991, which took a heavy toll on the S&P 500 energy sector (-20.1%).

The oil shock exacerbated recessionary concerns already fueled by the rapid spread of Covid-19, as speculation arose about potential layoffs and defaults within the highly-leveraged energy space. Stocks were halted from trading for 15 minutes in the opening minutes of action after the S&P 500’s 7.0% decline triggered a circuit breaker. At that point, the S&P 500 was down 18.5% from its all-time high and later it nearly entered bear market territory, which is typically defined as a loss of at least 20% from a recent high.

Expectations for stimulus measures from central bankers and policymakers rose amid the market turmoil. The fed funds futures market is expecting the Fed to cut rates by at least 75 basis points at its policy meeting next week, while the possibility of tax relief was floated by Senate Republicans. U.S. 2yr Yields fell 11bp to 0.38% (traded to a low of 0.257%), while U.S. 10yr Yields fell 20bp (traded to a low of 0.342%).

EU LEADERS TO HOLD CRISIS TELECONFERENCE TO TACKLE COVID-19

European Union leaders will hold emergency talks soon to discuss a joint response to the Covid-19, officials said on Monday, as the bloc’s executive considers relaxing state subsidy rules to allow extra public spending. The announcement of the teleconference, likely to take place on Tuesday, came after Italy and France called for Europe-wide stimulus to counter the economic impact of the epidemic.

Separately, the head of the European Commission Ursula von der Leyen said on Monday the bloc’s executive was considering all options to help the economy. The commission was assessing conditions to grant flexibility to states in providing public subsidies to crisis-hit sectors, she added.

IMPACT: The speed at which a decision must be made (due to the rapid spread of the virus) makes an agreement between EU nations to respond with fiscal measures highly plausible at this point in time. With the Euro trading as if it were a “safe-haven “ asset throughout its spread in the western hemisphere, fiscal measures will give us more reasons to be bullish on the Euro its effect is inflationary in nature. Having said that, the duration and the scope of the measures have to be studied to grasp its full implications on the European economy.

TRUMP PROMISES “VERY DRAMATIC” ACTIONS TO SUPPORT THE ECONOMY

During the daily virus update press conference, Trump said his administration will discuss a possible payroll tax cut with the U.S. Senate, saying they will seek “very very substantial relief” for the economy that has been roiled by the outbreak of Covid-19.

Trump, speaking at a White House news conference, added his administration plans to speak with lawmakers on Tuesday, seeking the aid to help hourly wage earners “so they don’t get penalized for something that’s not their fault.” Trump also said he plans to announce “very dramatic” actions to support the economy at a press conference on Tuesday.

IMPACT: When governments wake up to the seriousness of this virus and its economic impact the bailouts and monetization will be truly breathtaking. We will be flooded with easy money, but the fear is that easy money will not fix supply chain issues and if markets realize that central banks are impotent, this will create an even greater panic in market sentiment.

OPEC COUNTRIES LOSE $500 MILLION A DAY IN OIL PRICE CRASH

For the most part, oil is a top income source for members of the Organization of the Petroleum Exporting Countries (OPEC) and such a dramatic fall in prices will put strain on their economies, some of which such as Iran and Venezuela, are already on the brink. OPEC had been pushing for expanding the existing cuts with its allies, known as OPEC+, by an additional 1.5 million barrels per day to over 3 million bpd until the end of the year. Russia turned the proposal down, causing the collapse of the alliance and the start of a price war over market share. For some nations, including one the group’s richest members Saudi Arabia, fiscal budget break-even oil prices were already much higher than the oil price before the most recent collapse.

IMPACT: With 60% of Russia’s exports tied to oil, which is about 30% of GDP, it’s going to be interesting to see what Russia does. Russia’s break-even price is $42 per barrel.

Just a few weeks ago Putin promised a massive spending plan (4 trillion rubles, about $60B) on infrastructure and social programs. Putin is on shaky ground with the Russian man in the street. Approval ratings at all-time lows. That spending plan was meant to give that a boost. The Russian government plan on using $15 B of that $60B on their national wealth fund.

Oil prices tanking hurts the inflows into that fund and weakening the ruble. Remember the ruble collapsed 60% against the dollar in 2014 when oil prices tanked. It also hurts their ability to purchase foreign currency to build more reserves. Russia recently said it could finance its budget for four years at $30 per barrel oil. But it also said if falls below $42 per barrel it will sell foreign reserves in proportion to the dip. This doesn’t help him when the economy is at risk of a huge meltdown. Now think about this, Saudi knows by flooding the world with oil they will crush the US shale sector, which has taken away some of their world leverage in oil markets. It will also hurt Russian exports too. Interesting time to be a distressed investor in US shale names …

DAY AHEAD

U.S. Consumer and Producer price figures – due Wednesday and Thursday, respectively, will be the main release out of the U.S. this week. But with the economic climate being presently overrun by the sweeping Covid-19 epidemic, the data will probably be overlooked as policymakers pay more attention to forward-looking indicators. It also means there’s likely to be more pain to come for the tumbling Dollar, which has been battered by the collapse in Treasury yields.

SENTIMENT

OVERALL SENTIMENT:

Sentiment remains awful as policymakers scramble to reassure markets that they will do whatever it takes to help cushion the economic impact of the Covid-19 crisis. With the White House worrying more about the stock market reaction than actually taking the virus seriously, the spread will worsen in the US, and when it gets bad enough, will the US have the stomach to implement the draconian measures such as those introduced by China to contain the outbreak?

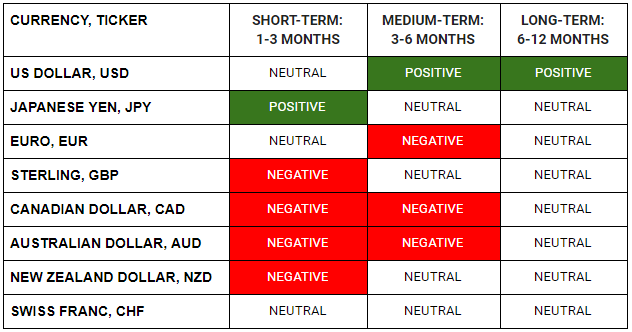

FX

STOCK INDICES

TRADING TIP

There will be Blood

It was essentially a bloodbath in the global equity markets yesterday. The double whammy of an oil price war and the relentless spread of the Covid-19 virus over the weekend knocked the bulls out with S&P500 hitting the limit down barrier of 5% during Asian trading hours.

Of course, there were those who reason that a lower oil price is good for many economies and for consumers in general but in imes of stress, anything that is unexpected and add to the turmoil will lead to investors running to cash and safe havens for refuge.

In the longer run, a lower oil price will add more money into the pockets of consumers and remove a potential source of inflation when Central Banks start to print more money but for now markets are running scared.

In times of stress, there will be many opportunities as illiquid markets will lead to flash crashes and “irrational moves”. Be wary and be nimble and size your trades correctly so as to not be the ones that are bloodied in the process.