NOTABLE MOVES

As of Thu, Jan 31, 08:00 Singapore Time zone UTC+8

USDJPY, -0.40%, $108.96

EURUSD, +0.50%, $1.1489

GBPUSD, +0.40%, $1.3122

USDCAD, -0.93%, $1.3144

AUDUSD, +1.36%, $0.7254

NZDUSD, +0.89%, $0.6895

S&P500, +1.55%, 2,681.05

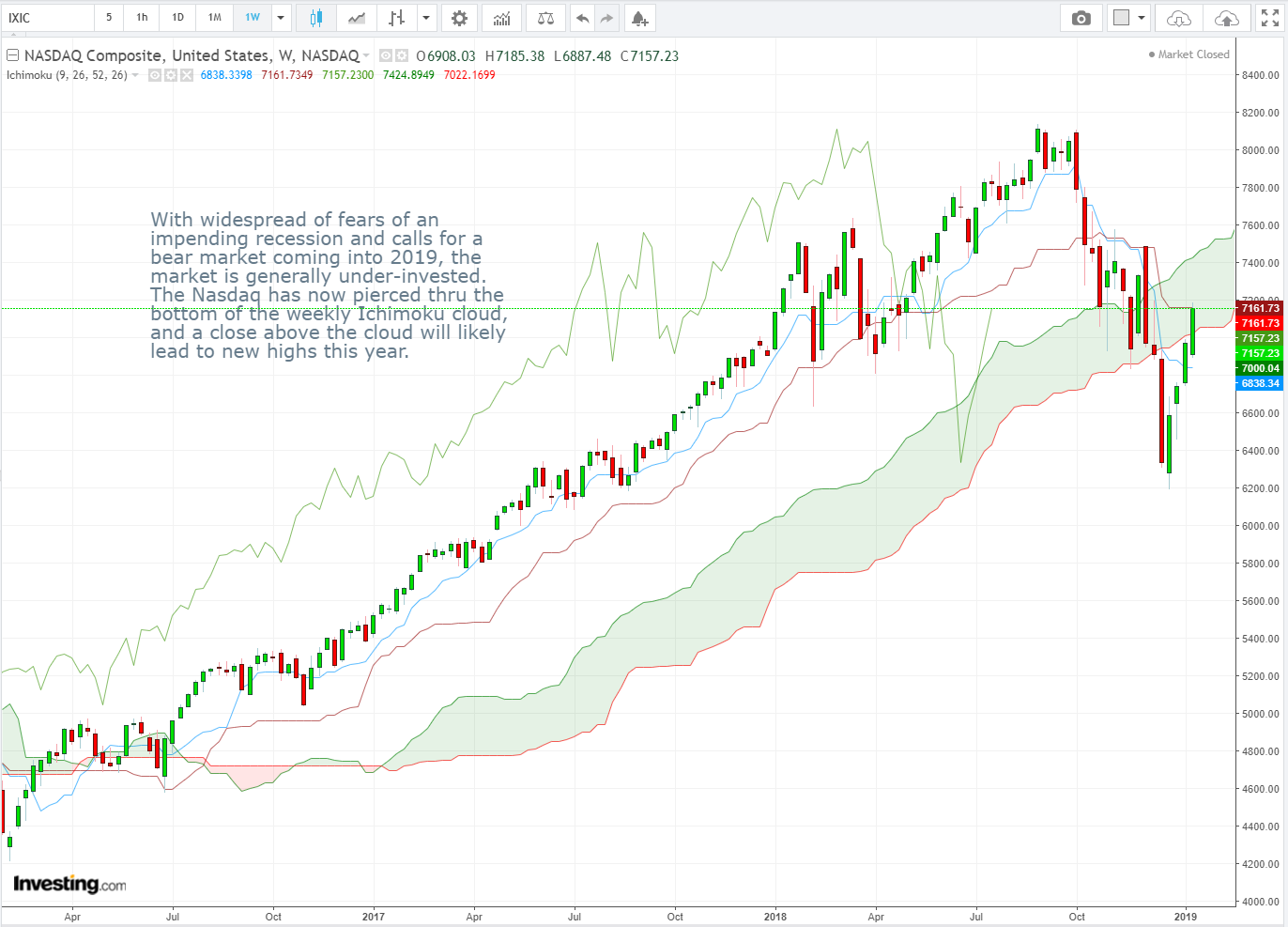

Nasdaq, +2.20%, 7,183.08

Nikkei Futures, +1.13%, 20,862.5

CURRENCY MARKET WRAP

- The ADP National Employment Report showed an increase of 213,000 in January (consensus 180,000), and the December reading was revised to 263,000 (from 271,000).

- The FOMC voted unanimously to keep the fed funds rate unchanged at a target range of 2.25% to 2.50%, as expected. The S&P 500 more than doubled its gains from 0.8% to 1.7% in the time between the FOMC releasing its policy directive at 2:00 p.m. ET and Fed Chair Powell’s follow-up press conference at 2:30 p.m. ET to explain the FOMC’s thinking. The underlying message from that decision, and Powell’s press conference, is that the market need not fear the Fed (for the time being), as the Fed is content to be patient with its policy approach and is open to curtailing its balance sheet normalization effort if necessary. The Fed’s dovishness sent U.S. Treasuries in the belly of the curve to session highs. Longer-dated Treasuries were less affected. The 2-yr yield, which was up as much as two basis points, decreased four basis points to 2.53%. The 10-yr yield, which was up as much as two basis points, decreased two basis points to 2.70%. The U.S. Dollar Index also fell on the news, losing -0.4% to 95.43.

