MEMBERS AREA

How aggressive will the rate hikes be?

TRADERS’ RISK CALL – 16 Mar 2022

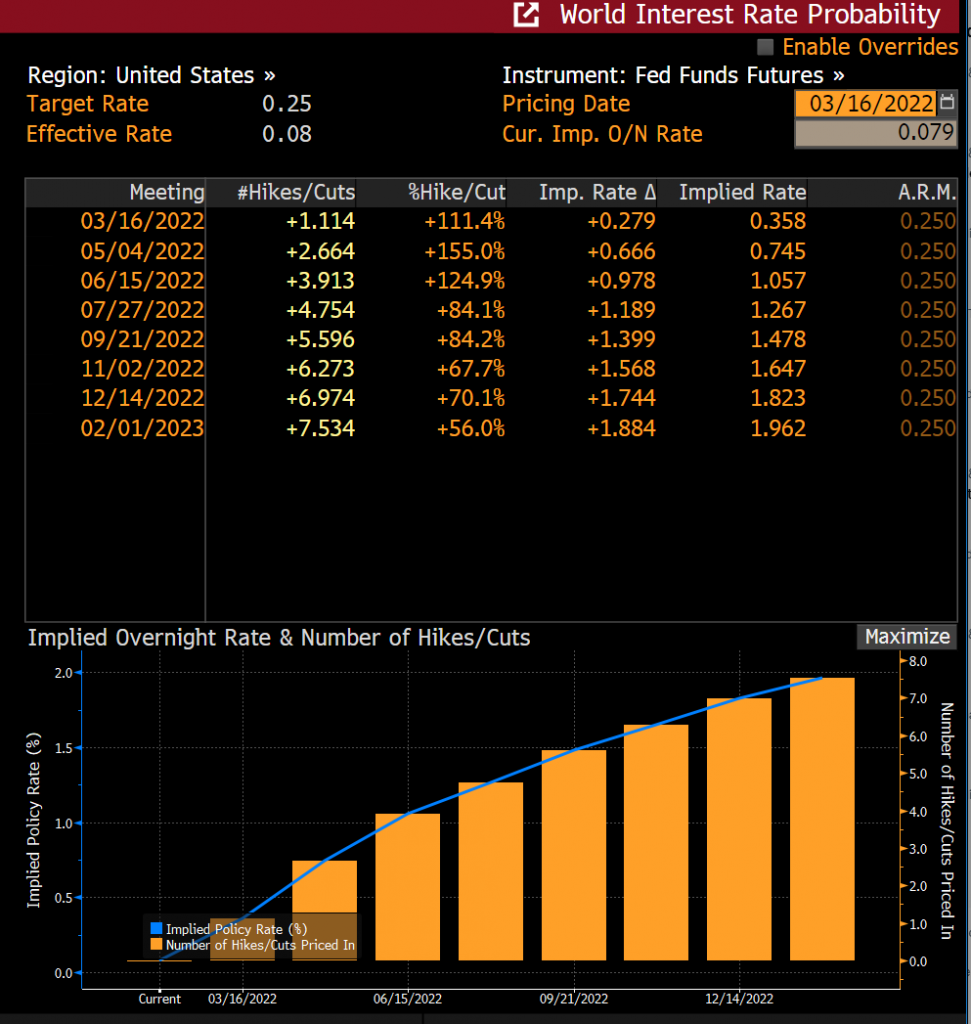

Hey guys, welcome back to a special edition of risk call. Today, we have with us Vee, the CIO and founder of TrackRecord. Hey, let’s talk about the Fed. We have the US Federal Reserve meeting later today. It’s the meeting that many anticipate that they will start their hiking cycle. Market is pricing for a 28 basis points hike, so slightly more than 25 basis points. A 25 bps is baked with a 10% probability of maybe a 50. But it’s low because it’s very unlikely that it’s going to be that way. Powell has already said that he will recommend a 25 basis points hike and I think that’s the way they’re going to go. That should not have an market impact. What’s going to impact the markets would be their statement on how they’re going to proceed with the hikes in the future. So, what’s important is also the dot plots, which is the projection of interest rate hikes for the future from each member of the committee. Then, they take poll and publish the range of their projections. So far, the market, is pricing the Fed to hike seven times of 25 basis points this year, which is I believe a lot. The dot plot previously showed only three, so they were talking about 3-4, but we’ll see how that has changed since last December projections (they only do projections every quarter so this is the first one since December). And another thing that market will be sensitive to will be the likelihood of 50 basis points hike at any some point in time, right? So we’ll see what Powell will say in his press conference. Likely that the journalist will grill him on how he intends to go about hiking. Would he consider 50 basis points hike, what does he think about the economic uncertainties from the Ukraine-Russian War, inflation from the supply disruptions of the war, especially in the Commodities, such as oil, gas, wheat and other food supplies as well. And also, what he thinks about the resurgent covid in China, which has led to the shutdown of Shenzhen and partial shutdown of Shanghai/partial restrictions in Shanghai. So that’s going to be all very closely watched. And that’s the excitement for today. Yeah, so I think we have a benign message from the Fed, they stressed on gradual hikes and seeing what happens and then adjusting, when data calls for adjustments, happy to take the time to slowly proceed with removing policy accommodation. Also, not just rate hikes but also balance sheet reduction. If it’s a gradual and benign policy statement, I think that stock markets and risk assets will rally further because today, we saw in Asia, a strong rally across the board because of the Chinese authorities – Chinese record State Council – saying that they will keep the stock market stable and they have encouraged the long-term investors to buy stocks. That’s basically also an encouragement for private investors and everyday investors to buy, basically saying the government will do everything in their power to keep the stock market stable. So that’s the first, I guess, it’s a very strong sign of support from the government. In this case, the risk sentiment is on the mend. If the Federal Reserve does not go extremely hawkish, does not express hawkishness beyond what the market is fearing, then risk assets will do well. Alright, on that note, as always stay true to the process, and eventually you’ll be profitable. Take care.

The long-awaited March US Federal Reserve policy meeting is here. How much will the Fed hike, and how aggressive are they going to be? What should we be watching out for?

Disclaimer: The views and opinions expressed in this material do not constitute a recommendation by TrackRecord Pte. Ltd. that any particular investment, security, transaction or investment strategy is suitable for any specific person. No part of this material may be reproduced or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission of TrackRecord Pte. Ltd.