NOTABLE MOVES

- U.S and Canadian banks were on holiday on Monday. Data was light out of the G7 countries. Japanese PPI y/y at 2.9% vs expected 2.8%. Prelim Machine Tool Orders y/y at -1.1% vs previous 2.9%. Risk-Aversion in capital markets continues on Monday. USDJPY down -0.14%, $113.69.

- Euro fell right after London’s opening amid mounting tensions about the Italian budget rejection by the EU commission last week. Italy has until this Tuesday to resubmit a fiscal plan that complies with EU rules or could face economic sanctions. Euro dropped -0.88%, $1.1224.

- Sterling got a boost from an FT news, which indicated that EU’s Chief Negotiator Barnier said that main elements of Brexit treaty text was ready, but resumed its decline after the market realized the Irish border issue remains unsolved. Sterling down -0.65%, $1.2854.

- S&P 500 down -1.97%, 2,726.22. Nasdaq down -2.78%, 7,200.87. Nikkei down -3.30%, 21,534.52.

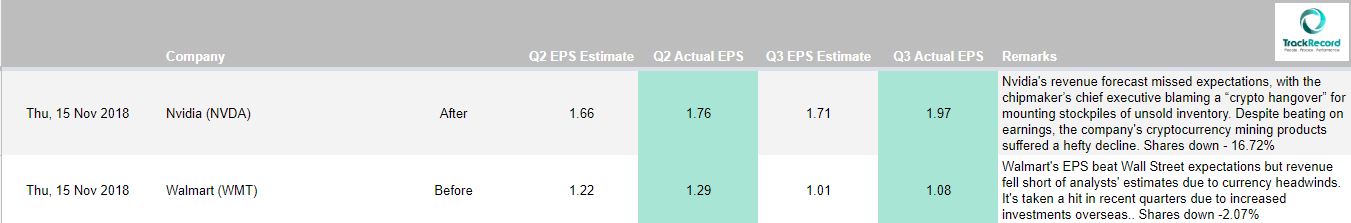

- Apple (AAPL 194.17, -10.30, -5.0%) and semiconductor companies dragged on the broader market. The rout in the information technology sector (-3.5%) underpinned the benchmark index’s retreat below its 200-day moving average (2762.39) and wiped out monthly gains for the tech-sensitive Nasdaq Composite, which lost -2.78% on Monday. The market decline was triggered by Apple supplier Lumentum (LITE 37.50, -18.45, -33.0%) cutting its guidance due to a large, unnamed customer requesting to reduce shipments of laser diodes for 3D sensing. It is widely assumed that Apple is the customer in question, as it accounted for 30% of LITE’s fiscal 2018 net revenue and uses laser diodes for its iPhone Face ID technology. This marks the second Apple supplier in as many weeks to have issued guidance warnings. Chip stocks, subsequently, posted heavy losses, as the Philadelphia Semiconductor Index dropped -4.4%. Unsurprisingly, Apple chip suppliers Qorvo (QRVO 63.80, -4.35, -6.4%), Skyworks Solutions (SWKS 72.84, -3.82, -5.0%), and Cirrus Logic (CRUS 35.64, -5.74, -13.9%) underperformed. Meanwhile, notable chipmaker NVIDIA (NVDA 189.54, -16.13) erased yearly gains with a loss of -7.8%, and Advanced Micro Devices (AMD 19.03, -2.00) lost -9.5%. The lack of investor confidence in growth stocks also manifested itself in the other FANG names. Facebook (FB 141.55, -3.41, -2.4%), Alphabet (GOOG 1038.63, -27.52, -2.6%), and Netflix (NFLX 294.07, -9.40, -3.1%) weighed on the communication services (-1.5%) sector, and Amazon (AMZN 1636.85, -75.58, -4.1%) led the consumer discretionary sector (-2.3%) lower. General Electric (GE 7.99, -0.59) struggles continued with a loss of -6.9%. CEO Larry Culp said the company’s biggest priority is to bring down leverage levels and has plenty of opportunity to do that through asset sales.

- Goldman Sachs (GS 206.05, -16.60) fell -7.5%. The investment management company is reportedly being pressed by Malaysia for a full refund of around $600 million over alleged fraudulent activity regarding the 1MDB investment fund Goldman Sachs set up for it.

- In energy, Saudi Arabia announced it will reduce its oil exports in December by 500,000 barrels a day due to a seasonal slowdown in demand. The world’s largest oil exporter also thinks a 1 million barrel per day cut by oil producers from October production levels might be necessary.Trump, in turn, tweeted his opposition to OPEC’s desire to cut oil production, saying that oil prices should be lower based on supply. President Trump’s tweet dampened an early WTI crude rebound, which backpedaled 0.5% to settle at $59.84/bbl

BLOCKCHAIN & CRYPTOCURRENCY NEWS

Major Oil Firms, Banks Partner to Launch Blockchain Platform for Energy Commodity Trading

Major oil companies BP, Shell, and Equinor have united with large banks and trading houses to launch a blockchain-driven platform Vakt for energy commodity trading. Vakt also includes banks ABN Amro, ING, and Societe Generale, along with trading houses Gunvor, Koch Supply & Trading, and Mercuria. The blockchain solution, first announced in November 2017, will enable major industry players to move from “cumbersome” paperwork to smart contracts, thereby helping to reduce time spent on operations and make trading more efficient. A platform similar to Vakt already exists in Switzerland, where a group of major global banks, trading firms, and a leading energy company launched a joint venture, dubbed komgo SA, to oversee a new blockchain-based platform for financing the trading of commodities.

Singapore’s Central Bank, SGX Develop Blockchain Settlement System

The Monetary Authority of Singapore (MAS) and the country’s stock exchange, Singapore Exchange (SGX), have developed a settlement system for tokenized assets that can work across different blockchains. The newly completed delivery versus payment (DvP) system utilizes smart contracts to simplify post-trade processes and shorten the settlement cycle. The purpose is to simplify for financial institutions to carry out the simultaneous exchange and final settlement of tokenized digital currencies and securities as required under DvP. The new system is also an extension of Project Ubin, which started life in November 2016 as a collaborative project by MAS and Singapore’s financial services industry to explore blockchain tech for clearing and settlement of payments and securities.

Combined Class-Action Lawsuit Against Ripple Moves to Federal Court

Attorneys for Ripple Labs and its affiliated defendants filed to move a consolidated class-action lawsuit from its previous venue at the San Mateo Superior Court to the U.S. District Court, Northern District of California. In addition to the request to change the venue, Ripple’s attorneys hinted at the company’s defense against the suit, which alleges that the XRP token is a security issued by Ripple. The consolidated class action combines previous class-action lawsuits filed by plaintiffs Avner Greenwald, David Oconer and Vladi Zakinov. The defendants now include Ripple Labs and its subsidiary XRP II, as well as Bradley Garlinghouse, Christian Larsen, Ron Will, Antoinette O’Gorman, Eric van Miltenburg, Susan Athey, Zoe Cruz, Ken Kurson, Ben Lawsky, Anja Manuel and Takashi Okita. Plaintiffs will file a motion to remand the case back to the San Mateo Superior Court. The next deadline for Ripple to respond to the complaint itself will either be two weeks from the date the motion to remand is denied (if it is denied) or two weeks from when the San Mateo court receives the case (if the motion to remand is approved).