WHAT HAPPENED YESTERDAY

As of Thu 5 Mar, Singapore Time zone UTC+8

FX

U.S. Dollar Index, +0.23%, 97.37

USDJPY, +0.54%, $107.71

EURUSD, -0.31%, $1.1138

GBPUSD, +0.46%, $1.2871

USDCAD, +0.00%, $1.3386

AUDUSD, +0.70%, $0.6629

NZDUSD, +0.41%, $0.6301

STOCK INDICES

S&P500, +4.22%, 3,130.12

Dow Jones, +4.54%, 27,090.42

Nasdaq, +3.85%, 9,018.09

Nikkei Futures, +2.12%, 21,425.0

COMMODITIES

Gold Futures, -0.41%, 1,637.70

Brent Oil Futures, -0.56%, 51.57

SUMMARY:

FX was relatively calm with mixed performance for the USD. As risk aversion eased, EUR pulled back a little vs the USD (-0.3%), the first real down-move since 21 Feb and lost ground by almost a percent vs the AUD. The FX market will likely be driven by the stock market sentiment for now.

U.S. markets rallied on Wednesday with the Dow (+4.5%), Nasdaq (+3.9%), and S&P 500 (+4.2%) erasing their losses from Tuesday and then some.

Equities benefited from a general improvement in sentiment, which was reflected by a mixed stock session in Asia and gains in European markets. The US Congress approved $8.3 billion in emergency funding to respond to the Covid-19 crisis and the IMF announced a $50 billion aid package to help emerging market countries to combat Covid-19. Those developments provided significant encouragement for U.S. equities even though there was no improvement on the Covid-19 front.

On the contrary, Italy’s Prime Minister, Giuseppe Conte, warned that Italy’s health care system, which is among the best in the world, is on the verge of being overwhelmed while sporting events will be conducted without fans through April 3. California declared a state of emergency after the first death due to Covid-19.

The ISM Non-Manufacturing Index for February registered a 57.3% reading (consensus 54.8%) versus 55.5% in January. The key takeaway from the report is that the February number is encouraging in its own right, but with the Covid-19 caseload rising in the U.S. and the public’s attention to containing it increasing, doubts are festering that the strength can be sustained.

The 10-yr yield rose another 6.8 basis points to 1.052% while the 2-yr yield rose 0.9 basis points to 0.698%, in a curve steepening trade.

CHINA’S SERVICES ACTIVITY PLUNGES AS VIRUS WIPES SALES, MARKET REMAINS BID

China’s services sector had its worst month on record in February as new orders plummeted to their lowest level since the global financial crisis, a business survey showed on Wednesday, with economists urging swift support to avoid mass bankruptcies.

The Caixin/Markit services purchasing managers’ index (PMI) almost halved last month to just 26.5 from 51.8 in January, the lowest it’s ever been since the survey began almost 15 years ago in late 2005. A reading below 50 on the index denotes contraction and above, expansion. A China Merchants Bank survey of over 20,000 companies mostly in the services sector conducted in February showed nearly 20% of the companies face “severe difficulties” due to the Covid-19, while nearly 6% are on the brink of collapse.

IMPACT: Despite the huge miss in economic print and the presumably dire narrative around chinese companies, ChinaA50 Futures and CSI300 were healthily bid on the day. This may be due to confidence in Xi’s resolve to do whatever it takes to ensure the chinese economy remains buoyant and the fact that China’s Covid-19 situation right now seems less viral (pun intended) as compared to its North Asian neighbours. Since a poor print did little to dent risk sentiment, any pick up in China should see Emerging Market and Commodity related Currencies start to get bids.

SUPER TUESDAY TRIUMPH FOR BIDEN SETS UP ONE-ON-ONE BATTLE AGAINST SANDERS

Biden, the former vice president whose campaign was on life support just weeks ago, won nine of 14 states voting on “Super Tuesday”, including surprise wins in Texas and Massachusetts, in the race to face President Donald Trump in November.

Just days after his campaign was resurrected by a thumping win in South Carolina, Biden, 77, emerged as a consensus champion for the moderate wing of the party against Sanders, 78, a left-wing senator with strong support among the youth. Biden, with overwhelming support from African-American, moderate and older voters, swept to wins in Alabama, Arkansas, Massachusetts, Minnesota, North Carolina, Oklahoma, Tennessee and Virginia.

IMPACT: Financial markets seemed to sense a swing in Biden’s direction. After a volatile day on Tuesday, U.S. stock futures jumped on Wednesday after the strong showing for the more market-friendly candidate. Sen. Bernie Sanders, the fiery populist, did score the biggest victory of the night in California. But after Super Tuesday, Biden according to projections leads in the delegate count, and now has the momentum. In the political betting market PredictIt, the Biden contract shot up to 74%, versus Sanders on just 18%. On another note, voters going out in droves to vote during a Covid-19 crisis seems like a script for a bad horror/disaster movie.