- Meanwhile trade talks aren’t going anywhere. Trump is under pressure to make a deal but with the Huawei charges, it is not clear how serious he really is. US and China plan to hold one to two more rounds of talks before the March 1 deadline.

- Aussie was bid on the back of better than expected inflation data. Although consumer price growth slowed year over year, the decline was less than expected thanks to a 0.5% increase in quarterly growth (Australia CPI q/q 0.5% vs expected 0.4%). The Reserve Bank said the next move in rates will be higher and this latest report supports their positive bias.

STOCK MARKET WRAP

- The S&P 500 began the day comfortably higher as Apple’s (AAPL 165.25, +10.57, +6.8%) better-than-feared earnings and Boeing’s (BA 387.72, +22.81, +6.3%) impressive report fuelled broad-based buying interest. The benchmark index then added as much as 1.9% after the Federal Reserve provided some market-friendly commentary before finishing up 1.55%.

- Specifically, Apple reported in-line Q1 results and guided Q2 revenue that was towards the low end of expectations, yet that was apparently enough to placate investors who found some comfort in the solid growth reported for the company’s services business. Boeing for its part exceeded Q4 revenue and earnings estimates by a wide margin and issued upbeat FY19 guidance.

- Advanced Micro Devices (AMD 23.09, +3.84) joined Apple with a better-than-feared report, which catapulted the stock 20.0%, and provided strong support for the Philadelphia Semiconductor Index (+2.9%) and the heavily-weighted information technology sector.

- Alibaba (166.82, +6.34%) reported EPS of $1.77 compared to $1.67 expected, and revenue of $17 billion vs $17.7 billion expected for its fiscal third quarter ended Dec. 31. Revenue from its cloud-computing business increased 84% from the year-ago period to $962 million. Revenue from its core e-commerce operation rose 40% to $14.95 billion. Alibaba said it ended the quarter with 699 million mobile monthly active users, up 33 million from the previous quarter.

- Facebook (167.74, +11.52%) posted a solid earnings and revenue beat for the fourth quarter, and investors applauded, sending shares up as much as 11% in after-hours trading. The social network giant reported EPS of $2.38 compared to $2.18 expected, while revenue of $16.9 billion beat estimates for $16.4 billion. Daily active users rose 9% to 1.52 billion, in-line with consensus. After several quarters of declining or flat user growth in Canada and the U.S., Facebook said it added 1 million daily members in those territories.

BLOCKCHAIN & CRYPTOCURRENCY UPDATES

Japanese IT Giant Fujitsu Completes Test of Blockchain Electricity Sharing Project

Japanese IT firm Fujitsu has successfully trialed a blockchain-based solution to address inefficiencies in electricity surplus management. Fujitsu, which partnered with local power distribution company ENERES, used blockchain to increase the success rates of power sharing, which is administered through a process known as Demand Response (DR). An agreement between utilities companies and consumers, DR aims to anticipate periods of peak demand by ensuring surplus power is available to those who need it. Fujitsu has now devised a system in which electricity consumers can efficiently exchange among themselves the electricity surpluses they have produced through their own electricity generation or power savings. The move is not the first venture into blockchain for Fujitsu, which launched a blockchain-based loyalty scheme for the retail sector in June last year, followed by plans for settlement infrastructure for nine Japanese banks in October.

SWIFT CEO Reveals Plans to Integrate Blockchain Consortium R3 Tech

Major global banking payments network SWIFT has revealed it plans to integrate technology from enterprise blockchain software firm R3. Speaking at the Paris Fintech Forum on Jan. 30, CEO Gottfried Leibbrandt said SWIFT would be formally announcing its plans for a Proof-of-Concept (PoC) with R3. Leibbrandt was reportedly participating in the panel alongside Brad Garlinghouse, CEO of Ripple — which has long touted itself as a blockchain competitor to SWIFT’s global interbank network, with Garlinghouse just recently commenting that “what we are doing on a day-to-day basis is in fact taking over SWIFT.” SWIFT last year took part in several blockchain pilots, but has not to date substantially rehauled its legacy wire transfer architecture.

US Blockchain Firm Introduces Wallet for Digital Assets and Securities

San Francisco-based blockchain firm TokenSoft has rolled out a beta version of its wallet for digital assets and digital securities. The new product called Knox Wallet provides cold storage and a self-custody platform for managing multiple assets, including both cryptocurrencies such as Bitcoin (ETH) and Ethereum (ETH), as well as tokenized assets such as real estate, equity, or debt. The wallet is now undergoing a testing phase, while the general availability launch is set for the first quarter of 2019. Back in December, TokenSoft invested in a broker-dealer that is compliant with the United States Securities and Exchange Commission (SEC). The investment purportedly enabled TokenSoft to offer issuers the option to host a token sale themselves or work with a broker-dealer to carry out the sale on their behalf.