BOC CUTS INTEREST RATE

The Bank of Canada cut its benchmark interest rate to 1.25% from 1.75% on Wednesday in the face of a fast-spreading Covid-19 outbreak and said it was prepared to cut again if needed to support economic growth. “Before the outbreak, the global economy was showing signs of stabilizing,” the Bank of Canada said in a statement. “While Canada’s economy has been operating close to potential with inflation on target, the Covid-19 virus is a material negative shock to the Canadian and global outlooks, and monetary and fiscal authorities are responding.”

IMPACT: If not for the Fed, the Bank of Canada might have opted for a smaller quarter-point cut. All things equal, lower interest rates will stoke demand for mortgages, and policy-makers worry that Canadian households are already carrying too much debt. Poloz and his deputies noted that consumption was stronger than expected in the first quarter, easing concerns that an important engine of economic growth might have been sputtering.

But external conditions trumped all other considerations. A gap between U.S. and Canadian benchmark rates could have put upward pressure on Canadian Dollar, or simply introduce more volatility in the exchange rate. Either would only add to the current trials of exporters. “Business activity in some regions has fallen sharply and supply chains have been disrupted,” the central bank said. “It is likely that as the virus spreads, business and consumer confidence will deteriorate further.”

DAY AHEAD

OPEC and its allies (known as OPEC+) will hold a scheduled meeting on Thursday and Friday and are likely to agree to additional output cuts as the demand outlook for oil continues to deteriorate in the face of a long-term impact on the global economy from the Covid-19. But there are doubts as to whether the alliance will be able to agree to lower production caps as key member Russia does not appear to have yet come around to the idea even as oil prices slump to more than one-year lows.

Russia had rebuffed attempts to hold an emergency meeting earlier in February and its refusal to back new output reductions could force Saudi Arabia to go it alone, with some other Arab nations possibly joining it. The lack of unity among the major producers does not bode well for oil so anything less than the recommended cut of 600,000 bpd will not do much in boosting prices.

SENTIMENT

OVERALL SENTIMENT:

As the market gets desensitised to the constant stream of bad news regarding the Covid-19 situation, relative calm returned to the market. Sentiment remains fragile and will be sensitive to worsening economic data. Increasing number of infections is now the norm and will take unexpected developments to shock the market. For example, an escalation in a country with hot weather will be especially bad as many expect/hope that the virus spread will be fizzling out come warmer weather.

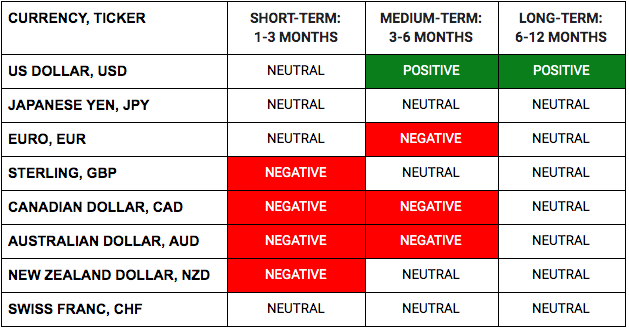

FX

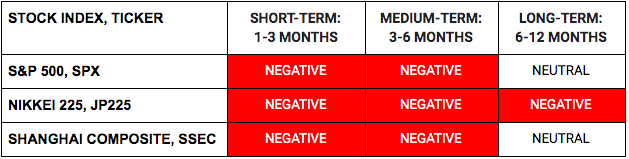

STOCK INDICES

TRADING TIP

Know what you do not know

Many people have a tendency to stick to convictions that they have no way of knowing to be true. For example, before the Covid-19 infection cases started popping up everywhere, the general view was that it was China’s problem and that it won’t be a problem anywhere else.

Of course, now that it’s patently obvious it has spread everywhere, it’s become obvious that it was just a matter of time before it does. For regular readers of our post, you will remember that you did hear it here first.

How then did we know that it will spread? Well, we didn’t but we also knew that we didn’t know that it wouldn’t. What the world did know then was that Wuhan had a population of 11 million, and when the border closed, 5 million of those were not within the city.

Most were somewhere in China, but some were overseas. The first infection cases in South East Asia were traced to these tourists. Why would these tourists only be hanging out exclusively in S.E. Asia? Chances are they would be elsewhere too. Cases increased in the infected countries soon after because local transmission occurred.

For the longest time, many were waiting for the media to confirm that human-to-human transmission was possible. Why would China close down cities, affecting lives of tens of millions of people and cancelling Chinese New Year celebrations, if human-to-human transmission was not already happening? Was it possible that millions of people would be rabidly eating wild animals (thought to be the likely original source of infection) even though people are getting sick from doing so?

It was also known then that each infected case spreads the infection to between 2-3 people on average and asymptomatic infected cases can still be infectious. Given those facts, it was just a matter of time before it spreads as no other country was seriously screening for the infected and it was impossible to screen for infected people who showed no symptoms.

What then do we not know now? The market generally assumes that this virus will fade away come the warmer months. How can anyone be sure of this? There are currently infection cases in countries with warm weather. Also, a study shows that most of the transmission between humans occurred in indoor settings. Sure, the virus does not survive well in warm places with bright sunlight, but does an air-conditioned room in Malaysia differ from an air-conditioned room in China that much?

An increase in cases in hot countries will test the conviction that this is going to be a short-lived problem that will disappear in the months ahead. Be vigilant!